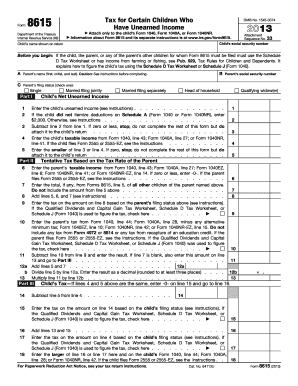

Get the free 2013 Instructions for Form 8615 - BizFilings - irs treas

Show details

2013 Instructions for Form 8615 Department of the Treasury Internal Revenue Service Tax for Certain Children Who Have Unearned Income Future Developments For the latest information about developments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2013 instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 instructions for form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 instructions for form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out 2013 instructions for form

How to fill out 2013 instructions for form:

01

Read the instructions carefully: The first step in filling out the 2013 instructions for form is to thoroughly read the instructions provided. This will give you a clear understanding of the requirements and guidelines for completing the form correctly.

02

Gather all necessary documents: Before starting to fill out the form, make sure you have all the required documents and information handy. This may include your identification documents, income statements, tax forms, and any other relevant paperwork.

03

Start with personal information: The form will typically begin with sections requiring your personal information, such as your name, address, social security number, and other identification details. Fill in accurate and up-to-date information in these sections.

04

Provide income information: Next, the form will ask for details about your income, including wages, salaries, tips, and any other sources of income. Make sure to report all income accurately and include any necessary attachments or schedules as instructed.

05

Deductions and credits: The form may include sections for claiming deductions and credits. These can help reduce your taxable income and potentially lower your overall tax liability. Follow the instructions provided to accurately claim any eligible deductions or credits.

06

Review and double-check: Once you have completed filling out the form, take the time to review all the information you have provided. Double-check for any errors or omissions that may impact the accuracy of your submission.

07

Submit the form: Once you are satisfied that the form is complete and accurate, submit it as per the specified instructions. This may include mailing it to the appropriate tax authority or electronically filing it through an online platform.

Who needs 2013 instructions for form?

01

Individuals filing tax returns for the year 2013: The 2013 instructions for form are primarily needed by individuals who are required to file their tax returns for the year 2013. These can include taxpayers who earned income during that period and need to report their financial information to the tax authorities.

02

Tax professionals and preparers: Tax professionals, such as accountants or tax preparers, may also need access to the 2013 instructions for form to assist their clients with accurate tax filings. These professionals rely on the instructions to ensure compliance with the tax laws and regulations applicable to that particular tax year.

03

Individuals seeking guidance on specific tax-related matters: Even if you are not required to file a tax return for the year 2013, you may still find value in reviewing the instructions for form. The instructions can provide guidance on various tax-related matters, such as deductions, credits, and reporting requirements. This can be helpful for individuals seeking a better understanding of their tax obligations or planning for future tax filings.

Please note that tax laws and forms may have changed since 2013, and it is always advisable to consult the most recent instructions and seek professional advice for accurate and up-to-date tax preparation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is instructions for form 8615?

Instructions for form 8615 provide guidance on how to properly complete and submit the form for tax purposes.

Who is required to file instructions for form 8615?

Taxpayers who have a child with unearned income over a certain threshold are required to file instructions for form 8615.

How to fill out instructions for form 8615?

To fill out instructions for form 8615, taxpayers need to provide information about their child's unearned income and calculate the tax owed.

What is the purpose of instructions for form 8615?

The purpose of instructions for form 8615 is to calculate the tax on a child's unearned income and report it to the IRS.

What information must be reported on instructions for form 8615?

Taxpayers need to report their child's unearned income, calculate the tax owed, and provide any other required information on instructions for form 8615.

When is the deadline to file instructions for form 8615 in 2023?

The deadline to file instructions for form 8615 in 2023 is typically April 15th, unless it falls on a weekend or holiday.

What is the penalty for the late filing of instructions for form 8615?

The penalty for late filing of instructions for form 8615 is typically a percentage of the tax owed, with additional interest accruing for each day the form is late.

How do I modify my 2013 instructions for form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 2013 instructions for form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for signing my 2013 instructions for form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your 2013 instructions for form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit 2013 instructions for form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 2013 instructions for form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your 2013 instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.