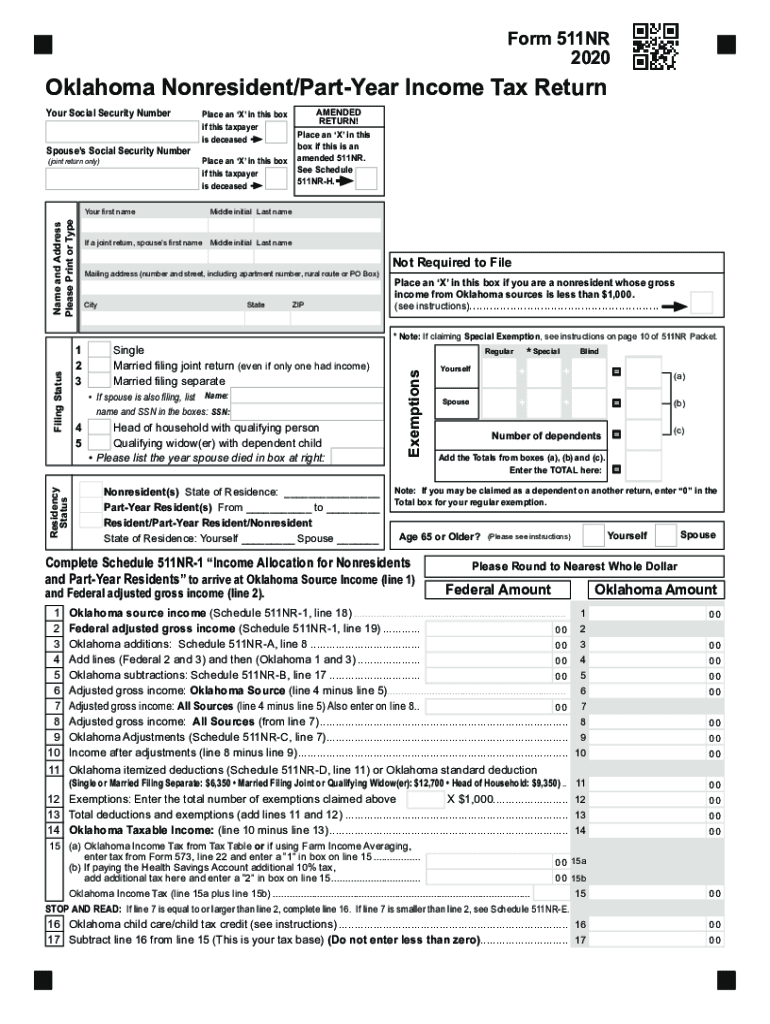

OK 511-NR Packet 2020 free printable template

Get, Create, Make and Sign OK 511-NR Packet

How to edit OK 511-NR Packet online

Uncompromising security for your PDF editing and eSignature needs

OK 511-NR Packet Form Versions

How to fill out OK 511-NR Packet

How to fill out OK 511-NR Packet

Who needs OK 511-NR Packet?

