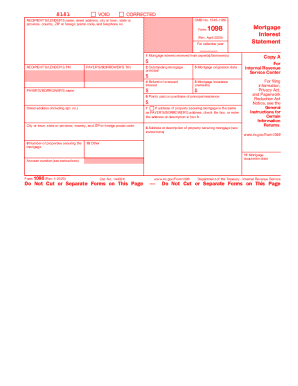

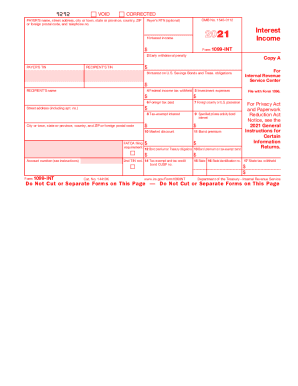

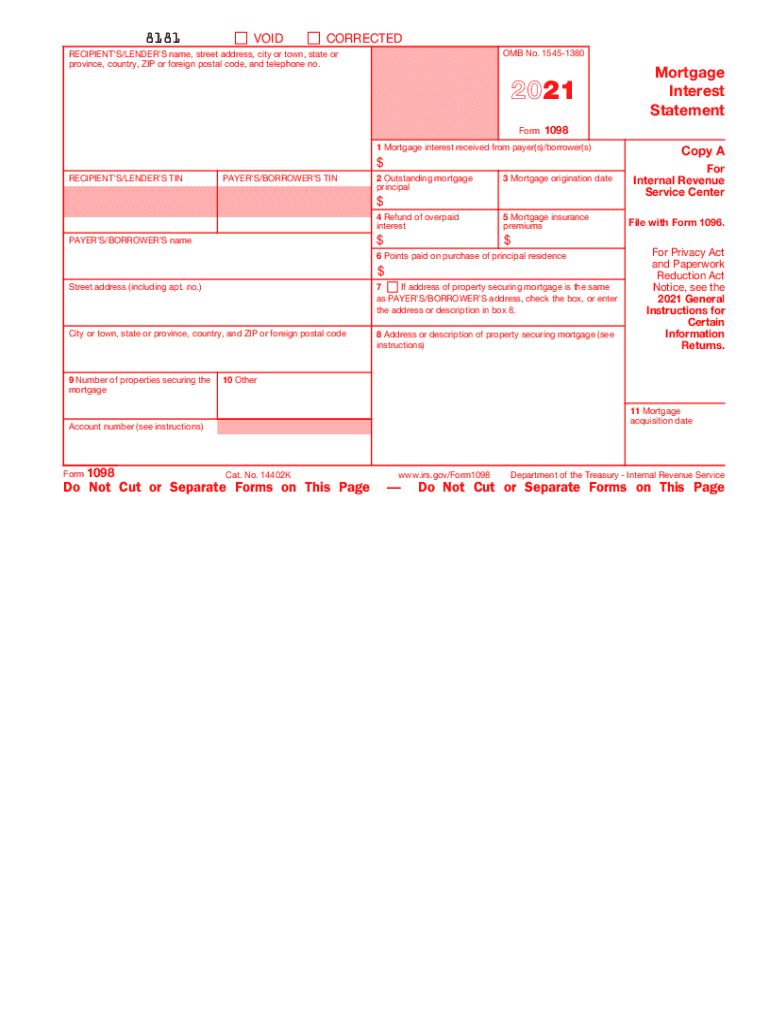

IRS 1098 2021 free printable template

Instructions and Help about IRS 1098

How to edit IRS 1098

How to fill out IRS 1098

About IRS previous version

What is IRS 1098?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

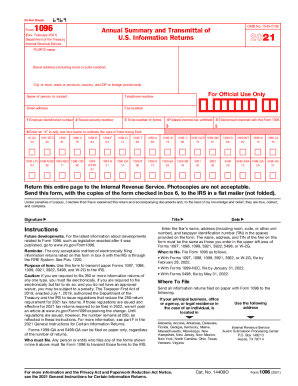

Where do I send the form?

FAQ about IRS 1098

What should I do if I find an error after submitting my IRS 1098?

If you discover an error after filing your IRS 1098, it is important to issue a corrected form as soon as possible. Obtain the correct information and submit the corrected IRS 1098 to the IRS, marking it as 'Corrected.' Additionally, inform the recipient of the correction to maintain transparency.

How can I verify the receipt of my IRS 1098 after filing?

To verify the receipt of your IRS 1098, you can check the IRS filing status by contacting them directly or through the online services provided for e-filing. You may also be able to receive confirmation from your e-filing software if you used one to submit the form.

What privacy considerations should I keep in mind when handling IRS 1098 information?

When managing IRS 1098 information, ensure that you are compliant with privacy laws by securely storing personal data. Utilize encrypted services when transmitting information electronically, and limit access to only authorized individuals to protect sensitive details.

What common mistakes should I avoid when submitting my IRS 1098?

Common mistakes to avoid when submitting your IRS 1098 include entering incorrect taxpayer identification numbers and failing to report all required payments. Double-check your entries for accuracy and ensure that all necessary documentation is attached to prevent rejections.

How does filing for a nonresident foreign payee differ when using IRS 1098?

Filing an IRS 1098 for a nonresident foreign payee involves additional considerations, such as ensuring that the form accurately reflects the payment information applicable to foreign tax laws. Make sure to consult IRS guidelines for any specific filing requirements related to foreign payees.

See what our users say