Get the free fha rate and term refinance worksheet form

Show details

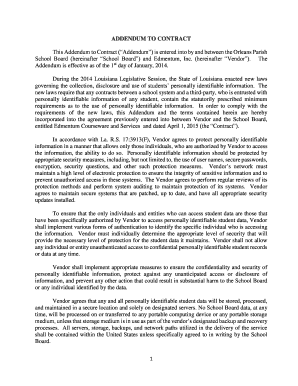

FHA Loans Refinances, Rate & Term FHA Maximum Mortgage Calculation Worksheet Rate & Term Refinance Transactions Borrower Name(s): Loan #: FHA Case #: st 1 CALCULATION LTV Limitation 1. Appraised Value*

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fha rate and term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha rate and term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha rate and term refinance worksheet online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fha rate term refinance worksheet form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out fha rate and term

How to fill out FHA rate and term:

01

Gather all the necessary information and documents such as personal identification, employment history, income statements, and bank statements.

02

Visit the official website of the Federal Housing Administration (FHA) or contact an approved lender to obtain the necessary forms for the rate and term application.

03

Fill out the application form accurately and completely, providing all the required information. Ensure that all the details are legible and verify the accuracy of the provided information.

04

Provide any supporting documentation required for the application, such as pay stubs, tax returns, or proof of assets.

05

Review the completed application and supporting documents thoroughly to ensure everything is accurate and complete.

06

Submit the application to the FHA or the approved lender either in person, by mail, or electronically, following the specified instructions.

Who needs FHA rate and term:

01

Individuals who currently have an FHA-insured mortgage and wish to refinance their existing loan to take advantage of lower interest rates or better loan terms.

02

Homeowners who want to convert their adjustable-rate mortgage (ARM) into a fixed-rate mortgage to provide stability and predictability in their mortgage payments.

03

Borrowers who are facing financial hardships and want to explore options for loan modifications to make their mortgage payments more affordable.

04

First-time homebuyers who are looking for a mortgage solution with more lenient credit requirements and a lower down payment compared to conventional loan options.

05

Homeowners who want to tap into their home's equity through a cash-out refinance to finance home improvements, pay off debts, or cover other expenses.

Overall, anyone with an FHA-insured mortgage or a desire to obtain one can benefit from understanding how to fill out FHA rate and term applications and determining if it meets their financial needs.

Fill fha refinance worksheet : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fha rate and term?

FHA rate and term refers to a type of refinancing option available to homeowners with an existing FHA-insured loan. Rate and term refinancing allows borrowers to adjust their interest rate and loan terms without taking out additional cash. The primary purposes of an FHA rate and term refinance are to secure a lower interest rate and/or change the loan term to better suit the borrower's financial needs. This type of refinance does not allow the homeowner to withdraw any equity from their property.

Who is required to file fha rate and term?

FHA rate and term refinances are typically initiated by homeowners who already have an FHA loan and wish to refinance it to obtain a lower interest rate or different terms. Therefore, the homeowners themselves are required to file an FHA rate and term refinance application.

How to fill out fha rate and term?

To fill out an FHA Rate and Term Refinance application, follow these steps:

1. Gather essential documents and information: You will need your personal information, such as name, address, and Social Security number. Additionally, gather documents like recent pay stubs, W-2 forms, bank statements, and tax returns.

2. Complete the loan application: Start by filling out the loan application form provided by your lender. This form will require information about your financial situation, employment history, and property details.

3. Provide information about the existing loan: Provide details about your current mortgage, including the lender's name, outstanding balance, interest rate, and loan term.

4. Specify your refinancing goals: Explain why you want to refinance, whether it's to lower your interest rate, reduce monthly payments, or change the loan term. This will help the lender understand your motivations and provide suitable loan options.

5. Provide income and asset information: Furnish details regarding your income, including employment history, salary, bonuses, and other sources of income. Disclose your assets, such as savings, retirement accounts, and investments.

6. Disclose your liabilities: List your current debts, including credit card balances, auto loans, and student loans. This helps lenders determine your debt-to-income ratio.

7. Consent to a credit check: You will need to authorize the lender to pull your credit report. This is necessary for evaluating your creditworthiness.

8. Submit supporting documents: Attach the necessary documents, including pay stubs, tax returns, bank statements, and any additional documents requested by the lender.

9. Review and sign: Finally, carefully review the entire application, ensuring all information is accurate and complete. Sign the application form to acknowledge your understanding and agreement.

10. Submit the application: Send the completed application to your chosen lender along with any required application fees.

Remember, it's always a good idea to work closely with your lender to ensure a smooth application process and to address any questions or concerns along the way.

What is the purpose of fha rate and term?

The purpose of FHA (Federal Housing Administration) rate and term refinance is to allow borrowers with an existing FHA-insured mortgage to refinance their loan with more favorable terms. This type of refinance is primarily aimed at reducing the interest rate or changing the loan's term (such as converting from an adjustable-rate mortgage to a fixed-rate mortgage). By refinancing, borrowers can potentially lower their monthly mortgage payments or save money on interest over the life of the loan.

What information must be reported on fha rate and term?

When reporting on an FHA rate and term, the following information must be included:

1. Borrower Information: The full name, Social Security number, address, and contact details of the borrower(s).

2. Loan Information: The loan amount, interest rate, loan term, and the type of FHA loan (e.g., 30-year fixed).

3. Property Information: The address of the property being financed and its estimated value.

4. Loan Purpose: Indicating that it is a rate and term refinance, meaning the borrower is refinancing the existing mortgage to obtain a lower interest rate or change the loan term, without taking any cash out.

5. Debt-to-Income Ratio: The borrower's current monthly income and monthly debt obligations, including any other mortgages, loans, or debts.

6. Credit Score: The borrower's credit score, as well as any significant derogatory credit events (such as bankruptcies or foreclosures).

7. Appraisal: Whether a new appraisal is required or if the property can be re-appraised based on the original FHA appraisal if it is less than 120 days old.

8. Mortgage Insurance: The type of FHA mortgage insurance required, including any upfront or monthly premiums.

9. Closing Costs: An itemized list of all closing costs and fees associated with the new FHA loan.

10. Compliance: Ensuring that all applicable federal, state, and local regulations and guidelines are met for an FHA rate and term refinance.

It's worth noting that specific lenders and underwriters may require additional information, documentation, or forms as part of their internal guidelines for an FHA rate and term refinance.

Can I create an electronic signature for signing my fha rate and term refinance worksheet in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your fha rate term refinance worksheet form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out fha rate and term refinance worksheet 2020 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign fha rate and term refinance worksheet and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit fha rate and term maximum mortgage worksheet on an Android device?

You can edit, sign, and distribute fha to fha refinance worksheet form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your fha rate and term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Rate And Term Refinance Worksheet 2020 is not the form you're looking for?Search for another form here.

Keywords relevant to fha rate term refinance worksheet form

Related to fha rate and term refinance worksheet 2020

If you believe that this page should be taken down, please follow our DMCA take down process

here

.