Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The Kansas tax form is called "Kansas Individual Income Tax Return." It is used by residents of Kansas to file their state income tax.

Who is required to file kansas tax form?

Residents and non-residents of Kansas are required to file a Kansas tax form if they meet certain criteria. Resident individuals must file a Kansas tax form if they have a Kansas filing requirement, which includes having a certain level of income or having Kansas tax withheld from their earnings.

Non-residents of Kansas must file a Kansas tax form if they earned income in Kansas that is subject to Kansas income tax. This could include income from sources such as wages, salaries, tips, commissions, royalties, or rental income from Kansas property. Non-residents may also be required to file a Kansas tax form if they have Kansas tax withheld from their earnings.

It is recommended to consult the official Kansas Department of Revenue website or a tax professional for specific and up-to-date information on who is required to file a Kansas tax form.

How to fill out kansas tax form?

Filling out the Kansas tax form consists of several steps. Here's a step-by-step guide:

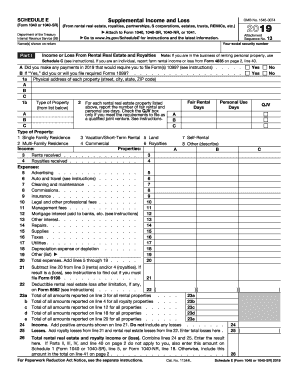

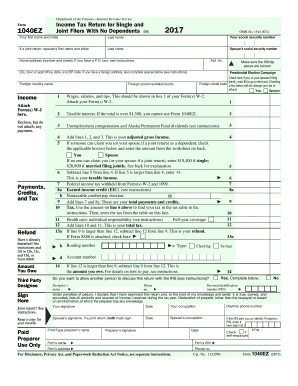

1. Obtain the correct form: Visit the Kansas Department of Revenue (KDOR) website or your local tax office to get the appropriate tax form for your filing status. Common forms include the K-40 Individual Income Tax Return for residents, K-40H Head of Household/Single Married with One Income Tax Return, K-40V Payment Voucher, etc.

2. Gather necessary documents: Collect all the necessary documents, such as W-2 forms, 1099 forms, receipts, and any other pertinent financial information, which will help you accurately report your income and expenses.

3. Fill in personal details: Start by providing your personal information, including your full name, Social Security number (SSN), address, and filing status. Indicate whether you are filing as single, married filing jointly, married filing separately, or head of household.

4. Report all sources of income: Enter your income information from all sources, which may include wages, salaries, tips, interest, dividends, rental income, and any other taxable income. Different income types will be reported on different sections of the tax form.

5. Calculate deductions and exemptions: Deductions and exemptions can reduce your taxable income. Kansas offers both standard deductions and itemized deductions. If you choose to itemize, you need to provide details about each deduction you are claiming for expenses such as mortgage interest, state/local taxes, medical expenses, etc.

6. Determine your tax liability: Use the tax tables or the tax rate schedule provided with the form to calculate your state tax liability. The table or schedule will depend on your filing status and taxable income.

7. Claim tax credits: If you are eligible for any tax credits, such as the dependent care credit, education credits, or the working family credit, make sure to claim them on the appropriate section of the form. Follow the instructions and provide the required information for each credit.

8. Calculate your final tax due or refund: Compare your tax liability amount with any payments or credits you have already made, including withholding taxes. If you've overpaid, you will be entitled to a refund. If you owe additional taxes, you need to pay the balance due.

9. Sign and submit: Sign and date your tax form once you have completed all the necessary sections. Attach any required schedules or additional documents, and keep a copy of the filled-out form for your records. Finally, mail the form to the address provided on the form or consider e-filing your return, which is faster and more convenient.

It's important to note that the steps outlined here are a general guide. For more specific instructions and details, consult the Kansas Department of Revenue website or seek assistance from a tax professional.

What is the purpose of kansas tax form?

The purpose of the Kansas tax form is to report and calculate the amount of state taxes owed by individuals and businesses in the state of Kansas. It is used to determine the taxpayer's income tax liability and any applicable deductions, credits, or exemptions. The form helps to ensure that individuals and businesses accurately report their income and pay the correct amount of taxes owed to the state of Kansas.

What information must be reported on kansas tax form?

When filing taxes in Kansas, the following information must be reported on the tax form:

1. Personal Information: Name, address, social security number, and other personal identification details.

2. Filing Status: Indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Income: Report all sources of income, including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, pensions, and any other form of income.

4. Deductions: Itemize or take the standard deduction, whichever is greater. Common deductions include mortgage interest, property taxes, medical expenses, charitable contributions, and state and local taxes.

5. Tax Credits: Report any tax credits you may qualify for, such as child tax credit, child and dependent care expenses, saver's credit, earned income credit, and others.

6. Withholdings and Estimated Tax Payments: Report the amount of taxes already withheld from your income by your employer(s) and any estimated tax payments you made throughout the year.

7. Kansas-Specific Information: Some Kansas-specific information may be required, such as Kansas income tax refunds from the previous year, rural opportunity zones credits, healthcare access surcharge, and others, depending on your situation.

8. Signature: Sign and date the tax form to certify that the information provided is true and accurate.

It's important to note that this is a general overview, and there may be additional forms or schedules specific to your situation, such as if you are a business owner or have certain deductions or credits.

When is the deadline to file kansas tax form in 2023?

The deadline to file Kansas tax forms in 2023 is April 17, 2023. However, it is important to note that tax deadlines can change, so it is recommended to verify with the Kansas Department of Revenue or consult a tax professional for the most up-to-date information.

What is the penalty for the late filing of kansas tax form?

In Kansas, the penalty for late filing of a tax form is a percentage of the tax due with the return. The penalty rate is based on the number of days the return is late and ranges from 5% to 25% of the tax owed. Additionally, interest is charged on any unpaid tax at a rate of 0.75% per month. It's important to note that if you are due a refund, there is no penalty for late filing.

How can I send 2019 kansas tax form for eSignature?

When you're ready to share your kansas state income forms, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit kansas 2019 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 2018 kansas tax form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out kansas state tax form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ks state tax form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.