Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

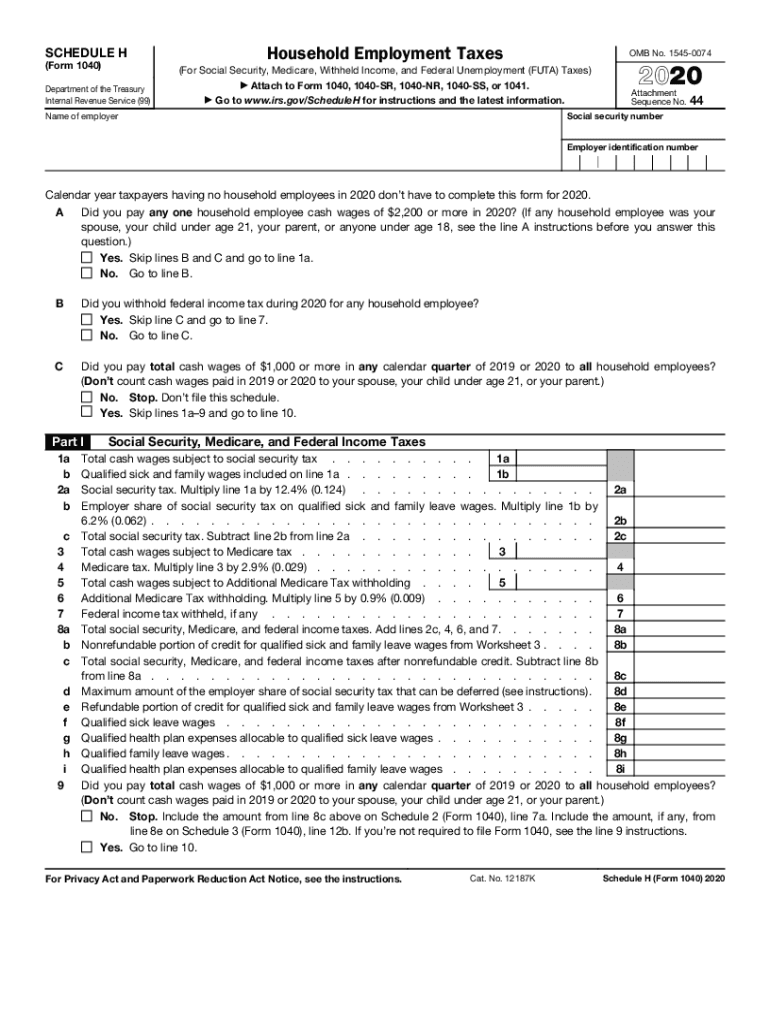

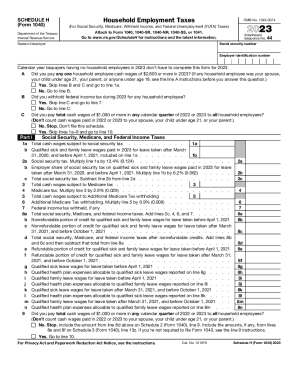

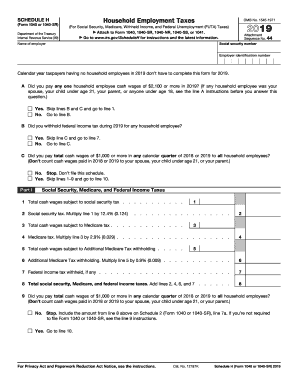

What is form 1040 employment?

Form 1040 is an IRS form used for reporting income and filing taxes for individuals. It is the most commonly used tax form for individuals in the United States. Employment income is one of the types of income that must be reported on Form 1040. This includes wages, salaries, and tips received from an employer.

What is the purpose of form 1040 employment?

Form 1040 is a federal income tax form used by individuals to report their income and calculate their tax liability. It is also used to claim credits and deductions, and to report certain additional information related to the taxpayer’s tax return. Employment income, such as wages, salaries, tips, and bonuses, are reported on Form 1040. The form is also used to report any income from self-employment or from any other sources, such as alimony, investments, and rental income. Additionally, income from Social Security, pensions, and annuities must be reported on Form 1040.

What information must be reported on form 1040 employment?

Form 1040 is the primary form used to report individual income taxes. When filing a Form 1040, you must report all sources of income, including wages, salaries, tips, bonuses, commissions, self-employment income, capital gains, dividends, alimony, unemployment compensation, Social Security benefits, pensions, rental income, royalties, and other income. You must also report any deductions, such as charitable contributions, mortgage interest, taxes, medical expenses, and any other expenses that you are eligible to claim. In addition, you must report any credits, such as the earned income tax credit and the child tax credit.

When is the deadline to file form 1040 employment in 2023?

The deadline for filing Form 1040 in 2023 is April 15, 2024.

What is the penalty for the late filing of form 1040 employment?

The penalty for the late filing of Form 1040 is typically 5% of the unpaid taxes for every month that the tax return is late, up to a maximum of 25%. The minimum penalty is typically the smaller of either $135 or 100% of the taxes owed.

Who is required to file form 1040 employment?

Any individual who has income from employment is generally required to file Form 1040 to report their earnings to the Internal Revenue Service (IRS). This includes employees who receive wages, salaries, tips, and other compensation from their employers. Self-employed individuals who have earned more than a certain threshold amount are also required to file Form 1040 and report their self-employment income.

How to fill out form 1040 employment?

To fill out Form 1040 for employment, follow these steps:

1. Provide your personal information: Fill in your name, address, Social Security Number (SSN), and other requested details at the top of the form.

2. Choose your filing status: Indicate whether you are filing as Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child. This affects your tax rates and deductions.

3. Report your income: Fill in your W-2 information in the designated section, including wages, salaries, tips, and any other income earned from employment. You may receive multiple W-2s from different employers, so ensure to report all of them accurately.

4. Deductions and credits: Enter deductions and credits that you qualify for. It is recommended to consult the instructions (available on the IRS website) or seek professional assistance to identify applicable deductions and credits and their specific requirements.

5. Calculate your tax liability: Use the provided tax tables or consult the tax computation worksheet to determine the amount of income tax you owe based on your taxable income.

6. Claim withholding and refundable credits: Enter any federal income tax withheld from your paychecks, as specified on your W-2(s), and any refundable tax credits you are eligible for. This reduces your tax liability.

7. Determine your refund or balance due: Subtract the total tax withheld and refundable credits from your tax liability to calculate whether you owe additional tax or are entitled to a refund.

8. Sign and date the form: Sign and date your completed form in the designated sections. If filing jointly, both spouses must sign.

Remember to attach any supporting documents, such as your W-2 forms or additional schedules if required. Make a copy of the completed form for your records and submit it either electronically or by mail to the appropriate IRS address.

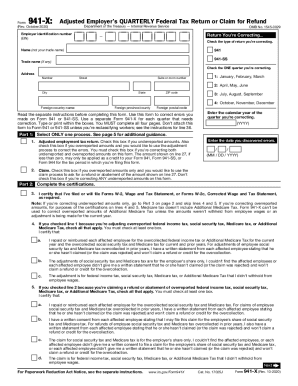

How can I send form 1040 employment to be eSigned by others?

Once your schedule h form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete irs schedule h online?

pdfFiller makes it easy to finish and sign form 1040 employment online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my irs 1040 schedule h in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your schedule h form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.