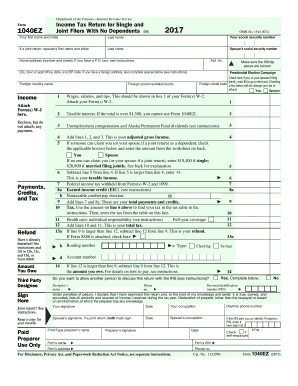

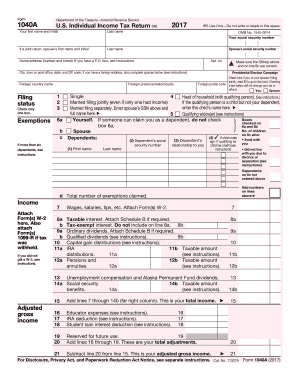

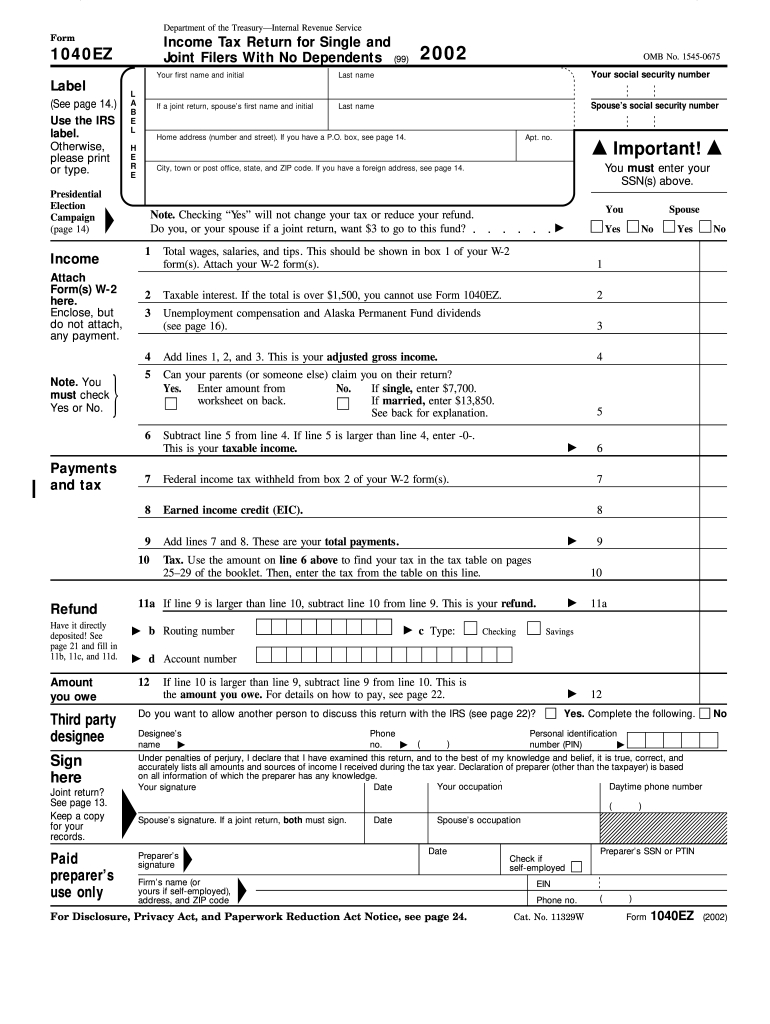

IRS 1040-EZ 2002 free printable template

Instructions and Help about IRS 1040-EZ

How to edit IRS 1040-EZ

How to fill out IRS 1040-EZ

About IRS 1040-EZ 2002 previous version

What is IRS 1040-EZ?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-EZ

What should I do if I realize I've made a mistake on my IRS 1040-EZ after filing?

If you've made an error on your IRS 1040-EZ after submission, you can file an amended return using Form 1040-X. Ensure you include a brief explanation of the correction and any supporting documentation. This correction process is important to accurately reflect your tax liability and avoid potential penalties.

How can I check the status of my IRS 1040-EZ after filing?

You can check the status of your IRS 1040-EZ by using the IRS 'Where's My Refund?' tool available on their website. By entering your details, you can verify if your submission was received and processed. Alternatively, contact the IRS for assistance with specific inquiries regarding your tax filing.

What are some common errors to avoid when filing the IRS 1040-EZ?

Common errors include incorrect Social Security numbers, math mistakes, and forgetting to sign the form. To minimize these errors, double-check all entries for accuracy and ensure all necessary fields are completed before submission. Using tax software can also help identify potential mistakes.

How long should I retain my IRS 1040-EZ records?

It's advisable to keep your IRS 1040-EZ records for at least three years from the date you filed the return. This retention period can help you respond to any inquiries or audits. Additionally, if you have supporting documents, make sure to keep them for the same duration.

Can I use my IRS 1040-EZ if I have filed for bankruptcy?

Yes, you can still file an IRS 1040-EZ if you are in bankruptcy, but it's crucial to consult with a tax professional or legal advisor. They can guide you on how your bankruptcy may affect your tax situation, including any potential implications for your tax obligations.

See what our users say