NM MVD-10009 2018-2024 free printable template

Show details

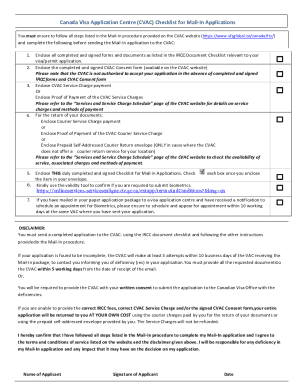

STATE OF NEW MEXICO TAXATION & REVENUE DEPARTMENT MOTOR VEHICLE DIVISION MVD 10009 REV. 03/18Bill of Sale ANY ALTERATIONS OR ERASURES WILL VOID THIS DOCUMENT!BEFORE FILLING OUT FORM CAREFULLY READ

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your new mexico bill sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new mexico bill sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new mexico bill sale online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mvd 10009 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NM MVD-10009 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out new mexico bill sale

How to fill out a New Mexico bill of sale:

01

Begin by obtaining a blank bill of sale form specific to the state of New Mexico. These forms can typically be found online or obtained from a local DMV office.

02

Fill in the date and location where the transaction is taking place. This should include the city and county.

03

Provide the full legal name, address, and contact information of the seller. This includes their phone number and email address if available.

04

Next, provide the full legal name, address, and contact information of the buyer. Similar to the seller, include the buyer's phone number and email address if applicable.

05

Clearly describe the item being sold. Include relevant details such as the make, model, year, color, and vehicle identification number (VIN) if applicable. For non-vehicle items, describe them as accurately as possible.

06

Indicate the purchase price of the item being sold. This should be written out numerically and in words to avoid any confusion.

07

Both the seller and buyer must sign and date the bill of sale to acknowledge their agreement and acceptance of the terms outlined within the document.

08

If necessary, have the bill of sale notarized for additional legal validity and protection.

09

Lastly, it's always a good idea to make copies of the completed bill of sale for both the seller and buyer to keep for their records.

Who needs a New Mexico bill of sale?

01

Individuals who are selling or buying a motor vehicle in New Mexico will typically need a bill of sale. This includes both private sellers and buyers, as well as individuals involved in vehicle trades or transfers.

02

Additionally, a bill of sale may be required when selling or purchasing other items of value, such as boats, motorcycles, trailers, or even personal property like furniture or electronics.

03

While not always legally required, having a bill of sale can provide both the buyer and seller with important documentation and protection in case of any disputes or issues that may arise after the transaction.

Fill nm mvd 10009 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new mexico bill sale?

A New Mexico bill of sale is a legal document that is used to transfer ownership of a vehicle from one individual to another. It is required by the state of New Mexico to transfer a vehicle’s title and must be completed in full and notarized in order for the transfer of ownership to be legally binding. It includes information about the buyer and seller, as well as the vehicle, such as the make, model, year, VIN number, and odometer reading.

When is the deadline to file new mexico bill sale in 2023?

The deadline to file a New Mexico Bill of Sale in 2023 is not yet known. Generally, New Mexico Bill of Sales are due within fifteen days of the transfer of the vehicle, so you should plan to file your Bill of Sale as soon as possible after the transfer.

What is the penalty for the late filing of new mexico bill sale?

The penalty for late filing of a New Mexico Bill of Sale is a $25 fine. Additionally, the late filing may cause the buyer to be liable for any unpaid taxes or fees associated with the sale.

Who is required to file new mexico bill sale?

In the state of New Mexico, both the buyer and the seller are required to file a bill of sale when transferring ownership or title of a motor vehicle. It is a legal document that provides proof of the transaction and should be filed with the New Mexico Motor Vehicle Division (MVD).

How to fill out new mexico bill sale?

To fill out a New Mexico bill of sale, follow these steps:

1. Personal Details: Begin by identifying yourself and the buyer. Include your full legal name, address, and phone number. Similarly, provide the buyer's full name, address, and contact details.

2. Description of the Vehicle: Provide detailed information about the vehicle being sold. Include the make, model, year, vehicle identification number (VIN), license plate number, and mileage. Additionally, specify if any liens or loans are associated with the vehicle.

3. Sale Details: Indicate the date of the sale and the purchase price of the vehicle. Make sure to specify the currency (e.g., USD). If any specific terms or conditions apply to the sale, mention them in this section.

4. Seller's Disclosure: In this section, you must disclose any known defects or issues with the vehicle. It is important to be honest and transparent about any problems to avoid any legal complications later on.

5. Seller's Signature: Sign the bill of sale in the space provided. Ensure that your signature matches the name provided at the beginning of the form.

6. Buyer's Signature: Leave a space for the buyer's signature. Make sure the buyer signs the form upon completion and they use their full legal name.

7. Notary Public: If desired, both the seller and buyer can have their signatures notarized for additional legal validity. However, notarization is not mandatory in New Mexico for a bill of sale to be legally binding.

8. Copies: Make copies of the completed bill of sale for both the seller and the buyer. Retain the original for your records.

It is advisable to consult with a legal professional or use an online bill of sale template specific to New Mexico to ensure compliance with the state's requirements. Additionally, each transaction may have unique circumstances, so it's important to tailor the bill of sale accordingly.

What information must be reported on new mexico bill sale?

In New Mexico, certain information must be reported on a bill of sale. The following information typically needs to be included:

1. Date of the sale: The specific date when the sale of the item or property took place should be mentioned.

2. Buyer and seller details: Full legal names, addresses, and contact information of both the buyer and the seller participating in the transaction should be mentioned.

3. Description of the item: A detailed description of the item being sold, including any identifying features or serial numbers, should be provided.

4. Purchase price: The total amount of money being exchanged for the item or property needs to be stated clearly.

5. Payment terms: If there are any payment terms, such as installments or a down payment, those should be outlined in the bill of sale.

6. Signatures: Both the buyer and the seller should sign the bill of sale to authenticate the document.

Please keep in mind that this information is a general guideline and may vary depending on the specific circumstances or the type of item or property being sold. It is always recommended to consult with legal professionals or refer to the laws specific to New Mexico for the most accurate and up-to-date information.

How can I edit new mexico bill sale from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your mvd 10009 form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in new mexico mvd bill sale without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing new mexico bill sale motor vehicle and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit mvd 10009 form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign new mexico sale form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your new mexico bill sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Mexico Mvd Bill Sale is not the form you're looking for?Search for another form here.

Keywords relevant to nm mvd bill sale form

Related to nm bill sale

If you believe that this page should be taken down, please follow our DMCA take down process

here

.