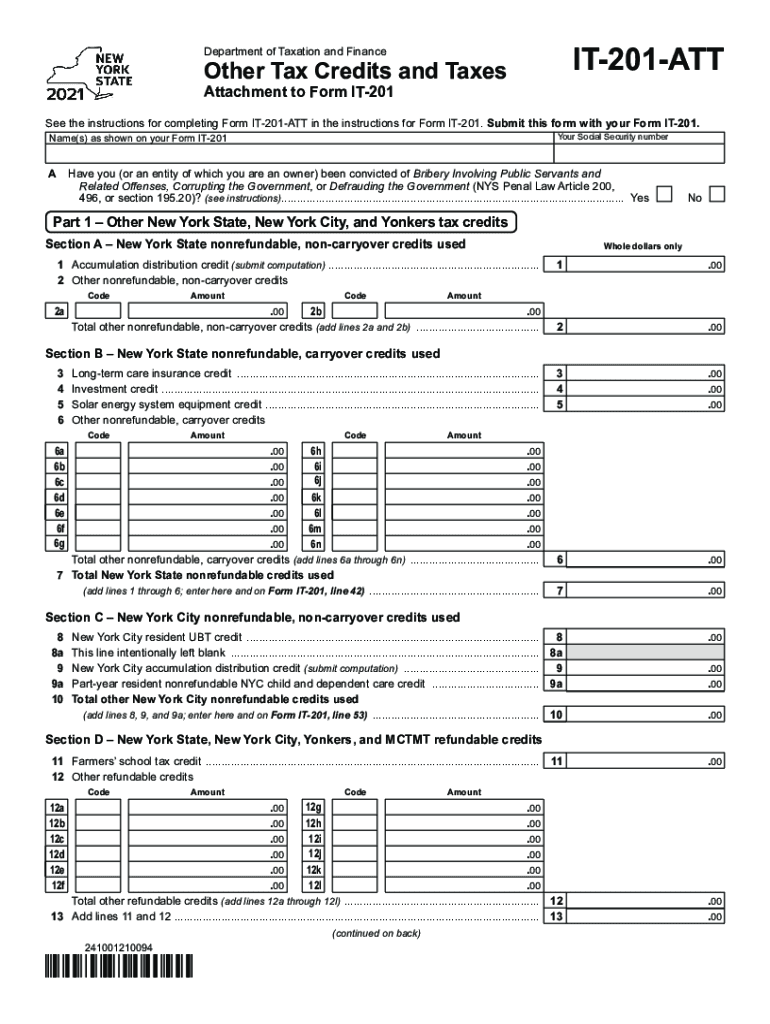

NY DTF IT-201-ATT 2021 free printable template

Show details

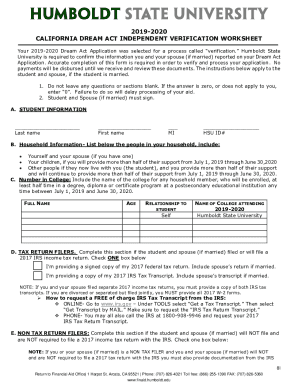

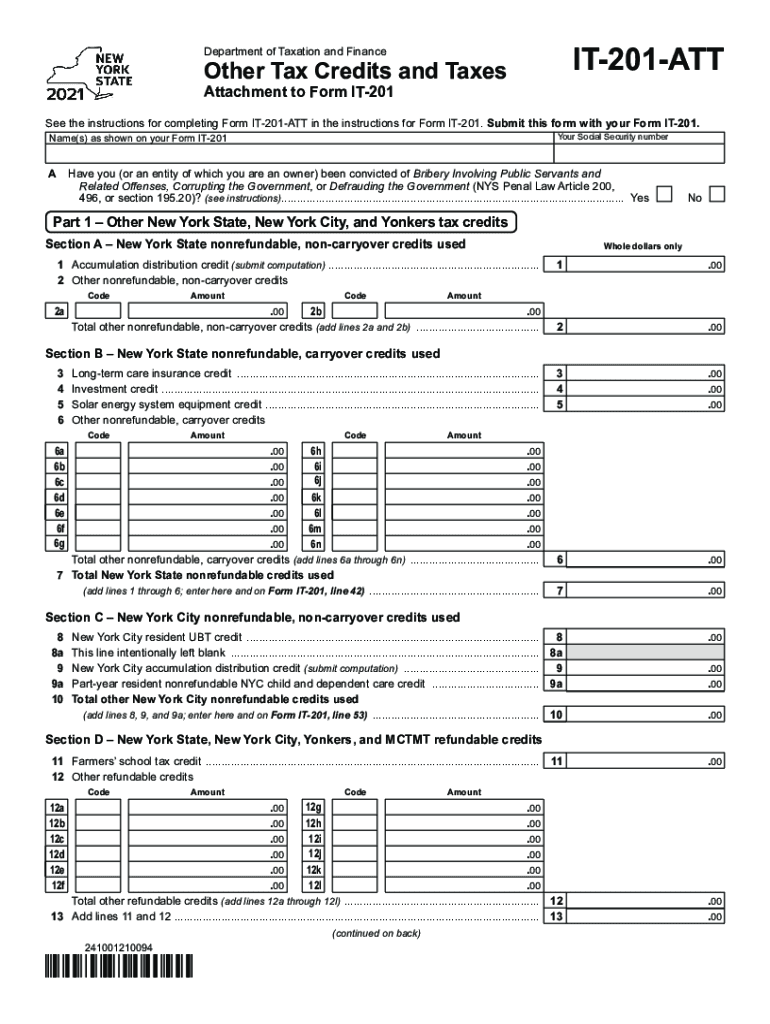

IT201ATTDepartment of Taxation and FinanceOther Tax Credits and Taxes Attachment to Form IT201See the instructions for completing Form IT201ATT in the instructions for Form IT201. Submit this form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-201-ATT

Edit your NY DTF IT-201-ATT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-201-ATT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

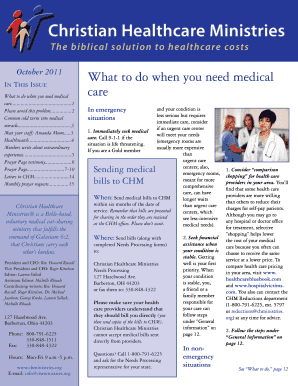

How to edit NY DTF IT-201-ATT online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF IT-201-ATT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-201-ATT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-201-ATT

How to fill out NY DTF IT-201-ATT

01

Obtain a copy of the NY DTF IT-201-ATT form from the New York State Department of Taxation and Finance website.

02

Provide your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form in the appropriate section.

04

Complete Part 1, which summarizes your income, including wages, pensions, and other sources.

05

Fill out Part 2 to determine any deductions or credits you're eligible for, such as itemized deductions or standard deductions.

06

If applicable, complete Part 3 to report any adjustments to your income.

07

Review any instructions specific to the form for clarity on each section and any additional requirements.

08

Check the form for accuracy, ensuring all calculations are correct.

09

Sign and date the form at the bottom before submitting it.

10

Submit the completed form by mailing it to the address provided in the instructions, or electronically if eligible.

Who needs NY DTF IT-201-ATT?

01

Residents of New York State who are filing an income tax return and need to report additional information or claim certain deductions and credits.

02

Individuals who have income that exceeds the standard form allowances and require additional schedules for accurate reporting.

03

Taxpayers who may benefit from tax credits that require detailed information provided by the IT-201-ATT.

Fill

form

: Try Risk Free

People Also Ask about

How do I calculate AGI from my w2?

At its simplest, Adjusted Gross Income (AGI) is gross income minus Adjustments to Income. To work out this calculation you should add up all the elements that make up your Gross Income, which includes wages, dividends, capital gains, business income, retirement distributions and some other income.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Is it201 and 1040 the same?

