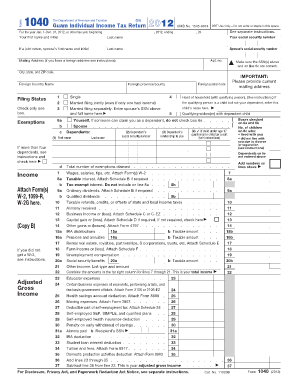

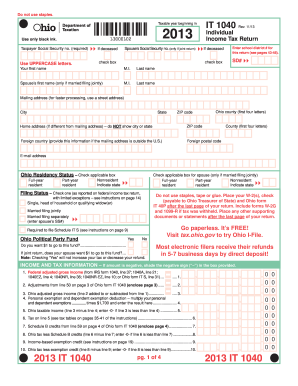

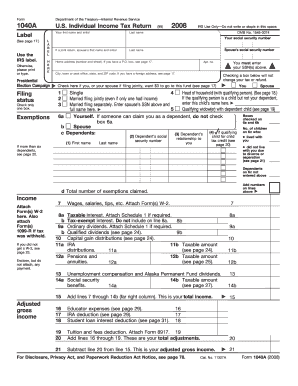

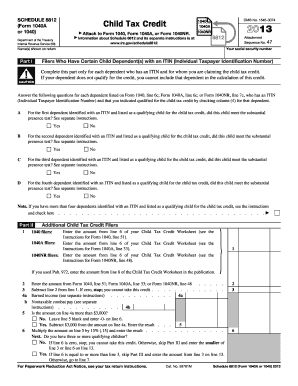

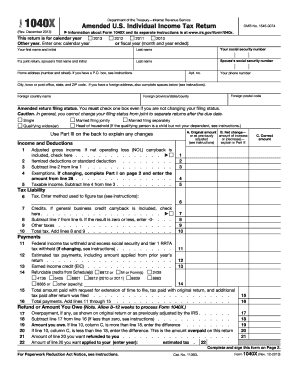

What is 2013 1040a?

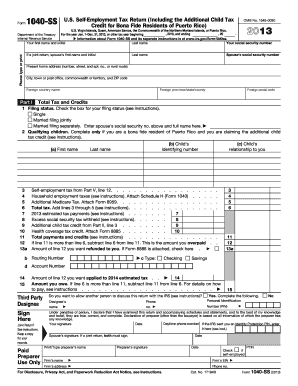

The 2013 1040a is a specific tax form used by taxpayers to report their income, deductions, and credits for the year 2013 to the Internal Revenue Service (IRS). It is a shorter and simpler version of the standard 1040 form, designed for individuals who meet certain eligibility criteria. The 2013 1040a is generally used by taxpayers with straightforward tax situations and who claim the standard deduction instead of itemizing their deductions.

What are the types of 2013 1040a?

There are several types of 2013 1040a forms, each designed to accommodate different tax situations. These include:

Single: This form is for individuals who are unmarried or legally separated.

Married Filing Jointly: This form is for married couples who choose to file their taxes together.

Head of Household: This form is for individuals who are unmarried but provide financial support for a dependent.

Qualifying Widow/Widower: This form is for individuals who are widowed and meet certain criteria.

Nonresident Alien: This form is for nonresident aliens who have income from U.S. sources and need to file a U.S. tax return.

How to complete 2013 1040a?

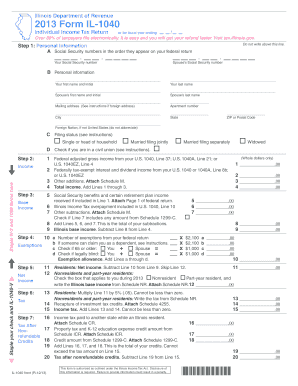

Completing the 2013 1040a form can be made easy by following these steps:

01

Gather your income documents, such as W-2 forms and 1099 forms.

02

Fill in your personal information, including your name, address, and Social Security Number.

03

Enter your income information, including wages, salaries, tips, and any other sources of income.

04

Claim any deductions and credits you are eligible for, such as the standard deduction, child tax credit, or education credits.

05

Calculate your tax liability using the provided tax tables or tax computation worksheets.

06

Enter any taxes you have already paid, such as withholding or estimated tax payments.

07

Review your completed form for accuracy and sign and date it.

08

Make a copy of the form for your records and mail it to the IRS.

By using pdfFiller, you can easily complete the 2013 1040a form online. pdfFiller provides unlimited fillable templates and powerful editing tools, making it the only PDF editor you need to confidently create, edit, and share your tax documents online.