Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

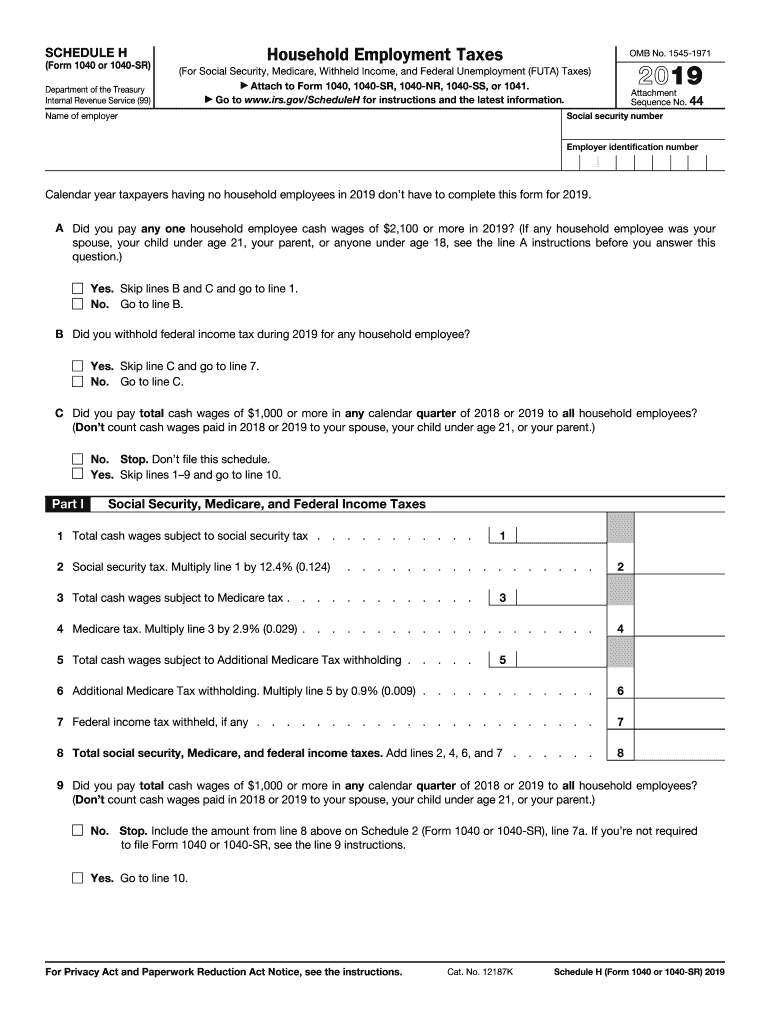

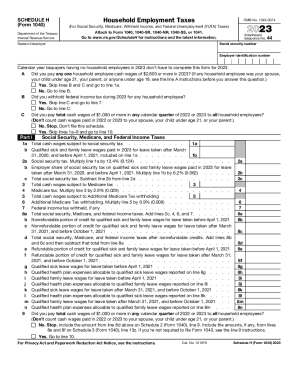

Schedule H is a type of supplemental form that is filed along with Form 1040 by taxpayers who need to report income from household employment taxes or household employment tax liabilities. This schedule is used to determine the amount of Social Security and Medicare taxes owed by individuals who employ household workers, such as nannies, caregivers, housekeepers, etc. It is used to calculate and report the household employment taxes that are usually paid by the employer rather than the employee.

Who is required to file schedule h?

Schedule H is required to be filed by individuals who have household employment taxes, also known as nanny taxes. The schedule is used to report and calculate the taxes owed for hiring household employees, such as nannies, babysitters, housekeepers, or caregivers.

How to fill out schedule h?

To fill out Schedule H, you should follow these steps:

1. Obtain Form 1040 or 1040-SR: Schedule H is an additional form that is filed with your individual income tax return. You'll need to first complete either Form 1040 or 1040-SR.

