Get the free 2011 Form 1040A - IRS.gov - Internal Revenue Service - apps irs

Show details

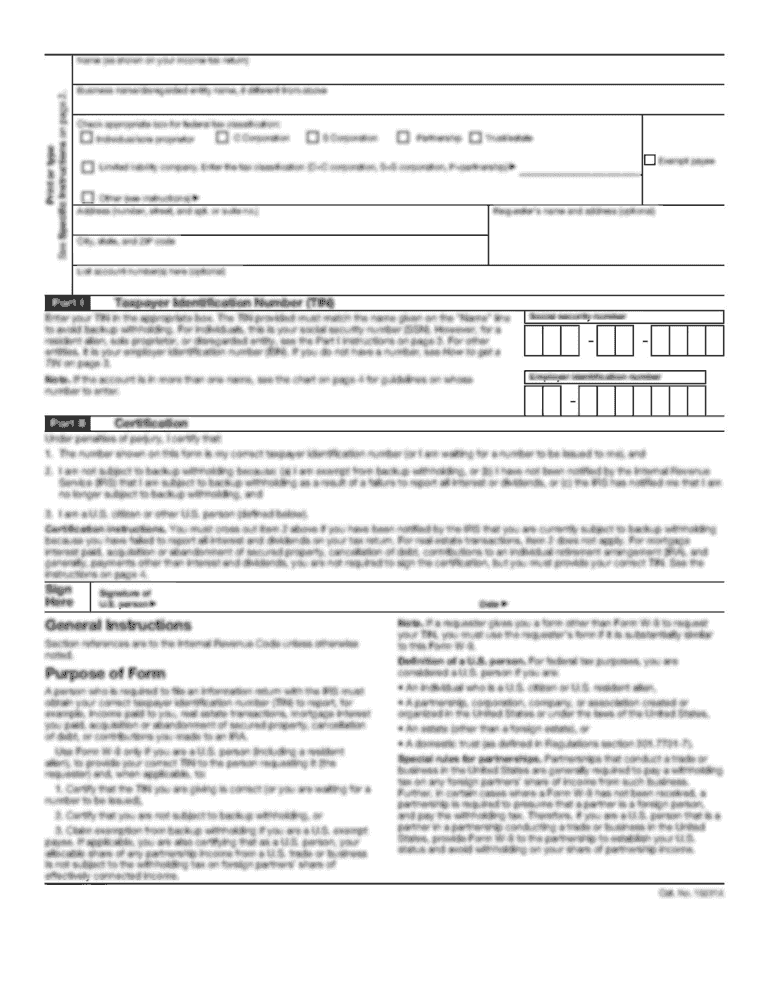

Jul 24, 2014 ... IRS Use Only Do not write or staple in this space. (99). OMB No. 1545-0074. Your first name and ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2011 form 1040a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 form 1040a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 form 1040a online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2011 form 1040a. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 2011 form 1040a

How to fill out 2011 form 1040a:

01

Gather all necessary documents: Before filling out the form, make sure you have all the required documents on hand. This may include your W-2 forms, 1099 forms, and any other relevant income or deduction records.

02

Provide your personal information: Begin by filling out the top section of the form, which includes your name, address, social security number, and filing status. This information is essential for the IRS to identify and process your tax return accurately.

03

Report your income: The next step is to report your income for the tax year 2011. This includes wages, salaries, tips, interest earned, dividends, and any other sources of income. Use the appropriate lines and attach any necessary additional schedules if needed.

04

Claim deductions and credits: After reporting your income, you can claim deductions and credits to potentially reduce your taxable income or increase your refund. Form 1040a provides various lines to claim deductions such as student loan interest, educator expenses, and IRA contributions. Additionally, you can claim credits like the Child Tax Credit or the Earned Income Credit if you qualify.

05

Calculate your tax liability: Once all income, deductions, and credits are accounted for, use the tax tables provided in the form's instructions to calculate your tax liability for the year. Depending on your circumstances, you may need to use the separate tax rate schedules included in the instructions.

06

Determine your refund or balance due: After calculating your tax liability, compare it to any taxes you have already paid throughout the year, such as through withholding or estimated tax payments. If you've paid more than your tax liability, you may be eligible for a refund. If you've paid less, you will owe the difference.

07

Sign and send: Finally, don't forget to sign and date the form. If you're filing jointly, both spouses must sign. Double-check that all necessary attachments and schedules are included and ensure you keep a copy of the completed form for your records. Mail the form to the appropriate IRS address provided in the instructions or consider filing electronically for faster processing.

Who needs 2011 form 1040a:

01

Individuals with a lower income: Form 1040a is specifically designed for individuals with relatively simple tax situations and a lower taxable income. It allows for more straightforward reporting of income, deductions, and credits compared to other tax forms.

02

Those who don't itemize deductions: If you don't have significant itemized deductions to claim, such as mortgage interest or high medical expenses, Form 1040a may be suitable for you. It provides certain deductions directly on the form, eliminating the need for additional schedules.

03

Individuals without complex financial transactions: If you didn't have any complicated financial transactions that require additional reporting, such as capital gains or losses, or self-employment income, you may be eligible to use Form 1040a.

Remember, it is always recommended to consult with a tax professional or utilize tax preparation software to ensure accurate completion of your tax return and to determine the most appropriate tax form for your specific situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1040a - irsgov?

Form 1040A is a simplified version of the IRS Form 1040 for individual income tax return.

Who is required to file form 1040a - irsgov?

Taxpayers who meet certain criteria, such as having taxable income below $100,000 and only claiming certain deductions and credits, are eligible to file Form 1040A.

How to fill out form 1040a - irsgov?

Taxpayers can fill out Form 1040A by following the instructions provided by the IRS, including reporting income, deductions, and credits accurately.

What is the purpose of form 1040a - irsgov?

The purpose of Form 1040A is to allow taxpayers with relatively simple tax situations to file their income tax returns without needing to use the more complicated Form 1040.

What information must be reported on form 1040a - irsgov?

Taxpayers must report their income, deductions, credits, and other relevant information on Form 1040A.

When is the deadline to file form 1040a - irsgov in 2023?

The deadline to file Form 1040A for the tax year 2023 is April 15, 2024.

What is the penalty for the late filing of form 1040a - irsgov?

The penalty for late filing of Form 1040A is typically a percentage of the unpaid taxes owed, with additional penalties accruing the longer the return remains unfiled.

Where do I find 2011 form 1040a?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific 2011 form 1040a and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in 2011 form 1040a?

With pdfFiller, the editing process is straightforward. Open your 2011 form 1040a in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my 2011 form 1040a in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 2011 form 1040a right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your 2011 form 1040a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.