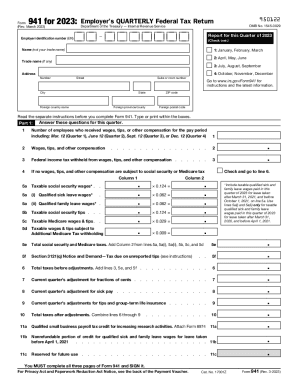

OK OTC WTH 10001 2021-2024 free printable template

Show details

WTH 10001Oklahoma Quarterly Wage Withholding Tax ReturnRevised 102021Taxpayer Copy/Worksheet. Taxpayer FEINT. Quarter Ending. Due Date Dollars Cents 1. Wages Paid. 2. Tax Withheld. 3. Interest(+).

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your oklahoma wage withholding tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma wage withholding tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma wage withholding tax online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oklahoma wth withholding form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

OK OTC WTH 10001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma wage withholding tax

How to fill out Oklahoma wage withholding tax:

01

Gather necessary information such as the employee's name, social security number, and filing status.

02

Obtain the Oklahoma Employer's Withholding Allowance Certificate (Form OW-4) from the Oklahoma Tax Commission website or by contacting the commission directly.

03

Fill out the Form OW-4 accurately, providing all required information including the employer's name and address, the employee's personal information, and the filing status.

04

Determine the employee's withholding status by considering factors such as their marital status, number of dependents, and any additional withholdings requested.

05

Calculate the appropriate amount of tax to withhold by referring to the Oklahoma Income Tax Withholding Tables provided by the Oklahoma Tax Commission.

06

Enter the calculated amount for each pay period on the appropriate line(s) of the Form OW-4.

07

Keep a copy of the completed Form OW-4 for your records and provide the original to the employee to keep for their reference.

Who needs Oklahoma wage withholding tax:

01

Employers in the state of Oklahoma are required to withhold state income taxes from their employees' wages.

02

Employees who earn income from employment within Oklahoma are subject to wage withholding tax.

03

Both resident and non-resident individuals who earn income in Oklahoma are subject to this tax.

04

Oklahoma wage withholding tax is applicable to individuals as well as businesses that have employees earning income in the state.

Video instructions and help with filling out and completing oklahoma wage withholding tax

Instructions and Help about oklahoma quarterly withholding form

Fill oklahoma form quarterly wage withholding tax : Try Risk Free

People Also Ask about oklahoma wage withholding tax

Which one of these states is not a mandatory withholding state?

Does Oklahoma have withholding tax?

What is Oklahoma tax rate 2022?

What are the 3 types of taxes withheld from paychecks?

Can I choose not to have taxes withheld?

What is normal tax withholding percentage?

What is the tax withholding rate in Oklahoma?

What are examples of withholding taxes?

Is tax withholding mandatory?

What are 4 examples of tax withholdings from your paycheck?

Do you get withholding tax back?

How much do you have to withhold for taxes in Oklahoma?

Is Oklahoma a mandatory withholding state?

What is withholding tax in simple terms?

Is w4 tax withholding mandatory?

What is withholding tax on wages?

Does Oklahoma have state withholding tax?

What are mandatory withholdings?

What happens if you don't withhold taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oklahoma wage withholding tax?

Oklahoma wage withholding tax is a type of tax deducted from an employee's wages or salary in the state of Oklahoma. It is the amount withheld by an employer from an employee's paycheck to cover their state income tax liability. The employer then remits these withholdings to the Oklahoma Tax Commission on behalf of the employee. The amount withheld is based on the employee's income, tax filing status, and any allowances or exemptions claimed on their W-4 form. The Oklahoma income tax rates range from 0.5% to 5%, depending on the employee's income level.

Who is required to file oklahoma wage withholding tax?

In Oklahoma, employers are required to file and remit wage withholding tax. This tax is withheld from employees' wages to be used for income taxes, state unemployment taxes, and other state taxes or contributions.

What is the purpose of oklahoma wage withholding tax?

