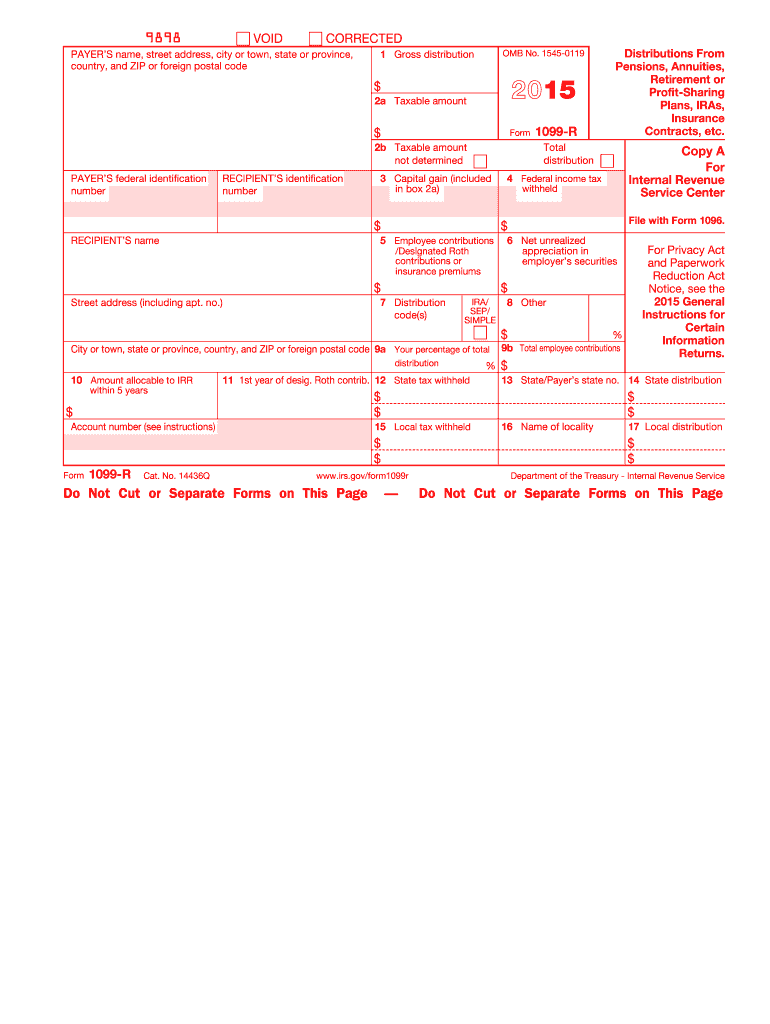

What is a 1099-R form?

People use 1099 forms to report income types they receive as independent contractors, including income, dividends, government payments, or interest. In general, 1099 forms are for filing reports about non-employment income (that is not a salary).

1099 R is an Internal Revenue Service tax form used to report distribution from retirement and profit-sharing plans, annuities, IRAs, pensions, and insurance contracts.

Every transaction reported in this record is reviewed to determine whether it falls under taxation or is subject to a penalty.

Who should file form 1099-R?

Form 1099-R, Distributions from Pensions, Annuities, or Profit-Sharing plans are sent to those who have been paid 10$ or more from the accounts below:

- Individual Retirement Account (IRA)

- Permanent or total disability payments under life insurance contracts

- Retirement or profit-sharing plans

- Charitable gift donations

- Annuities, insurance contracts, survivor income benefit plans, or pensions

How do I fill out 1099 R?

On the left side of the form, you will see the payer's name, contact information, and identification number. Next, the recipient's information is provided, including name and address.

The section on the right includes data about payments and taxes withheld from them. Detailed instructions on filling them out are provided on the Internal Revenue Service official website.

Do other forms accompany form 1099-R?

The recipient may be required to attach a tax return to this template.

When is 1099 R due?

Form 1099-R must be sent to the individual by January 31. If it is not available by this time, the individual should contact the Internal Revenue Service. The IRS will then contact the employer to request the missing record.

Where do I send form 1099-R?

The form should be sent to the Internal Revenue Service and the recipients by the set date.