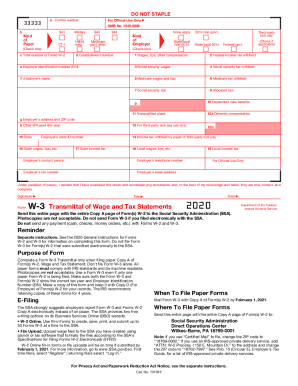

IRS Instruction W-2 & W-3 2020 free printable template

Get, Create, Make and Sign IRS Instruction W-2 W-3

Editing IRS Instruction W-2 W-3 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction W-2 & W-3 Form Versions

How to fill out IRS Instruction W-2 W-3

How to fill out IRS Instruction W-2 & W-3

Who needs IRS Instruction W-2 & W-3?

Instructions and Help about IRS Instruction W-2 W-3

The first thing to understand when finding out the information for a lost w-2 or lost 1099 or lost 1098 is the IRS herbage and for that they used the term transcript or transcript of your tax records so look go to the IRS website which is IRS.gov and right on the first page you will see get transcript of your tax records click on that up here go to get transcript online if you do not have an account and most people don't go ahead and just follow the steps to creating the account once you have it is will let you go on, but I need to log in here it asks for the reason why you need the transcript, and you can say federal tax or income verification you can answer it in any way I suggest if you've been a non filer and have not filed taxes in several years get tax professional help okay I don't need the full record of my previous rat axes or a record of the account what I'm looking for is a w2 income transcript so when you just go ahead and click on that boom it will go ahead and pop up all the w-2s 1099s and 1098 I hope this has been helpful thanks and bye

People Also Ask about

What does it mean to claim 3?

Where are the instructions for Schedule 3?

What is a Schedule 1 used for?

What is the percent of federal income tax withheld?

How do I calculate my tax owed?

What is IRS Schedule 3?

What is line 3 from the IRS calculator?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS Instruction W-2 W-3?

Can I sign the IRS Instruction W-2 W-3 electronically in Chrome?

How do I fill out IRS Instruction W-2 W-3 using my mobile device?

What is IRS Instruction W-2 & W-3?

Who is required to file IRS Instruction W-2 & W-3?

How to fill out IRS Instruction W-2 & W-3?

What is the purpose of IRS Instruction W-2 & W-3?

What information must be reported on IRS Instruction W-2 & W-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.