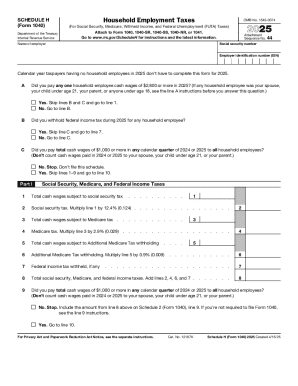

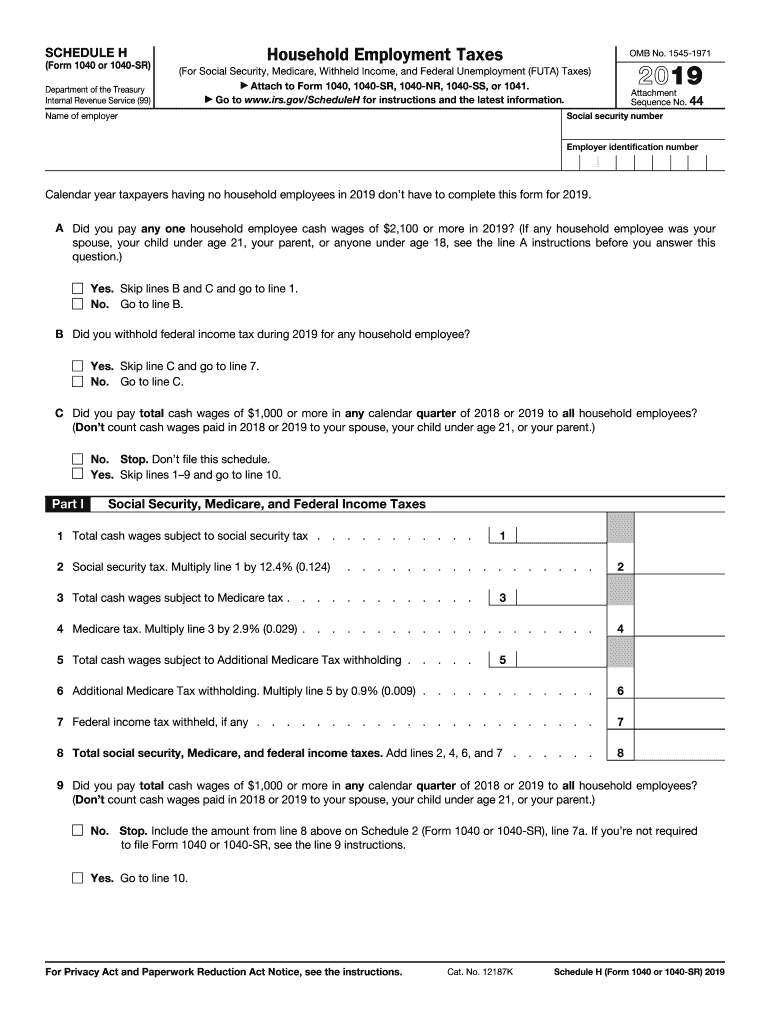

IRS 1040 - Schedule H 2019 free printable template

Instructions and Help about IRS 1040 - Schedule H

How to edit IRS 1040 - Schedule H

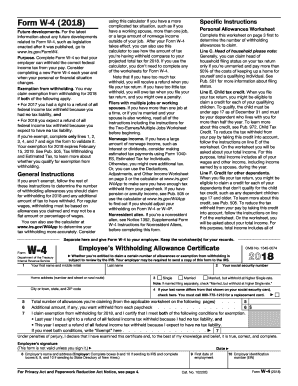

How to fill out IRS 1040 - Schedule H

About IRS 1040 - Schedule H 2019 previous version

What is IRS 1040 - Schedule H?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule H

How can I correct mistakes on my Schedule H after submission?

To correct mistakes on your Schedule H, you need to file an amended return. Make sure to clearly indicate it as an amendment and include the corrected Schedule H along with any necessary documentation to explain the changes. It's best to file it as soon as you discover the error to minimize complications.

What is the process for verifying the receipt of my Schedule H?

You can verify the receipt of your Schedule H by checking the status on the IRS website if you e-filed or by contacting their support line for mailed submissions. Keep any confirmation emails or tracking numbers as proof of submission.

What should I do if my Schedule H submission is rejected?

If your Schedule H submission is rejected, you will receive a rejection notice with the reason. Correct the errors noted, and resubmit the form promptly to avoid penalties. Ensure that all relevant details are accurate to prevent further issues.

Are there privacy concerns I should be aware of when filing Schedule H?

Yes, when filing Schedule H, it's important to ensure that you protect sensitive information. Use secure methods for e-filing and consider e-signature acceptability. Retain copies of documents securely and be mindful of data security practices to safeguard your privacy.

What common errors should I avoid when filing Schedule H?

Common errors when filing Schedule H include incorrect calculations, failing to include necessary signatures, and submitting incomplete forms. Double-check all information, especially numerical data and any required documentation, to ensure a smooth filing process.