Get the free louisville metro revenue commission form w 3

Show details

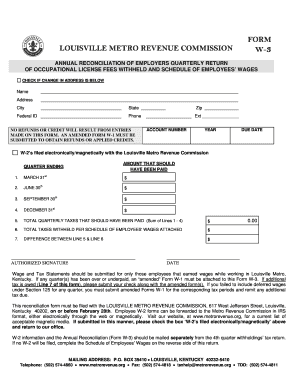

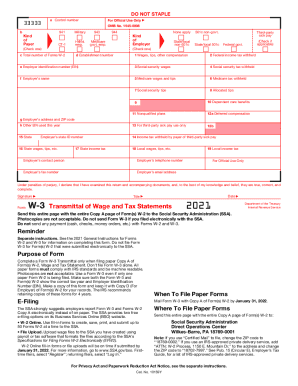

Employee W-2 forms can be forwarded to the Metro Revenue Commission in IRS format either electronically through the web or magnetically. If any quarter s has been over or underpaid an amended Form W-1 must be attached to this Form W-3. If additional tax is owed Line 7 of this form please submit your check along with the amended form s. If you failed to include deferred wages under Section 125 for any quarter you must submit amended Forms W-1 for ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your louisville metro revenue commission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisville metro revenue commission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit louisville metro revenue commission form w 3 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit louisville metro revenue commission form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

How to fill out louisville metro revenue commission

How to fill out Louisville Metro Revenue Commission:

01

Gather all necessary documentation such as income statements, financial records, and tax forms.

02

Review the instructions provided by the Louisville Metro Revenue Commission to ensure accurate completion of the form.

03

Begin filling out the form by providing personal information such as name, address, and social security number.

04

Follow the format provided on the form to report income from various sources including wages, dividends, and rental income.

05

Deduct any eligible expenses or deductions as specified by the instructions.

06

Calculate the total taxable income and ensure accurate reporting on the form.

07

Complete any additional sections or schedules required by the Louisville Metro Revenue Commission.

08

Double-check all entries for accuracy and make any necessary corrections.

09

Sign and date the form, and include any required attachments.

10

Submit the completed form to the Louisville Metro Revenue Commission by the specified deadline.

Who needs Louisville Metro Revenue Commission:

01

Individuals who reside in the Louisville Metro area and have a taxable income.

02

Businesses operating within the Louisville Metro area that are required to file income taxes.

03

Non-profit organizations based in the Louisville Metro area that have taxable income.

04

Anyone who receives income from Louisville Metro sources and exceeds the specified filing thresholds set by the Louisville Metro Revenue Commission.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is louisville metro revenue commission?

The Louisville Metro Revenue Commission is a government agency responsible for the administration and collection of various taxes and fees in the Louisville Metro area of Kentucky, United States. It is primarily responsible for the management of taxes such as property taxes, business license taxes, occupational taxes, and net profit taxes. The commission ensures compliance with tax laws, processes tax returns, issues licenses, and conducts audits to ensure accurate reporting and payment of taxes. The revenue generated through these taxes and fees is used to fund various public services and projects in Louisville Metro.

Who is required to file louisville metro revenue commission?

Individuals or businesses with taxable income or activities within the jurisdiction of the Louisville Metro Revenue Commission (LMRC) are required to file returns with the LMRC. This includes residents, non-residents, and businesses that derive income or conduct business within the Louisville Metro area.

How to fill out louisville metro revenue commission?

To fill out the Louisville Metro Revenue Commission form, follow these steps:

1. Obtain the form: You can download the form from the Louisville Metro Revenue Commission website or request a physical copy from their office.

2. Provide personal information: Fill in your personal details, such as your name, address, Social Security number, and contact information. Ensure all information is accurate and up-to-date.

3. Declare your filing status: Indicate your filing status, such as single, married filing jointly, married filing separately, head of household, etc.

4. Enter income information: Provide details about your income sources, including wages, self-employment income, rental income, investment income, retirement income, etc. Fill in all applicable fields accurately.

5. Deductions and credits: Report any deductions or credits you qualify for, such as education expenses, healthcare costs, mortgage interest deductions, etc. Follow the instructions carefully and provide supporting documentation, if required.

6. Calculate tax liability: Use the provided tables or formulas to calculate your tax liability based on your income, deductions, and credits.

7. Sign and date: After completing all necessary sections, sign and date the form to certify the accuracy of the information provided.

8. Attach additional documents: Include any additional forms or schedules required to support your tax return, such as W-2s, 1099s, and other relevant documents.

9. Review your information: Double-check all the information you have entered, ensuring there are no errors or omissions.

10. Submit the form: Once you have reviewed and confirmed the accuracy of your information, submit the form to the Louisville Metro Revenue Commission. If filing online, follow the instructions to submit electronically. If mailing a physical copy, use the provided address and ensure you have the correct postage.

Remember to keep a copy of your completed form and any supporting documents for your records. Additionally, if you are unsure about any information or have complex tax situations, consider consulting a tax professional for guidance.

What is the purpose of louisville metro revenue commission?

The purpose of the Louisville Metro Revenue Commission is to administer and enforce local taxation laws and regulations for the Louisville Metro area. Its primary responsibility is the collection of various taxes, such as occupational taxes, net profits taxes, and insurance premium taxes, which are levied on businesses and individuals within the Louisville Metro jurisdiction. The Revenue Commission ensures compliance with tax laws, provides information and assistance to taxpayers, and conducts audits to ensure accurate reporting and payment of taxes. The collected revenue is used to fund the operations and services provided by the Louisville Metro Government.

What is the penalty for the late filing of louisville metro revenue commission?

The penalty for late filing of taxes with the Louisville Metro Revenue Commission is typically 2% per month or part of a month that the return is late, up to a maximum of 20% of the tax due. There may also be additional interest charges on the unpaid tax amount. It is important to note that specific penalty amounts and regulations may vary, so it is advisable to consult the Louisville Metro Revenue Commission or a tax professional for accurate and up-to-date information.

How do I edit louisville metro revenue commission form w 3 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign louisville metro revenue commission form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out louisville metro form w 3 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your louisville metro revenue commission annual reconciliation, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete louisville metro revenue commission form w 3 on an Android device?

On Android, use the pdfFiller mobile app to finish your louisville metro revenue commission forms. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your louisville metro revenue commission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisville Metro Form W 3 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.