Instructions and Help about OK 511-NR Packet

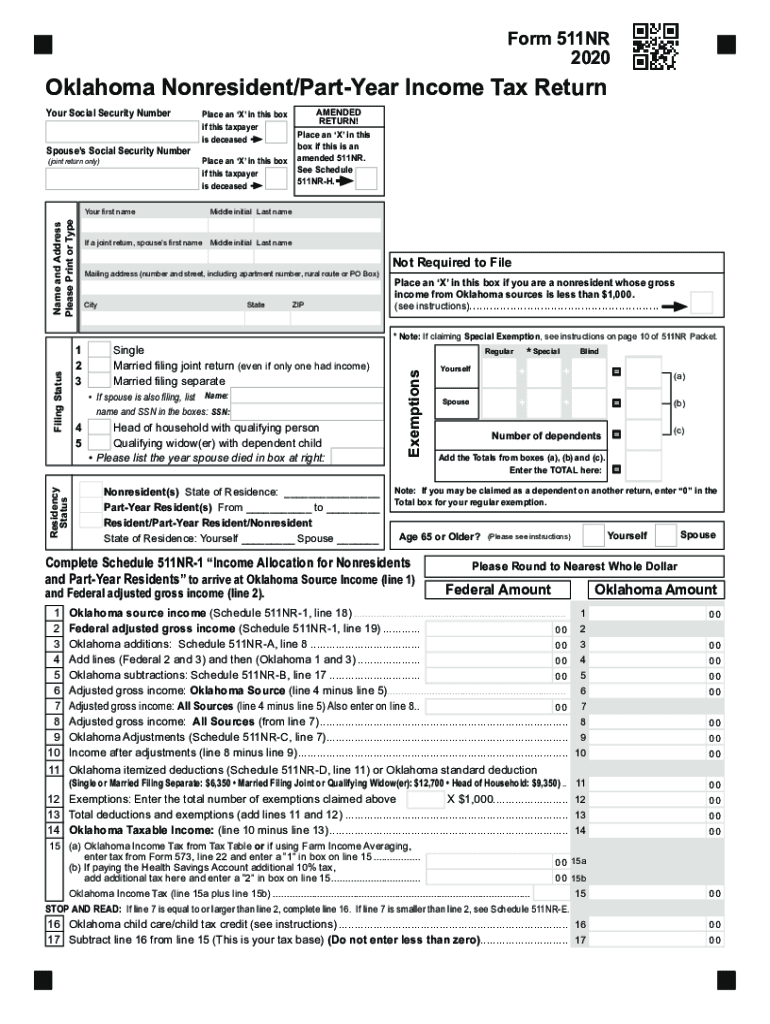

Laws dot-com legal forms guide form 5:11NR Oklahoma non-resident part year income tax return those who derived income from Oklahoma×39’s non-resident or part year residents file their state income tax owed using a form 511 NR this can be obtained from the website of the Oklahoma Tax Commission same for misused to file an amended return step 1 at the top of the first page enter your social security number as well as that of your spouse if filing jointly indicated with a check mark whether either party is deceased or if you're refiling an amended return step 2 enter your full name and address if filing jointly include your spouse×39’s full names well step 3 indicate your filing status with a check mark step 4 if you are finally as a non-resident enter your state of residence if you are filing as apart year resident give the starting and ending dates of your residence indicated with a check mark if you or your spouse is over the age of 65 step 5lines 1 through 24 provide instructions for calculating your adjusted gross income enter all numbers concerning your total income in the column on the left headed federal amount and the amounts relating to income only derived from Oklahoma in the column on the right complete lines 1 through 19 as instructed step 6 to determine your Oklahoma additions on line 20 complete schedule 511 and are — an on the third page complete line 21 as instructed complete schedule 511 NR — beyond the third page to determine your subtractions on line 20 to complete lines 23 and 24 as instructed step 7complete line 25 as instructed complete schedule 511 an hour — C to determine your adjustments on line 26 complete lines 27 through 32 as instructed step 8if claiming a child care or child tax credit complete schedule 511 an hour — Don the fourth page and enter the result on line 33 complete lines 34 through 52as instructed to determine your earned income credit on line 46 you will need to complete schedule 511 an hour — Watch more videos please make Sarto visit it laws calm

People Also Ask about

What is the 22 tax bracket for 2022?

Are Oklahoma taxes high?

Do I have to pay Oklahoma state income tax?

Which state is worse for taxes?

What are the US tax brackets for 2022?

What is Oklahoma state tax?

Is Oklahoma a high tax state?

What is the state income tax in Oklahoma?

What is the Oklahoma tax rate for 2022?

How much is federal tax in Oklahoma?

What is the tax threshold for 2022 in South Africa?

Why are Oklahoma state taxes so high?

What is the Oklahoma income tax rate?

What is the most heavily taxed state?

What is the current income tax rate in Oklahoma?

How much is 60k a year after taxes in Oklahoma?

What is Oklahoma income tax?

Why is Oklahoma tax so high?

Are property taxes in Oklahoma high?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OK 511-NR Packet from Google Drive?

How do I make changes in OK 511-NR Packet?

How do I make edits in OK 511-NR Packet without leaving Chrome?

What is OK 511-NR Packet?

Who is required to file OK 511-NR Packet?

How to fill out OK 511-NR Packet?

What is the purpose of OK 511-NR Packet?

What information must be reported on OK 511-NR Packet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.