Get the free CRAFT PAYROLL DEPART P299 DATE SUBJECT - lanl

Show details

P. O Box 1663. Los Alamos, New Mexico 87544. MEMORANDUM. TO: CRAFT PAYROLL DEPARTMENT P238. DATE: SUBJECT: AUTHORIZATION FOR 3rd ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your craft payroll depart p299 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your craft payroll depart p299 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing craft payroll depart p299 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit craft payroll depart p299. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

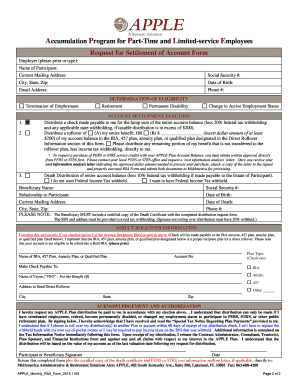

How to fill out craft payroll depart p299

How to fill out craft payroll depart p299:

01

Start by obtaining the craft payroll department p299 form. You can typically find this form on the government or relevant organization's website.

02

Carefully read the instructions provided on the form to ensure you understand the requirements and information needed.

03

Begin by filling out your personal information, such as your name, address, and contact details, in the designated fields.

04

Next, provide your employer information, including the employer's name and address.

05

Fill in your job information, including your job title, department, and any relevant identification or code numbers.

06

Enter the pay period start and end dates for the period you are reporting.

07

Record the hours you worked during the pay period, specifying regular hours, overtime hours, and any other categories as required.

08

Calculate your gross earnings for the pay period, taking into account any overtime pay or additional earnings.

09

Deduct any necessary taxes or withholdings from your earnings, such as income tax, social security contributions, or health insurance premiums.

10

Calculate your net pay by subtracting the withholdings from your gross earnings.

11

Double-check all the information you provided to ensure accuracy and make any necessary corrections.

12

Sign and date the form to certify the accuracy of the information you provided.

13

Submit the completed craft payroll department p299 form to the appropriate authority or your employer, following any specific submission instructions mentioned on the form or by your employer.

Who needs craft payroll depart p299:

01

Employees who work in the craft industry, such as carpenters, painters, plumbers, or electricians, may need to fill out craft payroll department p299 forms.

02

Craft businesses or organizations that hire individuals in these specific trades may require the completion of craft payroll department p299 forms for payroll purposes.

03

Employers or employees involved in craft-related projects or contracts that have unique reporting or documentation requirements may also need to utilize the craft payroll department p299 form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

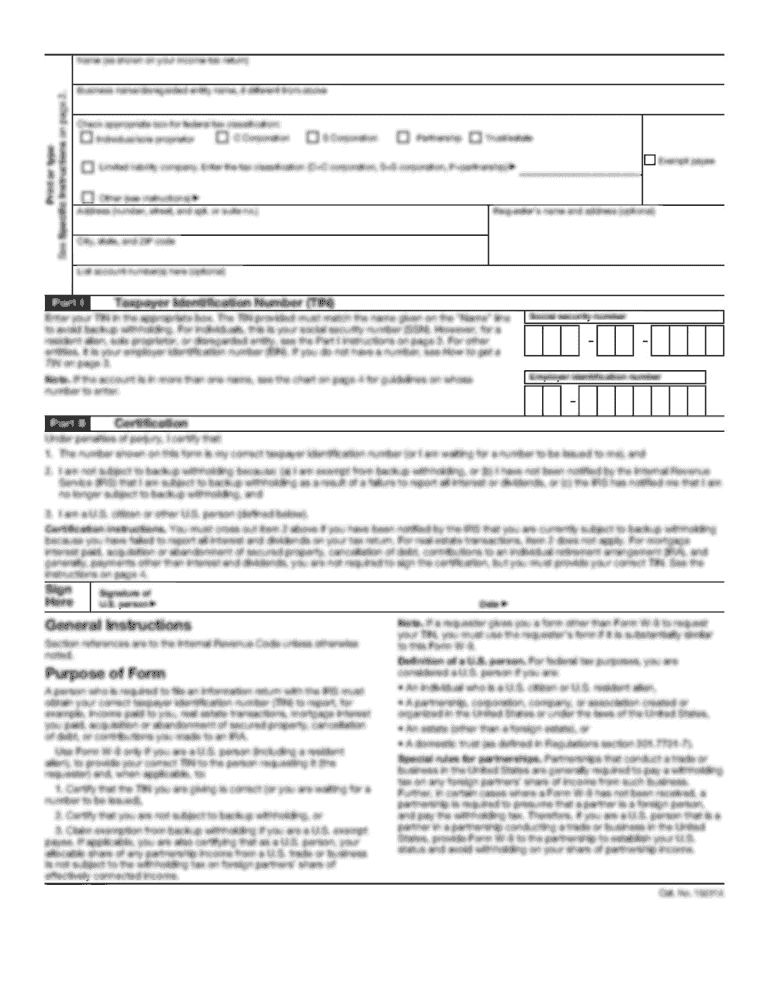

What is craft payroll depart p299?

Craft payroll depart p299 is a form used by craft employers to report wage and tax information for their employees in the construction industry.

Who is required to file craft payroll depart p299?

Craft employers in the construction industry are required to file craft payroll depart p299.

How to fill out craft payroll depart p299?

Craft employers can fill out craft payroll depart p299 by entering wage and tax information for each employee, as well as company information.

What is the purpose of craft payroll depart p299?

The purpose of craft payroll depart p299 is to report wage and tax information for employees in the construction industry.

What information must be reported on craft payroll depart p299?

Craft payroll depart p299 must include employee wage information, tax withholding information, and company details.

When is the deadline to file craft payroll depart p299 in 2023?

The deadline to file craft payroll depart p299 in 2023 is typically January 31st.

What is the penalty for the late filing of craft payroll depart p299?

The penalty for the late filing of craft payroll depart p299 is typically a fine based on the number of days past the deadline.

How do I make changes in craft payroll depart p299?

With pdfFiller, the editing process is straightforward. Open your craft payroll depart p299 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in craft payroll depart p299 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your craft payroll depart p299, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit craft payroll depart p299 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign craft payroll depart p299. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your craft payroll depart p299 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.