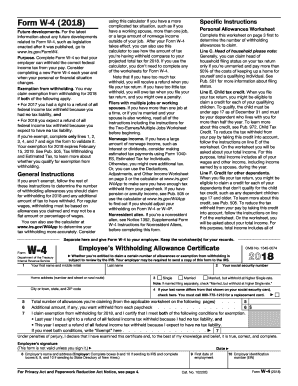

2. Gather relevant information: Collect all the necessary documentation to complete Schedule H, such as your household employee's information (name, address, Social Security number), wages paid, and taxes withheld.

3. Determine if you're eligible: Schedule H is used for reporting employment taxes if you're a household employer. You're considered a household employer if you pay wages of $2,300 or more to one or more household employees in a calendar year.

4. Complete Part 1 and Part 2: Part 1 of Schedule H involves providing your personal details, including your name, address, employer identification number (EIN), or Social Security number. Part 2 requires information about your household employee(s) and their wages.

5. Calculate and report employment taxes: Complete Part 3 of Schedule H to determine the Social Security, Medicare, and federal unemployment taxes you owe as a household employer based on the wages you paid. Use the appropriate tax rate percentages and the tax tables provided.

6. Complete Part 4: This section of Schedule H is used to calculate and report any advance earned income credit (EIC) payments you made to your household employee(s). Consult the instructions provided to accurately calculate this amount.

7. Complete Part 5: If applicable, Part 5 of Schedule H allows you to claim any exemption from federal unemployment tax (FUTA) if you qualify.

8. Sign and attach Schedule H: Once you have completed Schedule H, it must be signed and attached to your Form 1040 or 1040-SR along with any other additional forms or schedules that may be required.

Remember, it's always recommended to consult a tax professional or refer to the official IRS instructions for Schedule H to ensure accuracy and compliance with tax laws.

What is the purpose of schedule h?

The purpose of Schedule H is to report household employment taxes. It is used by taxpayers who pay wages to household employees, such as nannies, caregivers, housekeepers, and babysitters. This schedule helps individuals calculate and report their federal employment taxes, such as Social Security and Medicare taxes, and federal unemployment tax (FUTA) for household employees.

What information must be reported on schedule h?

Schedule H is used to report information on your household employment taxes, such as the employment taxes you pay to a household employee. The specific information that must be reported on Schedule H includes:

1. Household employee information: Name, address, and Social Security number or taxpayer identification number of each household employee.

2. Wages paid: The total amount of wages paid to each household employee during the tax year.

3. Social security and Medicare taxes: The total amount of Social Security and Medicare taxes withheld from each household employee's wages and the total amount of employer's share of these taxes.

4. Federal unemployment tax (FUTA): The total amount of FUTA tax owed and paid during the tax year.

5. Household employment taxes: The total amount of taxes owed for household employment (including Social Security, Medicare, and FUTA taxes), and any advance earned income credit payments made.

6. Other information: You may also need to provide other information relating to your household employment taxes, such as the dates of employment, if you provided the employee with health or retirement benefits, etc.

It is important to accurately report all the required information on Schedule H to ensure compliance with tax laws related to household employment.

When is the deadline to file schedule h in 2023?

The deadline to file Schedule H in 2023 would be April 17th, 2023. However, please note that tax deadlines can change, so it's always a good idea to double-check with the Internal Revenue Service (IRS) or a tax professional to ensure you have the most up-to-date information.

What is the penalty for the late filing of schedule h?

The penalty for late filing of Schedule H depends on the specific circumstances and applicable laws. It is important to note that Schedule H is a tax form used by taxpayers to report household employment taxes. The penalties for late filing of Schedule H may vary based on factors such as the jurisdiction and the amount of unpaid taxes.

In the United States, for example, the penalty for filing Schedule H late can be calculated as a percentage of the unpaid employment taxes. The penalty rate for late filing of Schedule H can range from 2% to 25% of the unpaid taxes per month, depending on the duration of the delay. There may also be additional penalties, interest charges, and other consequences for non-compliance with tax regulations.

To determine the specific penalty for late filing of Schedule H, it is advisable to consult the tax regulations and guidelines applicable to your jurisdiction or seek professional advice from a tax expert or accountant.

How can I send schedule h for eSignature?

form 1040 schedule h 2019 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find irs schedule h?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 2020 irs 1040 schedule h and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit schedule h household employment taxes in Chrome?

2019 schedule h form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.