Get the free form no 49a

Show details

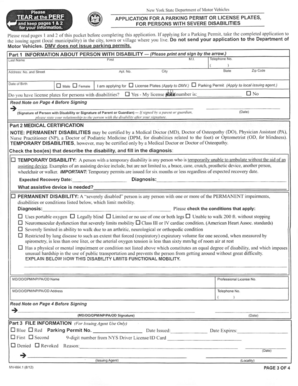

Form No. 49A Application for Allotment of Permanent Account Number In the case of Indian Citizens/Indian Companies/Entities incorporated in India/ Unincorporated entities formed in India Under section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form no 49a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form no 49a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form no 49a online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pan form no 49a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

How to fill out form no 49a

How to fill out form no 49a:

01

Obtain a copy of form no 49a from the designated authority.

02

Fill in the required personal information such as name, address, and contact details.

03

Provide your unique Permanent Account Number (PAN) if already assigned.

04

If applying for a new PAN, select the appropriate box and provide the necessary documents for proof of identity, proof of address, and proof of date of birth.

05

Select the appropriate category and provide details accordingly, such as individual, firm, company, etc.

06

If applying as an individual, provide details such as father's name and birthplace.

07

If applying as a firm or company, provide the necessary details such as registered name, registered office address, and date of incorporation.

08

Review the form for accuracy and ensure all required fields are filled correctly.

09

Attach any necessary documents or supporting evidence as mentioned in the form instructions.

10

Submit the completed form along with the required fee, either online or offline, as per the guidelines provided by the authority.

Who needs form no 49a:

01

Individuals who do not currently possess a Permanent Account Number (PAN) and wish to obtain one.

02

Firms and companies that need to register for a PAN.

03

Any individual or entity that has undergone a significant change in personal or business details, requiring an update or modification to their existing PAN information.

Fill form : Try Risk Free

People Also Ask about form no 49a

What is the full form of form 49A?

What is PAN Acknowledgement number form 49A?

Can I apply for India PAN card online?

How can I get Indian PAN card in USA?

How can I get Indian PAN card from USA?

What is form 49A for PAN card?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form no 49a?

Form No. 49A is a form used by individuals to apply for a Permanent Account Number (PAN) from the Indian Income Tax Department. It is also used to make changes or corrections to an existing PAN card.

What information must be reported on form no 49a?

Form 49A is the PAN application form used to obtain a Permanent Account Number (PAN) from the Income Tax Department in India. The form requires the applicant to provide their full name, date of birth, father's name, residential address, and other contact information. It also requires information about the source of funds and the purpose for which the PAN is needed. Information regarding a previous PAN, if applicable, must also be provided.

When is the deadline to file form no 49a in 2023?

The deadline to file Form No. 49A in 2023 is 31st May 2023.

What is the penalty for the late filing of form no 49a?

The penalty for the late filing of Form 49A is a fine of Rs. 10,000.

Who is required to file form no 49a?

Form 49A is required to be filed by individuals or entities who wish to apply for a Permanent Account Number (PAN) in India. This includes:

1. Individuals who are citizens of India, including minors and those born outside India but have at least one parent who is an Indian citizen.

2. Individuals who are foreign citizens but have a source of income or business in India.

3. Entities incorporated or established in India, such as companies, firms, trusts, associations of persons, etc.

4. Individuals or entities who are required to deduct or collect tax at source.

5. Non-resident Indians (NRIs) who wish to open a bank account or invest in India.

6. Government officials who are not Indian citizens but require a PAN for official purposes.

Please note that this answer is based on the general guidelines and may vary depending on specific circumstances. It is always recommended to consult with a tax professional or the official tax authorities for specific filing requirements.

How to fill out form no 49a?

To fill out Form 49A in India, follow these steps:

1. Visit the official website of the Tax Information Network - National Securities Depository Limited (TIN-NSDL) at https://www.tin-nsdl.com/.

2. On the homepage, click on the "Services" tab and select "TAN/PAN" from the drop-down menu.

3. Under the "Application Type" section, choose the option "Form 49A - Indian Citizens (Including PIO and OCI Cardholders)".

4. Read the guidelines and instructions provided on the page carefully.

5. After reading the instructions, scroll down and click on the "Online Application for New PAN (Form 49A)" link.

6. Select the relevant category as per your eligibility (individual, firm, company, etc.).

7. Fill in your personal details, such as full name, date of birth, gender, address, contact details, etc. Ensure that all the information provided is accurate and matches the supporting documents.

8. In the "AO Code" section, select the appropriate Assessing Officer code from the drop-down menu. You can search for the AO code based on your jurisdiction if you are unsure about it.

9. Next, fill in your other details, such as the source of income, tax applicable, etc.

10. Upload the supporting documents, including proof of identity, address, and date of birth. Make sure the documents are in the required formats and sizes.

11. Review all the details and documents you have provided to ensure there are no errors.

12. Enter the captcha code displayed on the page and click on the "Submit" button.

13. You will receive an acknowledgment number, and you can choose to proceed for payment or save/print the form for later payment.

14. Pay the required fee through online modes, such as credit/debit card, net banking, etc. The fee structure is available on the website.

15. After successful payment, you will receive a receipt and an acknowledgment for your PAN application.

16. It usually takes around 15-20 working days for the PAN card to be issued and delivered to your registered address.

Note: If you prefer to submit a physical form, you can download Form 49A from the TIN-NSDL website, fill it out manually, attach the necessary documents, and submit it to the nearest NSDL office or PAN service center.

What is the purpose of form no 49a?

Form 49A is a form issued by the Indian government for applying for a Permanent Account Number (PAN). PAN is a unique ten-digit alphanumeric identification number used to track tax-related transactions and to prevent tax evasion. The purpose of Form 49A is to collect information from individuals and entities who are eligible to apply for a PAN in India. This form includes details such as name, address, date of birth, contact information, and other relevant details required for the issuance of a PAN card.

Where do I find form no 49a?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific pan form no 49a and other forms. Find the template you need and change it using powerful tools.

Can I create an eSignature for the pan card form no 49a in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your form no 49 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete 49a on an Android device?

Complete 49a form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your form no 49a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pan Card Form No 49a is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.