What is Past Due Letter?

A Past Due Letter is a written communication sent to individuals or businesses who have failed to make a payment by the due date. It serves as a reminder to the recipient about the outstanding payment and urges them to take prompt action to settle the debt.

What are the types of Past Due Letter?

There are several types of Past Due Letters that can be used depending on the nature of the debt and the relationship between the parties involved. Some common types include:

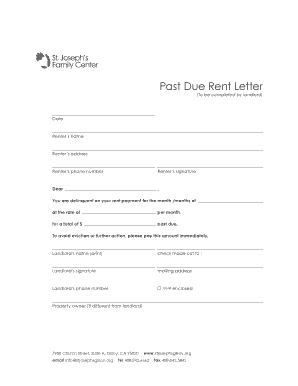

Friendly Reminder Letter: This type of Past Due Letter is designed to be gentle and polite, reminding the recipient about the outstanding payment without being overly assertive.

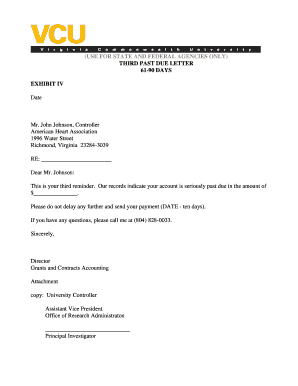

Final Notice Letter: When previous attempts to collect payment have been unsuccessful, a Final Notice Letter may be sent to demand immediate payment or threaten legal action.

Demand Letter: This type of Past Due Letter is more assertive and formal, explicitly demanding payment within a specified timeframe and outlining potential consequences for non-payment.

How to complete Past Due Letter

Completing a Past Due Letter doesn't have to be a complicated process. Here are the steps to follow:

01

Begin with a professional salutation and address the recipient by name.

02

Clearly state the purpose of the letter - to remind the recipient about the overdue payment.

03

Include specific details about the debt, such as the amount owed, the due date, and any late fees or interest charges that may apply.

04

Emphasize the importance of settling the debt promptly and provide payment instructions or options.

05

Include contact information for the sender in case the recipient has any questions or needs assistance.

06

Use a courteous and respectful tone throughout the letter, while making it clear that prompt payment is expected.

07

Sign off with a polite closing and your name or the name of your company.

pdfFiller is an excellent tool that can help you create, edit, and share professional Past Due Letters online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.