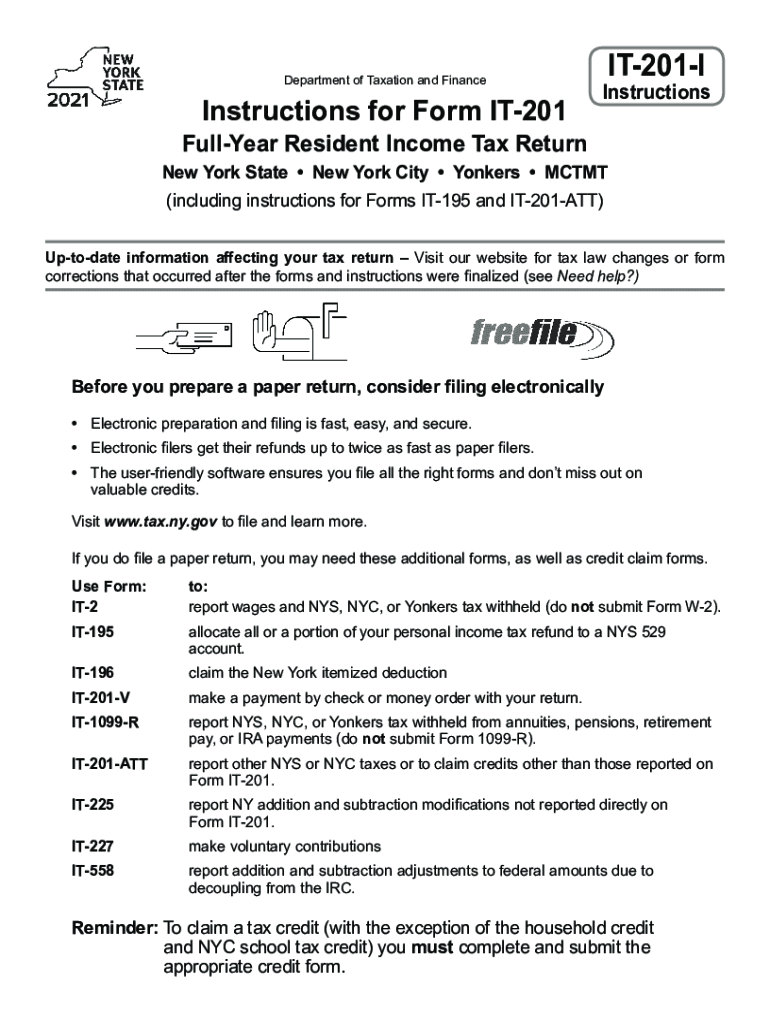

NY IT-201-I 2021 free printable template

Instructions and Help about NY IT-201-I

How to edit NY IT-201-I

How to fill out NY IT-201-I

About NY IT-201-I 2021 previous version

What is NY IT-201-I?

When am I exempt from filling out this form?

Due date

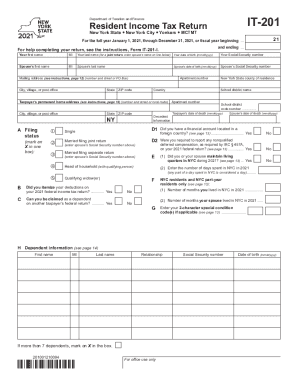

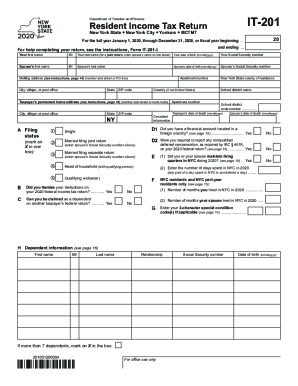

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about NY IT-201-I

What should I do if I discover an error after submitting my new york instructions tax?

If you find an error on your submitted new york instructions tax, you can file an amended return to correct it. This typically involves using the appropriate form designated for amendments and following specific guidelines outlined by the New York State tax authority. Ensure you provide clear explanations for the changes made.

How can I track the status of my new york instructions tax submission?

To verify the status of your new york instructions tax filing, you can use the online tracking system provided by New York State. You'll need certain details like your social security number and filing status. This allows you to check if your return has been received and processed.

What are common mistakes to avoid when filing my new york instructions tax?

Common errors when filing the new york instructions tax include incorrect personal information, math errors, and forgetting to sign the form if required. It's essential to double-check all information for accuracy before submission to prevent delays or rejections.

What should I do if I receive a notice regarding my new york instructions tax?

If you receive a notice concerning your new york instructions tax, carefully read the details provided in the notice. Follow the outlined steps to address any issues, which may include providing additional documentation or clarifying information. It’s crucial to respond promptly to avoid further complications.