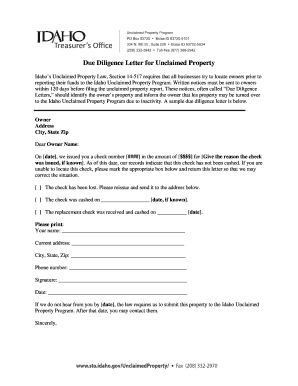

Phillips 66 Notice of Uncashed Check(s) 2010-2024 free printable template

Show details

Date: February 4,2010,

Account /Vendor:0000211755

Company: 01 Type: AP

Check Number: 0000795895

Check Date: 09/26/2008

Check(s) Total Amount: $105.63

IMA Sample

5432 EXAMPLE LANE

HOUSTON, TX, 77002

RE:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your uncashed check letter template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uncashed check letter template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uncashed check letter template online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit uncashed check letter form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out uncashed check letter template

How to fill out uncashed check letter template?

01

Start by addressing the letter to the recipient's name and address.

02

Include a clear subject line stating the purpose of the letter, such as "Request to Reissue Uncashed Check."

03

Begin the letter with a polite and professional salutation, such as "Dear [Recipient's Name]."

04

Introduce yourself and explain the reason for the letter. Clearly state that you have an uncashed check that needs to be reissued.

05

Provide the necessary information about the uncashed check, such as the check number, date of issue, and the exact amount.

06

Mention any specific reasons why the check was not cashed, such as being misplaced or lost.

07

Request the recipient to reissue the uncashed check and provide instructions on how they can do so.

08

Express gratitude for their cooperation and end the letter with a professional closing, such as "Sincerely" or "Best regards."

09

Sign your name and include your contact information, including your phone number and email address, so that the recipient can reach you if necessary.

Who needs uncashed check letter template?

01

Individuals or businesses who have received a check that they have not cashed or deposited.

02

People who have lost or misplaced a check and need a replacement.

03

Anyone who wants to request a reissue of an uncashed check due to various circumstances.

Fill unclaimed property letter template : Try Risk Free

People Also Ask about uncashed check letter template

What happens if you write a check that never gets cashed?

What is another word for uncashed check?

How do you write off a check that never cleared?

What happens if you write a check and there is no money in the account?

How long can a check go without being cashed?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file uncashed check letter template?

Anyone who has an uncashed check or other payment that is more than 90 days old is generally required to file an uncashed check letter template. This is usually done to protect the business from potential liabilities associated with unclaimed property.

When is the deadline to file uncashed check letter template in 2023?

The deadline to file an uncashed check letter template in 2023 will depend on the specific circumstances of the check. Generally speaking, the deadline will be determined by the issuing bank and the applicable laws in the state where the check was issued.

What is uncashed check letter template?

[Your Name]

[Your Address]

[City, State, ZIP]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP]

Subject: Uncashed Check

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to inform you that a check, which was issued to you on [Date] in the amount of [Check Amount], remains uncashed. As per our records, the check was issued for [Reason/Purpose].

We understand that circumstances may have caused the delay in cashing the check, and we would appreciate your prompt attention to this matter. Please find enclosed a copy of the original check for your reference. Kindly confirm if the check was, in fact, received by you, and if so, provide an explanation for the delay in cashing it.

In case the check has been misplaced or was not received, we will be happy to cancel the previous check and issue a new one to ensure you receive the funds owed to you. However, if you have encountered any challenges with cashing the check, please let us know so that we may assist you accordingly.

Please respond within [number of days] from the receipt of this letter to prevent any further delay or inconvenience. You can reach me at [Phone Number] or via email at [Email Address] for any queries or concerns you may have.

Thank you for your immediate attention to this matter. We value your time and partnership with us, and we want to ensure that all outstanding financial matters are resolved to your satisfaction.

We look forward to your prompt response.

Warm regards,

[Your Name]

How to fill out uncashed check letter template?

[Your Name]

[Your Address]

[City, State, ZIP]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP]

Subject: Request to Reissue Uncashed Check

Dear [Recipient's Name],

I hope this letter finds you in good health. I am writing to request the reissuance of a previously issued check that I have yet to cash. The details of the uncashed check are as follows:

- Check Issued by: [Name of Issuer]

- Check Number: [Check Number]

- Date of Issue: [Date of Issue]

- Payee's Name: [Your Name as written on the check]

- Amount: [Amount as written on the check]

- Purpose/Reference: [Optional – mention if applicable]

Due to unforeseen circumstances, I was unable to deposit or cash the aforementioned check before it expired or became outdated. I apologize for any inconvenience this may have caused. I would appreciate your assistance in reissuing a new check with the same details as mentioned earlier.

