Get the free it 215 instructions form

Show details

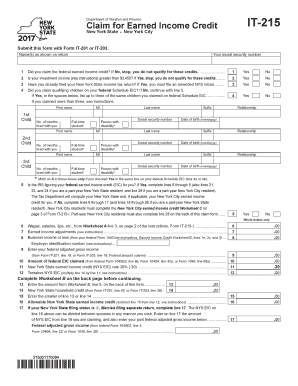

Nonresidents of New York State do not qualify for a refund of the How to claim the credit To claim the NYS EIC you must complete Form IT-215 using the information from your federal return worksheets and if applicable the federal earned income credit line instructions. For 2006 and have completed Form IT-215 in order to claim the NYC EIC. Because of the different methods in computing the two credits NYS EIC and NYC EIC if you qualify for the NYC E...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 215 instructions form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 215 instructions form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it 215 instructions online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new york state tax forms printable it215. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out it 215 instructions form

How to fill out New York state tax?

01

Gather all necessary documents: Before starting to fill out your New York state tax form, make sure you have all the required documents handy. These may include your W-2 forms, 1099 forms, receipts, and any other relevant financial records.

02

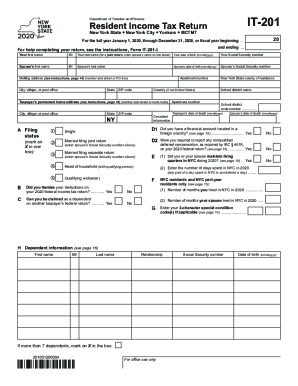

Choose the right tax form: Depending on your personal situation, you will need to choose the appropriate tax form. The most common form for individuals is Form IT-201, while self-employed individuals may need to use Form IT-203.

03

Provide your personal information: Begin by providing your personal information, such as your name, Social Security number, and address. Ensure that all the information you provide is accurate.

04

Report your income: Next, accurately report your income on the tax form. This includes wages, salaries, tips, and any other sources of income you may have received during the tax year. Be sure to include all the necessary documentation to support your income claims.

05

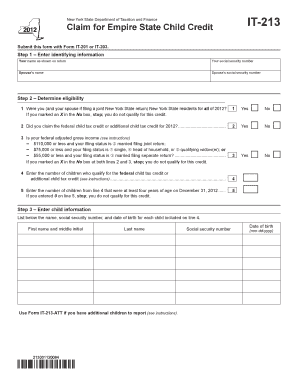

Deductions and credits: Determine if you qualify for any deductions or tax credits. New York state offers various deductions and credits, such as the standard deduction, child tax credit, or college tuition credit. Carefully review the eligibility criteria for each and claim the ones you qualify for.

06

Calculate your tax liability: Once you have reported all your income and claimed eligible deductions and credits, you can calculate your tax liability using the tax tables provided by the New York State Department of Taxation and Finance. Follow the instructions on the tax form to calculate the amount you owe or the refund you are entitled to.

07

Submit your tax form: After completing all the necessary sections and double-checking for accuracy, you are ready to submit your New York state tax form. Depending on your preference, you can file electronically (e-file) or mail a paper copy to the appropriate tax authority.

Who needs New York state tax?

01

Residents of New York: If you reside in the state of New York, you are generally required to file a New York state tax return. This includes both full-year residents and part-year residents.

02

Non-residents with New York source income: If you are not a resident of New York but earned income from within the state, you are still required to file a New York state tax return. This applies to non-resident individuals, estates, and trusts.

03

Individuals with New York state tax obligations: Even if you are not a resident of New York and did not earn any income in the state, you may still be required to file a New York state tax return if you have certain tax obligations, such as owing use tax on purchases made online or out-of-state.

It is important to note that tax laws can change, and individual circumstances may vary. It is always advisable to consult with a tax professional or refer to the official New York State Department of Taxation and Finance website for the most up-to-date information and guidance.

Fill it215 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new york state tax?

New York State tax refers to the taxes levied by the government of New York State on its residents and businesses. The taxes include income tax, sales tax, property tax, corporate tax, and various other taxes and fees. The specific rates and regulations for each tax may vary depending on income level, filing status, and other factors. It is important to consult the New York State Department of Taxation and Finance or a tax professional for accurate and up-to-date information on the state taxes.

Who is required to file new york state tax?

In general, individuals are required to file a New York state tax return if they meet any of the following criteria:

1. If their federal gross income exceeds certain thresholds, which vary depending on filing status and age.

2. If they are a New York resident for the entire year and have any amount of income during the year, regardless of the source.

3. If they are a nonresident of New York but have New York source income, such as wages earned in New York, rental income from property located in New York, or certain business income derived from New York.

