Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

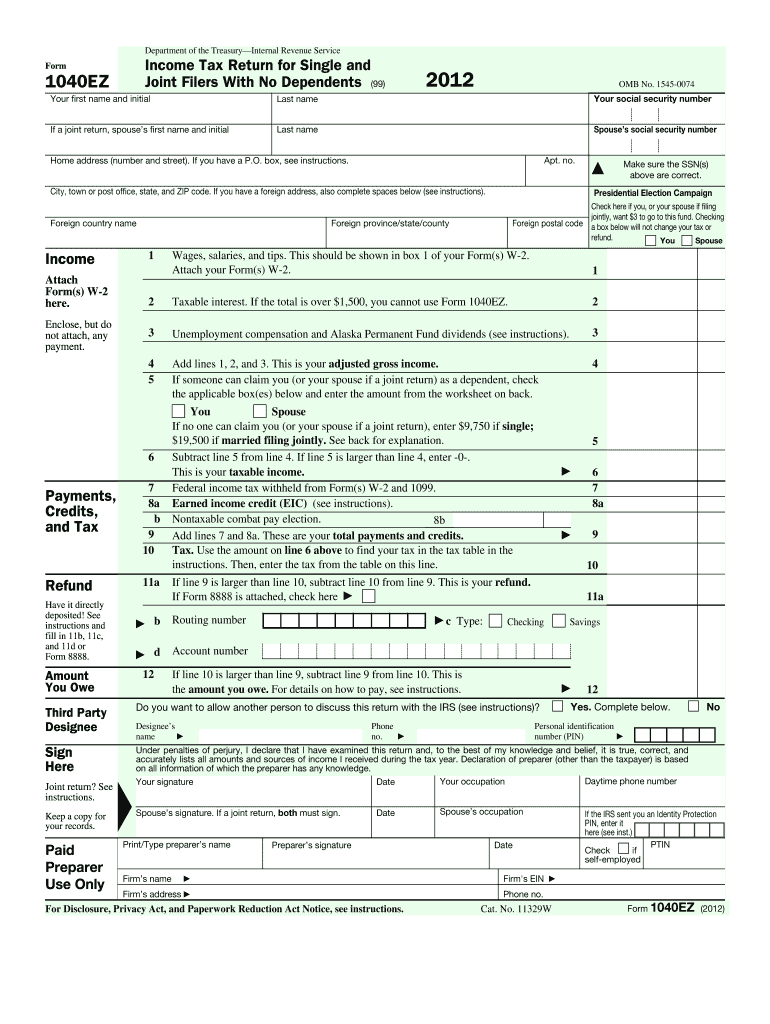

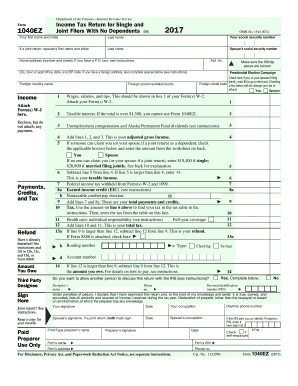

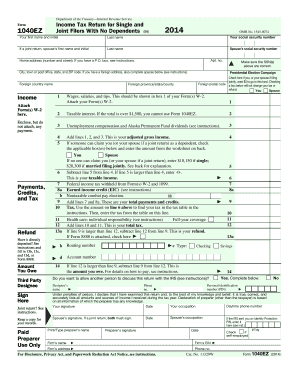

The 1040EZ form is a simplified version of the individual income tax return form used by individuals in the United States to file their federal income tax returns. It is generally used by taxpayers with straightforward tax situations, such as those who have no dependents, do not itemize deductions, and have an income of less than $100,000. The 1040EZ form is shorter and simpler to complete compared to the standard 1040 form, and generally allows for a quicker and easier filing process.

Who is required to file 1040ez form?

The 1040EZ form is typically used by individuals who have a simple tax situation and meet certain criteria. It is designed for taxpayers who have:

1. Filing status: Single or married filing jointly.

2. Income: Only income from wages, salaries, tips, taxable scholarships/grants, unemployment compensation, or Alaska Permanent Fund dividends.

3. Income amount: Total income less than $100,000.

4. Dependents: No dependents.

5. Age: Under 65 (unless the taxpayer is blind).

6. No itemized deductions: The taxpayer cannot claim any deductions other than the standard deduction.

7. No credits: The taxpayer cannot claim any credits other than the earned income credit (EIC).

It's important to note that the 1040EZ form has been replaced by the newer Form 1040-SR for taxpayers who are 65 and older.

