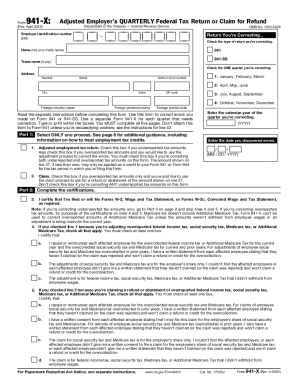

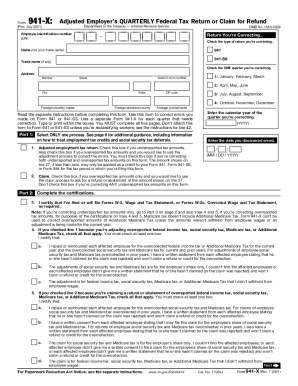

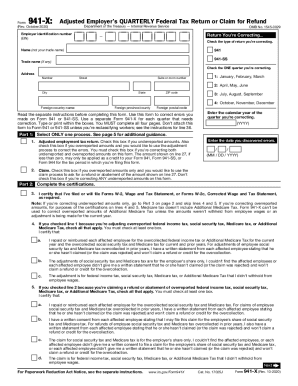

IRS 941-X 2022 free printable template

Instructions and Help about IRS 941-X

How to edit IRS 941-X

How to fill out IRS 941-X

About IRS 941-X 2022 previous version

What is IRS 941-X?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 941-X

What should I do if I realize I've made an error after filing my IRS 941-X?

If you discover an error after submitting your IRS 941-X, you may need to file a corrected version to accurately reflect your information. Ensure you gather all relevant documentation related to the initial submission and prepare to indicate the specific changes made. It's essential to keep a record of the amended filings in case of future queries from the IRS.

How can I check the status of my IRS 941-X submission?

To verify the status of your IRS 941-X, you can use the IRS's online tools or call their support line for assistance. Be prepared to provide essential details such as your EIN and filing period. Tracking your filing is crucial to ensure there are no issues with processing or potential rejection notices.

What are some common mistakes people make when submitting IRS 941-X?

Common errors when filing IRS 941-X include incorrect EIN entries, failing to sign the form, and not providing adequate documentation for changes claimed. To minimize mistakes, double-check all information for accuracy and completeness, and ensure you are referencing the correct tax period and amounts.

Are there any specific requirements for e-signatures on the IRS 941-X?

E-signatures on the IRS 941-X are accepted under specific conditions set by the IRS. Ensure that your e-signature complies with IRS regulations, and verify the requirements on the IRS website before submitting your form electronically. Proper adherence guarantees your submission's validity.

What should I do if I receive an IRS notice regarding my submitted 941-X?

Upon receiving an IRS notice related to your IRS 941-X, carefully read the communication to understand the issue raised. Prepare the necessary documentation to address the IRS's inquiries, and respond within the time frame specified to avoid further complications.

See what our users say