GA DoR IT-WH 2012 free printable template

Show details

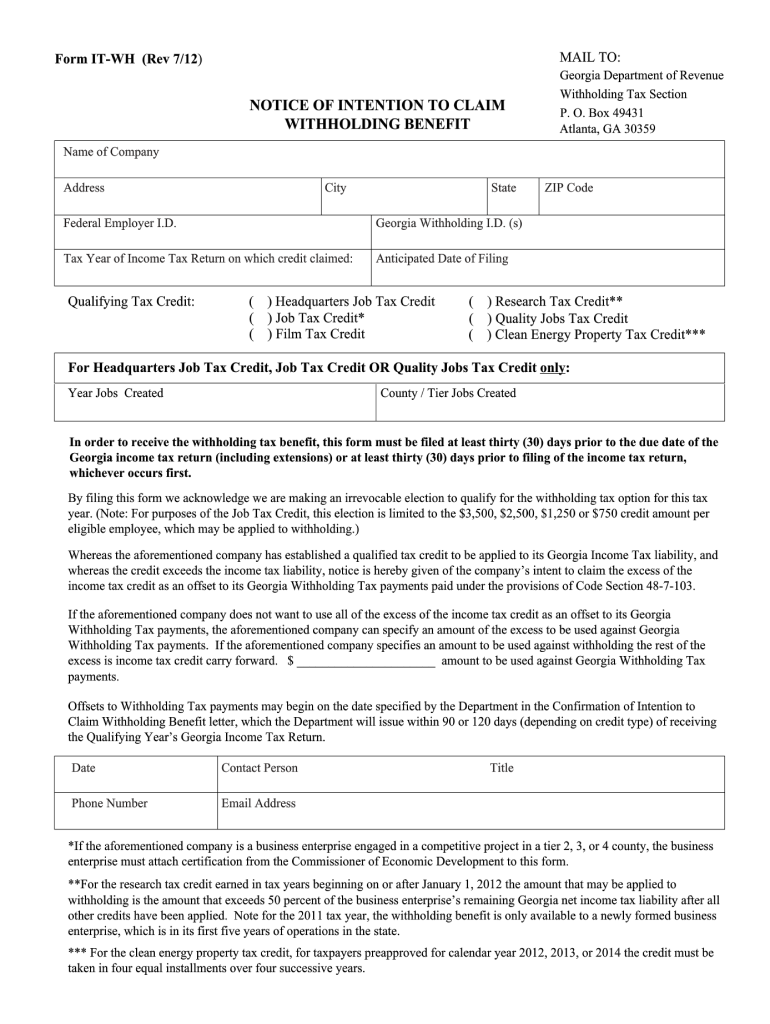

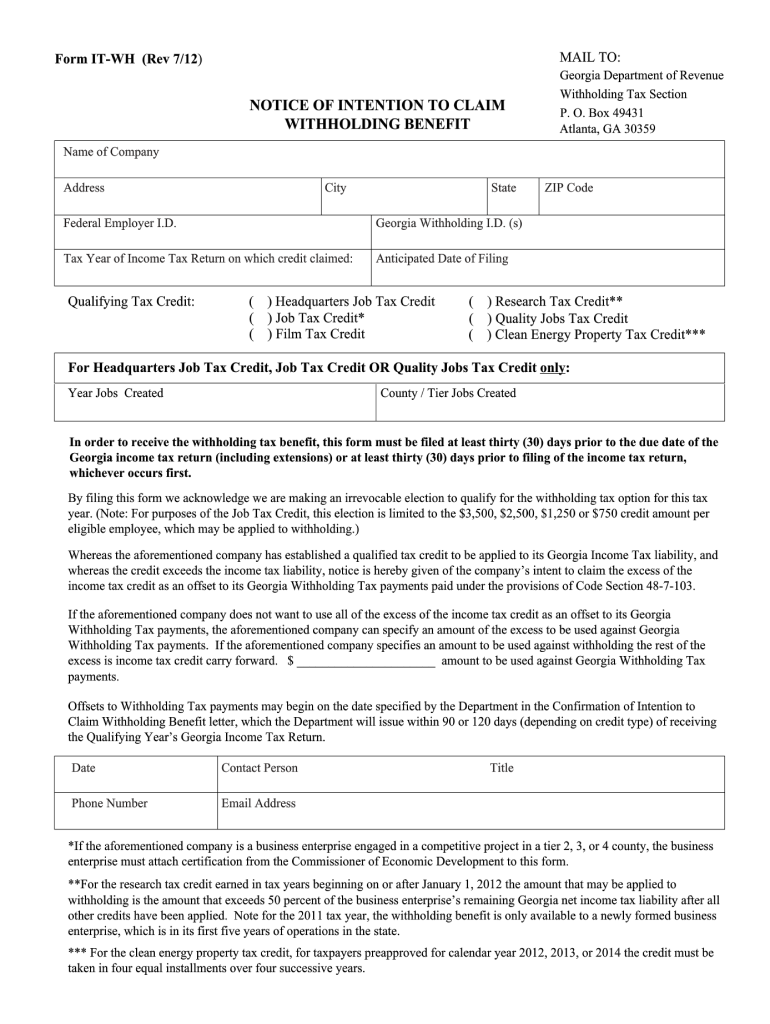

Form IT-WH (Rev 7/12) Print MAIL TO: Clear NOTICE OF INTENTION TO CLAIM WITHHOLDING BENEFIT Georgia Department of Revenue Withholding Tax Section P. O. Box 49431 Atlanta, GA 30359 Name of Company

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your revenue form 530 printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue form 530 printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue form 530 printable online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit revenue form 530 print. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

GA DoR IT-WH Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out revenue form 530 printable

How to fill out revenue form 530 printable:

01

Gather all necessary documents and information, such as your Social Security number, income statements, and any deductions or credits you may qualify for.