The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

Is 2 allowances too much?

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

What is an IT-201 resident income tax return?

What is tax form IT-201? The IT-201 is the main income tax form for New York State residents. It is analogous to the US Form 1040, but it is four pages long, instead of two pages. The first page of IT-201 is mostly a recap of information that flows directly from the federal tax forms.

What is NYS IT-201?

Form IT-201 Resident Income Tax Return Tax Year 2021.

Should I put 1 or 2 allowances?

You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

How to calculate AGI?

The AGI calculation is relatively straightforward. It is equal to the total income you report that's subject to income tax—such as earnings from your job, self-employment, dividends and interest from a bank account—minus specific deductions, or “adjustments” that you're eligible to take.

What is the difference between IT-201 and IT-203?

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.

Can I calculate my AGI myself?

To calculate your AGI, start with your gross income and subtract all eligible above-the-line deductions. Your gross income includes your wages and other forms of income like business income, pensions, interest paid to you, dividends, tips, and earnings from rental properties you own.

How many allowances should I claim New York State?

When you use the form IT-2104 Employee's Withholding Allowance Certificate for your state and city taxes, you may claim as many allowances as are justified by your circumstances. However, if you claim more than 14 allowances, you must complete the Withholding Certificate Affirmation.

Where do I file my NY state tax return?

STATE PROCESSING CENTER, 575 BOICES LANE, KINGSTON NY 12401-1083. The private delivery service address was changed on August 28, 2015. To receive written proof of the delivery date, see the list of Designated Private Delivery Services.

What is form IT-201 on my tax return?

Form IT-201 is the standard New York income tax return for state residents. Nonresidents and part-time residents must use must use Form IT-203 instead. Form IT-201 requires you to list multiple forms of income, such as wages, interest, or alimony .

What is AGI income example?

What Is AGI? Adjusted Gross Income, or AGI, starts with your gross income, and is then reduced by certain “above the line” deductions. Some common examples of deductions that reduce adjusted gross income include 401(k) contributions, health savings account contributions and educator expenses.

How do I find my AGI amount?

If you do not have a copy of your tax return, you can get your AGI from one of the IRS self-service tools: Use your online account to immediately view your AGI on the Tax Records tab. If you don't have an existing IRS username or ID.me account, have your photo identification ready. Use Get Transcript by Mail.

How many allowances should I claim NY State Single?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance.

On what line of the IT-201 is the taxable income?

Net taxable income is the income reported on line 37 of your 2015 IT-201 Tax Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY DTF IT-201-ATT in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your NY DTF IT-201-ATT, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the NY DTF IT-201-ATT in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NY DTF IT-201-ATT and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit NY DTF IT-201-ATT on an Android device?

You can make any changes to PDF files, such as NY DTF IT-201-ATT, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY DTF IT-201-ATT?

NY DTF IT-201-ATT is a New York State tax form used to report additional information and adjustments regarding individual income tax returns filed by residents of New York.

Who is required to file NY DTF IT-201-ATT?

Taxpayers who are claiming specific credits, deductions, or adjustments on their New York State income tax return are required to file NY DTF IT-201-ATT.

How to fill out NY DTF IT-201-ATT?

To fill out NY DTF IT-201-ATT, taxpayers must provide their personal information, carefully list any credits, deductions, or adjustments they are claiming, and ensure all necessary calculations are accurate before submitting it with their IT-201 return.

What is the purpose of NY DTF IT-201-ATT?

The purpose of NY DTF IT-201-ATT is to provide a detailed account of adjustments, credits, or deductions that affect the calculation of an individual's tax liability for compliance with New York State tax laws.

What information must be reported on NY DTF IT-201-ATT?

Information that must be reported on NY DTF IT-201-ATT includes personal identification details, descriptions of the credits and deductions claimed, as well as supporting calculations or documentation as required.

Fill out your NY DTF IT-201-ATT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-201-ATT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.