Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

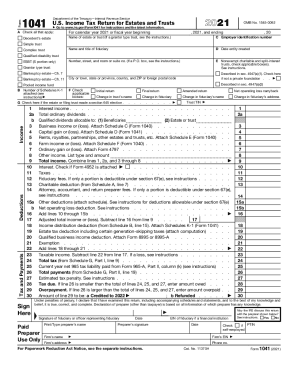

Form 6252 is a tax form issued by the Internal Revenue Service (IRS) in the United States. It is used to report income and deductions related to the installment sale of property. An installment sale occurs when a taxpayer sells property and receives one or more payments over a period of time, rather than receiving the full payment upfront. This form is used to calculate the taxable gain or loss from the installment sale and report it to the IRS.

Who is required to file form 6252?

Taxpayers who sell property on an installment basis, such as real estate or certain types of business assets, are required to file Form 6252, Installment Sale Income. This form is used to report the income received from the sale and provide the details of the installment agreement.

How to fill out form 6252?

Form 6252, also known as the Installment Sale Income form, is used to report the sale of real estate or personal property where the seller receives income through installment payments. Here's a step-by-step guide on how to fill out form 6252:

1. Provide your personal information:

- Enter your name and Social Security number (SSN) or taxpayer identification number (TIN) at the top of the form.

- Fill in your address and other contact details.

2. Identify the property sold:

- Enter the description, address, and other necessary details about the property sold.

- Indicate whether the property is real estate or personal property.

3. Determine the sale price and adjusted basis:

- Enter the total sale price of the property in column (a) of Part I.

- Calculate and enter the total cost of the property (basis) in column (b).

- Subtract any depreciation or other adjustments to the basis in column (c).

4. Calculate the gross profit percentage:

- Divide the gross profit (sale price minus basis) by the sale price.

- Enter the gross profit percentage in Part III, Line 10.

5. Complete Part I:

- Fill in the taxable year for the sale and the number of years over which the installment sale is being reported.

- Complete the installment sale computation for each year of the installment period by providing the necessary details in columns (a) through (j).

6. Complete Part II:

- Report any payment received in the current year from the buyer in column (a).

- Calculate the gross profit percentage for the year and enter it in column (b).

- Determine the installment sale income by multiplying column (a) by column (b) and entering the result in column (c).

7. Complete Parts III and IV:

- Follow the instructions provided on the form to complete these sections, which involve adjustments and calculations related to the installment sale.

8. Attach additional documents, if required:

- If there are any special circumstances or additional information related to the installment sale, attach the necessary documents along with the completed form 6252.

9. Sign and date the form:

- Sign and date the form at the bottom, confirming the accuracy of the information provided.

Remember to keep a copy of the completed form 6252 for your records. Additionally, it is recommended to consult with a tax professional or refer to the instructions provided with the form for further guidance specific to your situation.

What is the purpose of form 6252?

Form 6252, also known as the Installment Sale Income form, is used to report the sale of property or assets where the seller receives at least one payment in a year after the year of sale. This form is used by individuals, partnerships, corporations, trusts, and estates to report income from the sale of property through an installment sale transaction. The purpose of this form is to calculate and report the taxable income from the installment sale, including reporting the total gain, gross profit percentage, and the portion of the gain to be reported as income in the current tax year.

When is the deadline to file form 6252 in 2023?

The deadline to file Form 6252 (Installment Sale Income) for the tax year 2023 is typically on April 15, 2024. However, it's always recommended to verify the exact deadline with the Internal Revenue Service (IRS) or consult with a tax professional, as deadlines can sometimes change.

What is the penalty for the late filing of form 6252?

The penalty for the late filing of Form 6252, which is used to report installment sale income, can vary depending on the circumstances. As of 2021, the penalty for late filing is generally 5% of the unpaid tax amount per month, up to a maximum of 25% of the unpaid tax. However, if the tax return is over 60 days late, the minimum penalty is $435 or 100% of the unpaid tax, whichever is less.

It's important to note that these penalty amounts are subject to change, and the specific penalty for late filing of Form 6252 should be verified with the IRS or a tax professional.

What information must be reported on form 6252?

Form 6252 is used to report installment sales of property, which is when a taxpayer sells property and receives at least one payment after the tax year of the sale. Here are the key information that must be reported on Form 6252:

1. Buyer and Seller Information: The names, addresses, and taxpayer identification numbers (TIN) of both the buyer and seller of the property must be provided.

2. Description of Property: A detailed description of the property being sold must be provided, including its type, location, and any relevant identification numbers.

3. Sales Price: The total sales price of the property must be reported, including any payments received in the current tax year as well as any payments received in previous years.

4. Gross Profit Percentage: The gross profit percentage is calculated by dividing the gross profit from the sale by the contract price of the property. This percentage is used to determine the taxable profit in each tax year of the installment sale.

5. Installment Sale Payments: The amount of principal and interest received during the tax year must be reported. This includes any down payment made by the buyer.

6. Ordinary Income: If any ordinary income is recognized in the current tax year, such as the recapture of depreciation, it must be reported separately.

7. Installment Sale Deductions: Any allowable deductions related to the installment sale, such as selling expenses or bad debts, must be reported on the form.

8. Computation of Gain or Loss on Installment Sale: The gain or loss on the installment sale is calculated by multiplying the gross profit percentage by the total payments received during the tax year.

9. Capital Gain or Loss: The capital gain or loss from the installment sale is calculated by subtracting the recognized gain or loss from the installment sale from the gain or loss reported on previous tax returns.

10. Sales Basis: The seller's basis in the property is reported, which is generally the original purchase price plus improvements minus any depreciation taken.

11. Depreciation Recapture: If any depreciation was taken on the property being sold, the amount of depreciation recapture must be calculated and reported separately.

It is important to note that this information is a general overview, and each taxpayer's situation may differ. Therefore, consulting with a tax professional or reviewing the IRS instructions for Form 6252 is recommended for more specific guidance.

Can I create an electronic signature for the form 6252 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your irs form 6252 in seconds.

How do I edit 6252 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing form 6252 instructions, you need to install and log in to the app.

How do I edit form 6252 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 6252 form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.