4. If they are a part-year resident of New York, having moved into or out of the state during the tax year, and have any amount of income during the year, regardless of the source.

It is important to note that there may be exceptions and additional considerations depending on individual circumstances. It is always recommended to consult with a tax professional or refer to the official New York State Department of Taxation and Finance guidelines for specific filing requirements.

How to fill out new york state tax?

Filling out a New York State tax return can be done by following these steps:

1. Gather all necessary documents: Ensure you have your W-2 forms, 1099 forms, Social Security card, income receipts, and any other relevant tax documents.

2. Determine your filing status: Determine whether you will be filing as Single, Married Filing Jointly, Head of Household, etc. Your filing status will affect your tax rate and deductions.

3. Choose the correct tax form: If you are a full-year resident of New York, you will generally use Form IT-201. If you are a part-year or nonresident, you may need to use a different form such as IT-203 or IT-150.

4. Fill out personal information: Enter your name, address, Social Security number, and other required personal details on the tax form.

5. Report your income: Fill out the appropriate sections to report your income, such as wages, self-employment income, investment income, etc. Report each income source separately.

6. Deductions and credits: Fill out the deductions and credits section to claim any tax breaks you are eligible for, such as student loan interest deduction, child tax credit, etc.

7. Calculate your tax liability: Follow the instructions on the tax form to calculate your tax liability, considering any exemptions, deductions, and credits you qualify for.

8. Pay any owed taxes or claim a refund: If you owe taxes, pay the amount due by the filing deadline. If you expect a refund, provide your banking information for direct deposit or request a paper check.

9. Attach necessary documents: Attach any required supporting documents, such as W-2 forms or 1099 forms, along with your completed tax return when mailing it.

10. Review and file: Carefully review your completed tax return for accuracy and sign it. Make a copy of your return and keep it for your records. File your tax return by mailing it to the appropriate address provided on the form or electronically through the New York State Department of Taxation and Finance website.

Note: It is recommended to seek assistance from a tax professional or use tax software to ensure accuracy, especially if you have complex tax situations or are unsure how to proceed.

What is the purpose of new york state tax?

The purpose of New York State tax is to generate revenue for the state government in order to fund various public services and programs. This includes supporting education, transportation infrastructure, healthcare, public safety, social services, environmental conservation, and other government operations and initiatives. State taxes are also used to balance the state budget and ensure the delivery of essential services to the residents of New York.

What information must be reported on new york state tax?

On the New York State tax return, the following information must be reported:

1. Personal Information: Taxpayers must provide their full name, social security number, and address.

2. Filing Status: Taxpayers must indicate their filing status, such as single, married filing jointly, married filing separately, or head of household.

3. Income: All sources of income must be reported, including wages, salaries, self-employment income, rental income, interest, dividends, pension and retirement distributions, and any other income earned during the tax year.

4. Deductions: Taxpayers can choose between itemized deductions or claiming the standard deduction. If opting for itemized deductions, they must report eligible expenses such as mortgage interest, property taxes, state and local taxes, medical expenses, charitable contributions, and other qualifying expenses.

5. Credits: Any applicable tax credits must be reported, such as the New York State earned income credit, child and dependent care credit, college tuition credit, and other available credits.

6. Additional Taxes and Payments: Taxpayers must report any additional taxes owed, such as self-employment tax or alternative minimum tax, as well as any estimated tax payments made during the year.

7. Health Insurance Coverage: Taxpayers must report whether they had health insurance coverage for themselves and their dependents throughout the tax year, or if they qualify for an exemption from the requirement.

8. Other Information: Depending on individual circumstances, taxpayers may need to report additional information, such as gambling winnings, rental property details, or other specific tax situations.

It is important to note that this is not an exhaustive list, and taxpayers should consult the official New York State tax instructions or a tax professional for specific guidance based on their personal situation.

What is the penalty for the late filing of new york state tax?

The penalty for late filing of New York State taxes depends on the amount of tax owed and the length of the delay. The late filing penalty is generally 5% of the tax due for each month (or part of a month) that the return is late, up to a maximum of 25% of the tax due. Additionally, interest is charged on any unpaid tax from the original due date until paid in full. It is important to note that penalties and interest may vary depending on individual circumstances, and it is recommended to consult the New York State Department of Taxation and Finance or a tax professional for specific information related to a particular case.

How can I manage my it 215 instructions directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your new york state tax forms printable it215 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make edits in it 215 instructions 2020 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your nys tax form it 215 instructions, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit it 215 form 2020 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as form it215. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your it 215 instructions form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It 215 Instructions 2020 is not the form you're looking for?Search for another form here.

Keywords relevant to ny it 215 form

Related to form it 215

If you believe that this page should be taken down, please follow our DMCA take down process

here

.