Please find attached the original uncashed check for your reference. If you require any further information or documentation to process this request, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

I kindly ask you to expedite this request and send the reissued check to the address mentioned above or contact me to discuss alternative delivery options if necessary. I assure you that I will promptly deposit or cash the new check upon receipt.

Thank you for your understanding and cooperation in this matter. I greatly appreciate your attention to resolve this issue as soon as possible.

Yours sincerely,

[Your Name]

What is the purpose of uncashed check letter template?

The purpose of an uncashed check letter template is to notify the recipient or payee that a check issued to them has not been cashed or deposited within a specified time frame. The letter serves as a reminder, urging the recipient to take action and cash the check. It typically includes details such as the check number, amount, date of issue, and instructions on how to proceed. The template helps to streamline the process of writing such letters and ensures that all necessary information is included.

What information must be reported on uncashed check letter template?

When preparing an uncashed check letter template, the following information should typically be included:

1. Date: The date you are writing the letter.

2. Sender's Information: Your name, address, phone number, and email address.

3. Recipient's Information: The name, address, phone number, and email address of the individual or company who has not yet cashed the check.

4. Opening Greeting: A polite and formal salutation, such as "Dear [Recipient's Name]."

5. Subject Line: Clearly state the purpose of the letter, for example: "Reissue or Statement Request for Uncashed Check."

6. Explanation: Provide a brief and clear explanation of the reason for your letter. Mention that you have issued a check for a specific amount on a particular date, provide the check number, and state that it remains uncashed.

7. Request for Action: Clearly state what action you want the recipient to take, such as cashing the check, providing a written statement on why the check has not been cashed, or requesting a reissued check if it is lost or expired.

8. Deadline: Specify a reasonable deadline by which you expect the recipient to respond or take action.

9. Offer Assistance: Provide your contact information and offer to assist or answer any questions the recipient may have regarding the check or the letter.

10. Closing Remarks: Express gratitude for their prompt attention and cooperation, and conclude on a courteous note.

11. Closing: Use a formal closing, such as "Sincerely" or "Best regards," followed by your name and signature.

Remember to adapt the template to suit your specific situation and company guidelines, as well as to maintain a professional and polite tone throughout the letter.

What is the penalty for the late filing of uncashed check letter template?

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Penalty Notice for Late Filing of Uncashed Check

Dear [Recipient's Name],

I hope this letter finds you in good health and high spirits. I am writing to bring to your attention a matter regarding a check issued by [Your Company/Organization] that remains uncashed even though it was issued [time/frame] ago.

We would like to highlight that it is essential for all checks to be presented for payment within a reasonable time frame, as outlined by applicable regulations and internal policies. Failure to do so can result in operational inefficiencies and complications in accounting processes.

After thorough analysis, it has been determined that the check in question has not been cashed or deposited until the current date. As a result, we regretfully inform you that a late filing penalty will be imposed in accordance with the terms stated on the original check or the terms and conditions of our organization.

The purpose of this letter is to formally notify you of the aforementioned penalty. The specifics of the penalty, including the amount and any associated charges, are delineated within the terms and conditions mentioned earlier. We kindly request you to review those and promptly address the payment of the imposed penalty.

Should you have any legitimate reason for the delayed deposit or cashing of the check, please provide us with the necessary supporting documentation within [number of days] from the date of this letter. We will then review your situation and consider any justifiable circumstances that may have caused the delay.

We are committed to resolving this matter swiftly and amicably. Therefore, we kindly request your immediate attention in settling the outstanding penalty to avoid any further complications or escalation of this issue.

Please do not hesitate to contact me directly at [Your Phone Number] or via email at [Your Email Address] should you have any questions, concerns, or require any additional information.

Thank you for your prompt attention to this matter, and we appreciate your cooperation in resolving the issue.

Yours sincerely,

[Your Name]

[Your Designation]

[Your Company/Organization]

How can I get uncashed check letter template?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific uncashed check letter form and other forms. Find the template you need and change it using powerful tools.

How can I fill out sample letter for unclaimed checks on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your unclaimed property letter sample. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit unclaimed funds letter template on an Android device?

With the pdfFiller Android app, you can edit, sign, and share escheatment letter sample form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your uncashed check letter template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Letter For Unclaimed Checks is not the form you're looking for?Search for another form here.

Keywords relevant to sample due diligence letter for uncashed check form

Related to sample letter for unclaimed money

If you believe that this page should be taken down, please follow our DMCA take down process

here

.