How to fill out 1040ez form?

To fill out a 1040EZ form, follow these steps:

1. Gather all necessary documents: You will need your W-2 form from your employer, any 1099 forms for additional sources of income, and any other relevant financial documents such as interest statements or charitable contribution receipts.

2. Start with your personal information: Fill out your name, address, Social Security number, and filing status (single, married filing jointly, etc.) at the top of the form.

3. Complete the income section: Enter the total amount of wages, salaries, and tips from your W-2 form on line 1. Include any interest income (if applicable) on line 2. If you have any unemployment compensation or Alaska Permanent Fund dividends, enter them on line 3.

4. Calculate your Adjusted Gross Income (AGI): Subtract the total of lines 2 and 3 from line 1 and enter the result on line 4.

5. Determine your taxable income: Enter your standard deduction (based on your filing status) on line 5. If applicable, claim any exemptions on line 6a and multiply by the exemption amount for your tax year, then enter the total on line 6b. Subtract line 6b from line 5 and enter the result on line 7.

6. Calculate your tax: Look up your tax amount based on your taxable income on the tax tables provided in the 1040EZ instructions. Enter your tax on line 8.

7. Enter any credits: If you qualify for any tax credits, enter them on line 9.

8. Calculate your total tax: Subtract line 9 from line 8 and enter the result on line 10.

9. Determine your tax refund or amount due: Enter any federal income tax already withheld from your paychecks (found on your W-2) on line 11. If your tax withheld is more than your total tax, you will receive a refund. If it's less, subtract line 11 from line 10 to calculate the amount you owe.

10. Sign and date the form: Make sure to sign and date your completed 1040EZ form.

It's recommended to use tax software or consult a tax professional if you have a complicated tax situation or have any questions about filling out the form.

What is the purpose of 1040ez form?

The purpose of the 1040EZ form is to provide a simplified way for individuals with relatively straightforward tax situations to file their federal income taxes. It is the shortest and simplest form in the 1040 series, designed for taxpayers who have no dependents, do not claim any tax credits or deductions, and have a taxable income of less than $100,000. The 1040EZ form allows taxpayers to report their taxable income, calculate their tax liability, and claim any refund they may be eligible for.

What information must be reported on 1040ez form?

The 1040EZ form is the simplest form for filing federal income tax returns. It can only be used by taxpayers with a straightforward tax situation and certain eligibility criteria. Here is the information that must be reported on the 1040EZ form:

1. Personal Information: This includes your name, address, Social Security number, and filing status.

2. Income: Report any income earned during the tax year, including wages, salaries, tips, taxable scholarships, unemployment compensation, or a taxable portion of a state refund.

3. Taxable Interest: If you earned any interest on a savings account, checking account, or other investment, report it in this section.

4. Dependent Information: If you can be claimed as a dependent by someone else, provide the necessary information in this section.

5. Payments, Credits, and Tax: Report any federal income tax withheld from your wages by your employer, any estimated tax payments made, or any refund you received and chose to apply to the following year's taxes.

6. Health Care Coverage: Indicate whether you had health care coverage for the entire year and if there was any applicable exemption or penalty.

7. Sign and Date: Don't forget to sign and date the form.

It is important to note that the 1040EZ form has strict limitations on income, deductions, and eligibility. If your tax situation is more complex, you may have to use a different form, such as the 1040A or the standard 1040.

When is the deadline to file 1040ez form in 2023?

The deadline to file the 1040EZ form in 2023 is typically April 17th. It is important to note that tax deadlines can vary from year to year, so it is recommended to check with the Internal Revenue Service (IRS) or consult a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of 1040ez form?

The penalty for late filing of a 1040EZ form depends on whether you owe taxes or if you are due a refund.

If you are owed a refund, there is typically no penalty for filing late. However, it is always best to file your taxes as soon as possible in order to receive your refund in a timely manner.

If you owe taxes and file the 1040EZ form late, the penalty is typically a percentage of the unpaid tax amount. The penalty is usually 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. If you file more than 60 days late, the minimum penalty is either $215 or 100% of the unpaid tax, whichever is smaller.

It's important to note that penalties and interest may vary depending on individual circumstances and the country's tax laws. It is always recommended to consult a tax professional or the official IRS guidelines for specific penalty information.

How can I edit 2012 1040ez form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2012 1040ez form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in 2012 1040ez form without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 2012 1040ez form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the 2012 1040ez form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2012 1040ez form in minutes.