Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

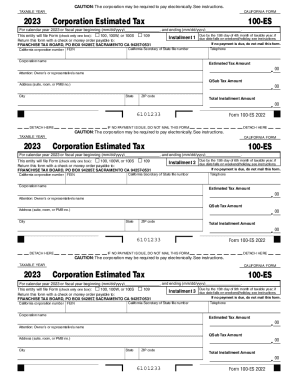

What information must be reported on tax corporation?

The information that must be reported on a tax return for a corporation includes: total gross income, total deductions, total taxable income, total taxes paid, any credits or losses, and the total amount of taxes due.

When is the deadline to file tax corporation in 2023?

The deadline for filing corporate taxes in 2023 will depend on when the tax year ends. Generally, the deadline for filing corporate taxes is the 15th day of the third month following the end of the tax year. For example, if the tax year ends on December 31, 2023, the deadline for filing corporate taxes would be March 15, 2024.

Tax corporation refers to a legal entity, typically a business organization, that is subject to taxation on its income or profits. A tax corporation can be a separate legal entity, such as a company, limited liability company (LLC), or a partnership that is treated as a corporation for tax purposes. It is required to comply with the tax laws and regulations of the jurisdiction in which it operates and pay corporate income tax on its taxable income. The specific tax obligations and rates vary depending on the country and the legal structure of the corporation.

Who is required to file tax corporation?

Corporations are required to file tax returns with the Internal Revenue Service (IRS). This includes both C corporations and S corporations.

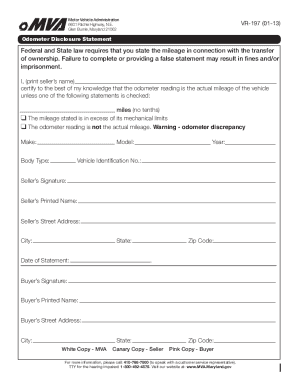

How to fill out tax corporation?

Filling out tax forms for a corporation can be a complex process. Here is a general step-by-step guide to help you with filling out tax forms for a corporation:

1. Determine your corporation's tax year: A tax year is a 12-month accounting period for which you calculate your taxes. Select either a calendar year (January 1 to December 31) or a fiscal year (a 12-month period ending on the last day of any month other than December).

2. Obtain the necessary forms: The most common form for corporate tax return in the United States is Form 1120, "U.S. Corporation Income Tax Return." You can download this form and other related schedules from the official IRS website (www.irs.gov) or request them by mail.

3. Gather all financial records: Collect all relevant financial records such as income statements, balance sheets, profit and loss statements, bank statements, and any other necessary supporting documents. Ensure that all records are complete and accurately reflect your corporation's financial activities.

4. Fill out the tax return form: Start by completing the basic identification information, such as the corporation's name, address, and Employer Identification Number (EIN). Proceed to fill in the income, deductions, and credits sections based on the instructions provided with the tax form. Be meticulous and ensure all numbers are accurate.

5. Complete necessary schedules and attachments: Depending on your corporation's activities and sources of income, you may need to attach additional forms and schedules. Common attachments include Schedule C for deductions and Schedule K-1 for shareholders.

6. Calculate your tax liability: Once you have filled out all the necessary sections, calculate your corporation's tax liability by following the instructions provided on the form. Be aware of any special rules or limitations related to corporate taxation.

7. Review and verify your tax return: Before submitting, carefully review the completed tax return and all supporting documents to minimize errors or omissions. Make sure calculations are correct, forms are signed, and all required attachments are included.

8. File your tax return: Mail your completed tax return to the appropriate address provided on the form or, if eligible, use e-file services to submit your return electronically. Ensure that you meet the filing deadline, which is typically on or before the 15th day of the third month following the end of your corporation's tax year.

9. Keep copies for your records: Retain copies of your completed tax return, supporting documents, and any payment confirmation received for future reference or potential audits.

It is crucial to note that tax laws and requirements may vary based on your country and jurisdiction. Therefore, it is advisable to consult with a professional tax advisor or accountant who can provide personalized guidance based on your corporation's specific circumstances.

What is the purpose of tax corporation?

The purpose of tax corporations, also known as corporate taxes, is to generate revenue for the government from businesses operating within the jurisdiction. These taxes are imposed on the profits earned by corporations and are used to fund public services, infrastructure development, social welfare programs, defense, and other essential functions of the government.

The key objectives of tax corporations are as follows:

1. Revenue generation: Corporate taxes contribute significantly to government revenue, which is used to finance various public expenditures. It helps in maintaining a functioning government apparatus and providing essential services to citizens.

2. Economic stability and growth: By collecting taxes from corporations, governments can ensure economic stability and sustainable growth. The revenue generated can be utilized for investment in infrastructure, education, healthcare, and other sectors that promote economic development.

3. Redistribution of wealth: Corporate taxes can play a role in redistributing wealth and reducing income inequality. Governments often use progressive tax systems, which impose higher tax rates on higher earning corporations. This helps in ensuring a more balanced distribution of wealth and resources.

4. Leveling the playing field: Taxing corporations helps in creating a fair business environment by preventing some corporations from gaining an unfair advantage over others. It helps in maintaining competition, ensures a level playing field, and discourages tax evasion or avoidance.

5. Social and environmental objectives: Tax corporations can be levied on certain industries or activities to influence their behavior towards socially and environmentally responsible practices. Governments can provide incentives or impose higher taxes on corporations that engage in harmful practices, encouraging responsible business conduct and promoting sustainability.

Overall, the purpose of tax corporations is to secure revenue for government activities, promote economic growth, maintain fairness and equity, and drive socially responsible business behavior.

What is the penalty for the late filing of tax corporation?

The penalty for late filing of tax returns for corporations varies by jurisdiction and can depend on factors such as the amount of tax owed and the duration of the delay. In the United States, for example, the penalty for late filing of a corporate tax return (Form 1120) is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax.

However, it is important to note that penalty regulations can differ across jurisdictions, so it is advisable to consult the tax laws and guidelines specific to the relevant country or state for accurate information on late filing penalties for corporations.

How can I send tax corporation to be eSigned by others?

form estimated is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in how to corporation?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your ca form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the 1040 es form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your how to tax 100 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.