NY IT-2105-I 2022 free printable template

Show details

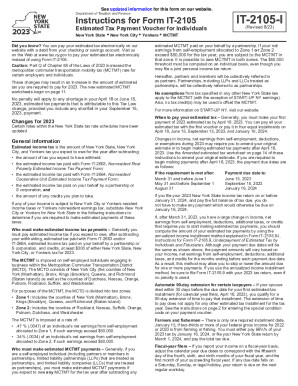

Department of Taxation and FinanceInstructions for Form IT2105Estimated Tax Payment Voucher for Individuals New York State New York City Yonkers MC TMT Did you know? You can pay your estimated tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form it-2105 estimated income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it-2105 estimated income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form it-2105 estimated income online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form it-2105 estimated income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

NY IT-2105-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form it-2105 estimated income

How to fill out form it-2105 estimated income:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income statements.

02

Determine your estimated income for the year by reviewing your financial records and projecting your future earnings.

03

Fill out the personal information section of the form, including your name, address, and Social Security number.

04

Proceed to the income section of the form and enter all sources of income, including wages, dividends, and rental income. Ensure accuracy and double-check your calculations.

05

Complete any additional sections of the form, such as deductions or exemptions, if applicable to your situation.

06

Review the completed form for any errors or omissions. Make any necessary corrections before submitting.

07

Sign and date the form before mailing it to the appropriate tax authority.

Who needs form it-2105 estimated income:

01

Individuals who anticipate having income that is not subject to withholding taxes, such as self-employed individuals or those with significant investment income.

02

Taxpayers who expect to owe a substantial amount of taxes at the end of the year and want to avoid underpayment penalties.

03

Individuals who want to ensure that they are paying the correct amount of taxes throughout the year to avoid a large tax bill or refund.

Note: It is always recommended to consult a tax professional or refer to the specific instructions provided by the tax authority to accurately complete and file form it-2105 estimated income.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form it-2105 estimated income?

Form IT-2105, Estimated Income Tax Payment Voucher for Individuals, is a tax form used by residents of New York State to calculate and pay their estimated income tax. It is typically used by individuals who expect to owe more than $300 in taxes for the current tax year and want to make quarterly estimated tax payments to avoid potential underpayment penalties. The form helps individuals calculate their estimated tax liability based on their projected income and deductions, and it provides a voucher to send with their payment to the New York State Department of Taxation and Finance.

Who is required to file form it-2105 estimated income?

The IT-2105 form is filed by individuals who are required to make estimated tax payments in New York State. They must file this form to determine their estimated tax liability and to make quarterly estimated tax payments if their tax liability is expected to be $300 or more after subtracting withholding and credits.

How to fill out form it-2105 estimated income?

To fill out form IT-2105, the estimated income tax payment voucher for individuals, follow the steps below:

1. Start by providing your personal information at the top of the form, including your name, address, and taxpayer identification number (SSN or ITIN).

2. In Part 1, enter your estimated tax liability for the tax year. This can be calculated by referring to your previous year's tax return, considering any changes in income, deductions, or credits that may affect your liability.

3. Check the appropriate box in Part 2, indicating whether you are a full-year New York State resident, part-year resident, or nonresident for the tax year.

4. If you are a part-year resident, indicate the dates of your residency in the spaces provided.

5. In Part 3, estimate your wages, salaries, tips, and other taxable compensations. If you have multiple employers, list them separately and provide the corresponding federal identification numbers.

6. Estimate your taxable interest and dividend income in Part 4. If you have earned interest or dividends from multiple sources, list them separately.

7. If you have other sources of income, such as self-employment income, pensions, or rental income, estimate the amounts in Part 5. Be sure to include all taxable income.

8. Deduct your total estimated deductions from your estimated total income in Part 6. This includes deductions such as student loan interest, tuition expenses, and retirement plan contributions.

9. In Part 7, estimate your total tax credits for the tax year. This can include credits for dependent care expenses, education expenses, or other eligible credits.

10. Subtract your estimated tax credits from your estimated tax liability to determine your estimated net tax in Part 8.

11. Finally, in Part 9, calculate your quarterly estimated tax payments. Divide your estimated net tax by four, and enter the result in the appropriate section for each quarter.

12. Sign and date the form at the bottom. If filing jointly, both individuals must sign the form.

Remember to consult the instructions provided with the form for additional guidance and any specific requirements particular to your tax situation.

What is the purpose of form it-2105 estimated income?

Form IT-2105 Estimated Income is used by individuals in New York State to make estimated tax payments for the current tax year. The purpose of this form is to help individuals estimate and pay their state income taxes throughout the year, rather than waiting until the end of the year to pay the full amount owed. By making estimated tax payments, individuals can avoid underpayment penalties and ensure that they have met their tax obligations by the tax filing deadline.

What information must be reported on form it-2105 estimated income?

On form IT-2105, you are required to report the following information:

1. Your name and complete address.

2. Your social security number.

3. Your spouse's information, if applicable.

4. Number of dependents claimed on your federal income tax return.

5. Your estimated New York State taxable income, including any wages, salaries, tips, bonuses, self-employment income, rental income, etc.

6. Estimated New York State tax withheld, if applicable.

7. Any other income that is subject to New York State tax, such as unemployment compensation, interest, dividends, pensions, and annuities.

8. Estimated New York State sales or use tax paid, if applicable.

9. Estimated credits, such as child and dependent care credit, earned income credit, etc.

10. Estimated itemized deductions, if applicable.

11. Any other pertinent information regarding your estimated income and tax liability.

It is important to accurately report this information to ensure proper calculation and payment of your estimated taxes.

What is the penalty for the late filing of form it-2105 estimated income?

The penalty for late filing of form IT-2105 (Estimated Income Tax Payment Voucher for Individuals) varies depending on the specific tax regulations of each state. In general, late filing penalties may include additional interest charges on the unpaid tax amount, as well as possible late payment penalties. It is advisable to refer to the official guidelines and instructions provided by the tax authorities of your particular state for accurate information on penalties associated with late filing.

How can I send form it-2105 estimated income for eSignature?

To distribute your form it-2105 estimated income, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit form it-2105 estimated income in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your form it-2105 estimated income, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out form it-2105 estimated income on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your form it-2105 estimated income. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your form it-2105 estimated income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.