US Bank Receipt of Correspondents Lenders Manual 2002-2024 free printable template

Show details

RECEIPT OF CORRESPONDENTS LENDERS MANUAL Undersigned acknowledges receipt of the Correspondents Lenders Manual (Many l”) of U.S. Bank N.A. (“U.S. Bank Home Mortgage). Undersigned agrees that the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your mortgage receipt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage receipt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage receipt online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage receipt template form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

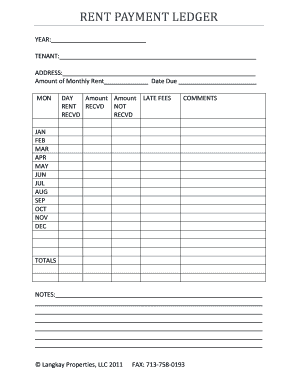

How to fill out mortgage receipt form

How to fill out mortgage payment receipt:

01

Start by writing the date of the payment receipt at the top of the document.

02

Include the name and contact information of the recipient, such as the mortgage lender or financial institution.

03

Indicate the amount of the mortgage payment in both numeric and written form.

04

Specify the purpose of the payment, such as "monthly mortgage payment" or "principal and interest payment."

05

If applicable, include any additional fees or charges associated with the payment, such as late fees or escrow payments.

06

Sign the receipt and provide your own contact information for reference.

07

Finally, save a copy of the completed receipt for your records.

Who needs mortgage payment receipt:

01

Mortgage lenders and financial institutions require mortgage payment receipts for their bookkeeping and record keeping purposes.

02

Homeowners also benefit from having mortgage payment receipts as proof of payment for their mortgage obligations.

03

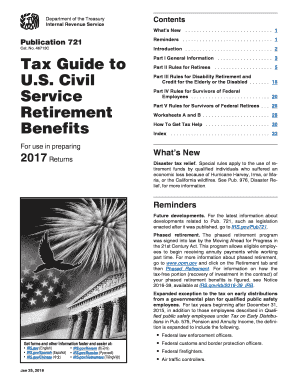

Mortgage payment receipts may be requested by tax authorities or auditors for verification purposes when assessing tax deductions or eligibility for government programs.

Fill excel mortgage payment receipt template : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file mortgage payment receipt?

The lender is usually required to file a mortgage payment receipt when a borrower makes a payment.

What is the purpose of mortgage payment receipt?

Mortgage payment receipts serve as proof that a mortgage payment has been made. They provide evidence of the amount and date of payment, as well as other details such as the borrower's name, the loan number, and the lender's name. This information is essential for both the borrower and the lender to track the payments and ensure that the loan is paid off on time.

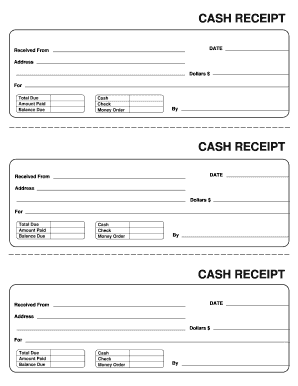

What information must be reported on mortgage payment receipt?

A mortgage payment receipt should include the following information:

1. Name and contact information of the lender

2. Name of the borrower

3. Date of the payment

4. Amount of the payment

5. Payment type (e.g. check, cash, electronic transfer)

6. Account number

7. Receipt number

8. Late fees, if any

What is the penalty for the late filing of mortgage payment receipt?

The penalty for late filing of a mortgage payment receipt will vary depending on the mortgage lender, but typically it includes late fees, interest, and possibly other charges.

What is mortgage payment receipt?

A mortgage payment receipt is a document that serves as proof of payment made towards a mortgage loan. It indicates the specific amount paid, the date of payment, and usually includes information about the lender or mortgage company. The receipt may also include details of the mortgage account, such as the loan number or property address. Mortgage payment receipts are typically provided to borrowers by the lender or mortgage servicer after each payment is made.

How to fill out mortgage payment receipt?

To fill out a mortgage payment receipt, follow these steps:

1. Start by writing the date on the top of the receipt. This is the date when the payment is received.

2. Write the name and contact details of the person or company receiving the payment. Include their full name, address, and phone number.

3. Provide the name and contact details of the person making the payment. Include their full name, address, and phone number.

4. Specify the amount of payment received. Write the payment amount in both words and numbers to avoid any confusion.

5. Mention the purpose of the payment, which in this case is for mortgage payment. Clearly state the month or period covered by the payment.

6. Include any additional details or notes regarding the payment. For example, if the payment includes any fees or penalties, indicate them in this section.

7. Add a signature line for both parties involved – the person receiving the payment and the person making the payment. This allows both parties to acknowledge the receipt of payment.

8. Finally, print the receipt and provide a copy to the person making the payment.

How do I edit mortgage receipt online?

The editing procedure is simple with pdfFiller. Open your mortgage receipt template form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit mortgage payment receipt straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing mortgage payment receipt template.

Can I edit house payment receipt on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share loan payment receipt form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your mortgage receipt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Payment Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to mortgage payment receipt book form

Related to mortgage receipt format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.