02

Download or obtain a printable version of revenue form 530 from the IRS website or other reliable sources.

03

Carefully read the instructions provided with the form to familiarize yourself with the requirements and any changes specific to the current tax year.

04

Begin filling out the form by entering your personal information, such as your name, address, and filing status.

05

Proceed to report your income accurately and thoroughly according to the instructions provided. This may include wages, interest, dividends, and other sources of income.

06

Deduct any eligible expenses or credits, such as education expenses or child tax credit, following the appropriate sections and guidelines.

07

Calculate the total tax owed or the refund due based on the information you have provided.

08

Double-check all the information entered to ensure accuracy and completeness.

09

Sign and date the form before submitting it to the IRS or including it with your tax return.

10

Retain a copy of the filled-out form for your records.

Who needs revenue form 530 printable?

01

Individuals or households who are required to file an income tax return with the IRS.

02

Taxpayers who want to claim specific deductions or credits that are applicable on revenue form 530.

03

Anyone who prefers to fill out their tax forms manually and does not use electronic filing methods.

Video instructions and help with filling out and completing revenue form 530 printable

Instructions and Help about revenue form 530 printable

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is revenue form 530 printable?

Revenue Form 530 is an income tax form used by the State of California to report the income of businesses and individuals who are required to file an income tax return. The form is available online and can be printed and filled out.

Who is required to file revenue form 530 printable?

All self-employed individuals, including independent contractors, freelancers, and sole proprietors, are required to file Form 530, California Self-Employment Tax Return.

How to fill out revenue form 530 printable?

1. Begin by downloading the form from the California Franchise Tax Board website.

2. Fill in your name, address, and Social Security Number in the appropriate fields.

3. Select the filing status that applies to you.

4. Enter your total income from all sources.

5. Enter your deductions.

6. Calculate your taxable income by subtracting your deductions from your total income.

7. Enter your total tax liability and any estimated payments you have made.

8. Calculate your refund by subtracting your total tax liability from your estimated payments.

9. Sign and date the form.

10. Submit the form to the California Franchise Tax Board.

When is the deadline to file revenue form 530 printable in 2023?

The deadline to file your form 530 printable in 2023 is April 15, 2023.

What is the penalty for the late filing of revenue form 530 printable?

The penalty for filing a late Form 530 is 5% of the unpaid tax for each month, or part of a month, that the return is late, up to a maximum of 25% of the unpaid tax.

What is the purpose of revenue form 530 printable?

Revenue Form 530 is an Internal Revenue Service (IRS) form used by taxpayers to report their income and expenses from their agricultural activities. This form is specifically designed for farmers and ranchers who are engaged in agricultural production and need to file their taxes accordingly.

The purpose of Revenue Form 530 is to provide a structured format for farmers and ranchers to report their income and expenses related to their agricultural operations. This form helps them calculate their net farm profit or loss, which is then used for income tax purposes.

By filling out this form, taxpayers can document their sales, farming expenses, and other income sources, such as government payments or insurance proceeds. This information is necessary for the IRS to determine the correct amount of taxable income and assess any applicable taxes.

Overall, Revenue Form 530 printable is essential for farmers and ranchers as it ensures accurate reporting of their agricultural income and expenses, helping them comply with IRS regulations and fulfill their tax obligations.

What information must be reported on revenue form 530 printable?

Form 530 is used to report the domestic production activities deduction (DPAD). Therefore, the information that must be reported on this form includes:

1. Taxpayer information: Name, address, identification number, and tax year.

2. Income from domestic production activities: This includes the gross receipts or sales from qualified production activities minus the cost of goods sold and other deductions directly related to those sales.

3. Deductions related to production activities: This includes any other direct expenses directly related to production activities.

4. Qualified production activities income (QPAI): This is calculated by multiplying the net income from the production activities by the smaller of 9% or your taxable income.

5. The domestic production activities deduction (DPAD): This is calculated by multiplying the QPAI by the applicable percentage based on the taxpayer's activities.

6. Other information: The form also requires some additional information, such as if the taxpayer is electing to reduce DPAD based on oil-related qualified production activities income or if they are using any alternative simplified methods.

It is important to note that the instructions for Form 530 should be carefully reviewed and followed to ensure accurate reporting. It is advisable to consult a tax professional or refer to the official IRS instructions for Form 530 for comprehensive guidance.

How do I make changes in revenue form 530 printable?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your revenue form 530 print and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the revenue form 530 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your revenue form 530 printable directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit revenue form 530 print on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign revenue form 530 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your revenue form 530 printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Form 530 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.