The purpose of Oklahoma wage withholding tax is to ensure that employers withhold a portion of their employees' wages to cover their income tax liabilities to the state of Oklahoma. This tax is deducted from employees' wages on a regular basis and is then remitted to the Oklahoma Tax Commission. The withholding tax helps in the efficient collection of income taxes from individuals and businesses, ensuring that the state receives a regular inflow of revenue to fund various public services and initiatives.

When is the deadline to file oklahoma wage withholding tax in 2023?

The exact deadline for filing Oklahoma wage withholding tax in 2023 has not been specified. It is recommended to check with the Oklahoma Tax Commission or refer to their official website for the most up-to-date information on tax deadlines.

What is the penalty for the late filing of oklahoma wage withholding tax?

The penalty for late filing of Oklahoma wage withholding tax is 5% of the tax due if the return is filed within 30 days after the due date, and an additional 5% for each additional 30 days or fraction thereof that the return remains unfiled, up to a maximum penalty of 25%.

How to fill out oklahoma wage withholding tax?

To fill out the Oklahoma Wage Withholding Tax, you need to follow these steps:

1. Obtain the Oklahoma Wage Withholding Tax Form: You can download the form from the Oklahoma Tax Commission's website or request a copy from the commission directly.

2. Provide Employer Information: Fill out the employer's name, address, and federal employer identification number (FEIN) in the designated sections of the form.

3. Employee Information: Fill in the employee's name, social security number (or taxpayer identification number), and address.

4. Filing Period: Indicate the filing period for the wage withholding tax return. This can be monthly, quarterly, or annually, depending on your withholding tax liability.

5. Calculation of Tax Withholding: Calculate the total amount of tax withheld from each employee's wages during the filing period. Use the Oklahoma Income Tax Withholding Tables or the Oklahoma Wage Withholding Tax Calculator provided by the Oklahoma Tax Commission to determine the correct amount for each employee.

6. Total Tax Withheld: Add up all the individual employee tax withholding amounts to find the total amount of tax withheld during the filing period. Write this amount in the designated section of the form.

7. Payment: If you have any tax liability after deducting the tax withheld from employees' wages, calculate the amount due. Ensure to include this payment along with the completed form.

8. Sign and Submit: Sign and date the form to authenticate it. You can then mail the completed form and payment to the Oklahoma Tax Commission or submit it online through the commission's online filing portal.

It's important to note that these instructions are for general guidance, and it is recommended to consult the Oklahoma Tax Commission's instructions or seek advice from a tax professional for specific and up-to-date information.

What information must be reported on oklahoma wage withholding tax?

In Oklahoma, employers are required to report the following information on wage withholding tax:

1. Employer Identification Number (EIN): Employers must provide their EIN on all withholding tax reports. This number identifies the employer for tax purposes.

2. Employee Information: Employers should report the name, Social Security Number (SSN), and address of each employee subject to wage withholding tax.

3. Payment Details: Employers must report the total amount of wages paid to each employee during the reporting period. This includes regular wages, bonuses, commissions, tips, and any other taxable compensation.

4. Deductions: Employers should report any deductions from employee wages, such as federal income tax, state income tax, Social Security tax, Medicare tax, and any other applicable deductions.

5. Tax Withholding: Employers should report the amount of tax withheld from each employee's wages for state income tax purposes.

6. Reporting Period: Employers are required to report wage withholding tax on a regular basis, generally either monthly or quarterly. The specific reporting period and deadline depends on the size of the employer's payroll.

It is important to note that employers may also be required to file related forms such as the Oklahoma Employer's Quarterly Tax Report or the Oklahoma Annual Withholding Reconciliation Return, depending on the frequency of reporting and total amount of tax withheld.

How can I manage my oklahoma wage withholding tax directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your oklahoma wth withholding form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify oklahoma form wage withholding without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your oklahoma withholding return into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete ok wth 10001 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your oklahoma quarterly wage withholding tax return form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your oklahoma wage withholding tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Form Wage Withholding is not the form you're looking for?Search for another form here.

Keywords relevant to wth 10001 form

Related to oklahoma wth 10001 tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.