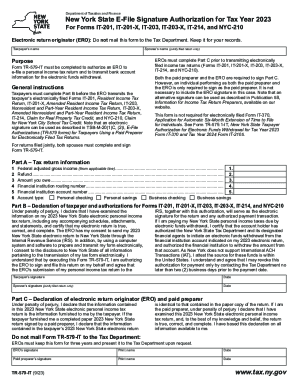

NY DTF TR-579-IT 2022 free printable template

Get, Create, Make and Sign

How to edit form tr 579 it online

NY DTF TR-579-IT Form Versions

How to fill out form tr 579 it

How to fill out form taxpayer nyc:

Who needs form taxpayer nyc:

Video instructions and help with filling out and completing form tr 579 it

Instructions and Help about new york state form tr 579 it

Hi I'm Johanna, and we are here at the New York DMV flagship office you're about to get the fast easy and convenient look at the recently opened Midtown office on West 31st Street in New York City this newly created space was designed with a focus on customer service, and it doesn't disappoint bright signage friendly greeters self-serve kiosks comfortable seating new computerized test stations you name it when you enter the office you'll be met by a representative located here at the new welcome station who will assist you in preparing your transactions and here's a quick tip if you make a reservation online through our newly designed website DMV NY gov all you need to do is scan your reservation barcode to receive your prioritized ticket thatll help speed up your visit I wouldn't get too comfortable in the waiting area if I were you because our new queuing system just like everything else in this office is equipped to process your transactions quickly, so our customers can get back to their busy lives not sure what documents you need look no further than our trusty chalkboard or check with our mobile customer service representative and any additional questions you may have been ready to be answered right here at the consultation counter where they have all the answers if you need to complete some of the most common transactions like changing your address renewing your registration driver license or non-driver ID card try using our automated kiosks they're so fast really easy and super convenient and for those of you needing to get your permit or drive trucks or buses we have a little innovation for you as well these new computerized test stations save loads of time, and they help the environment by reducing the amount of paper needed for paper-based tests at the New York DMV were truly transforming the way we do business not only in Manhattan but throughout New York States what's one word to describe the new DMV that easy convenient go on home Alan where my by your DMV how can we help you today

Fill new york ero : Try Risk Free

People Also Ask about form tr 579 it

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form tr 579 it online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.