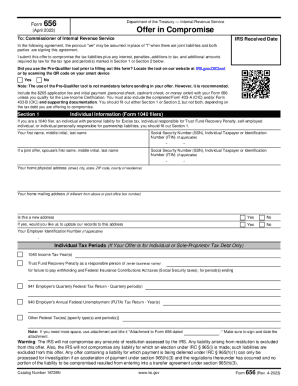

IRS 656 2022 free printable template

Get, Create, Make and Sign

Editing irs form 656 online

IRS 656 Form Versions

How to fill out irs form 656 2022

How to fill out irs form 656:

Who needs irs form 656:

Video instructions and help with filling out and completing irs form 656

Instructions and Help about internal revenue form

Hey guys my name is Anthony Fontana I'm a CPA with ea tax resolutions in this video we're going to be going over line by line in detail how to fill out the iris form 656 to submit an offer in compromise if at any point in this video you think this is way too much, and you want to hire a professional well you're in luck I'm here to help you out a link in the description you can schedule appointment with me, we charge a flat 250, and we go through your case, and we give you your options see if you even qualify for something like this all right so the 656 is the form you need to fill out definitely to file an offer and compromise, and it lays out the terms of the offer it is basically the con it's not basically it is the contract for the offer now if the offer changes later when the IRS maybe discovers something new or things change then they will amend the 656 later, but you will need to submit the form 656 to file an offer and compromise all right so here it is the 656...

Fill revenue internal service : Try Risk Free

People Also Ask about irs form 656

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 656 2022 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.