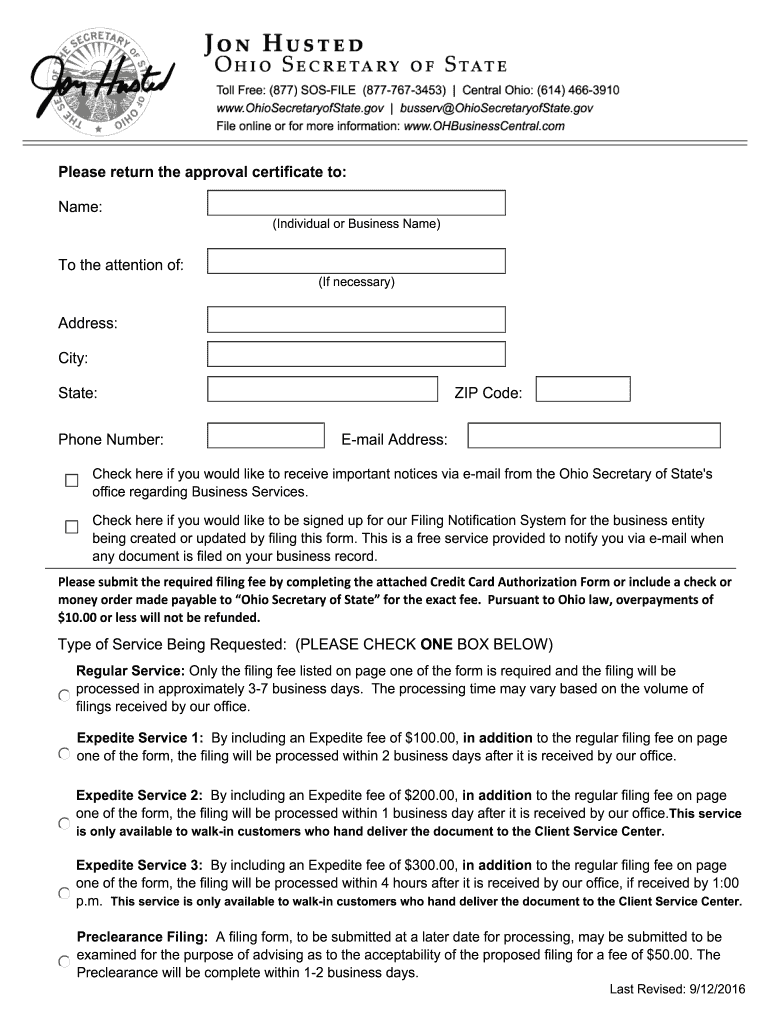

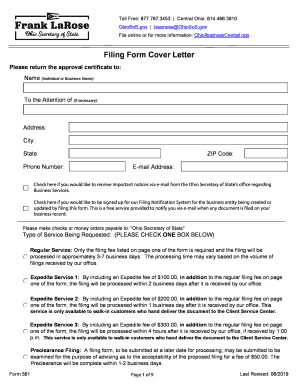

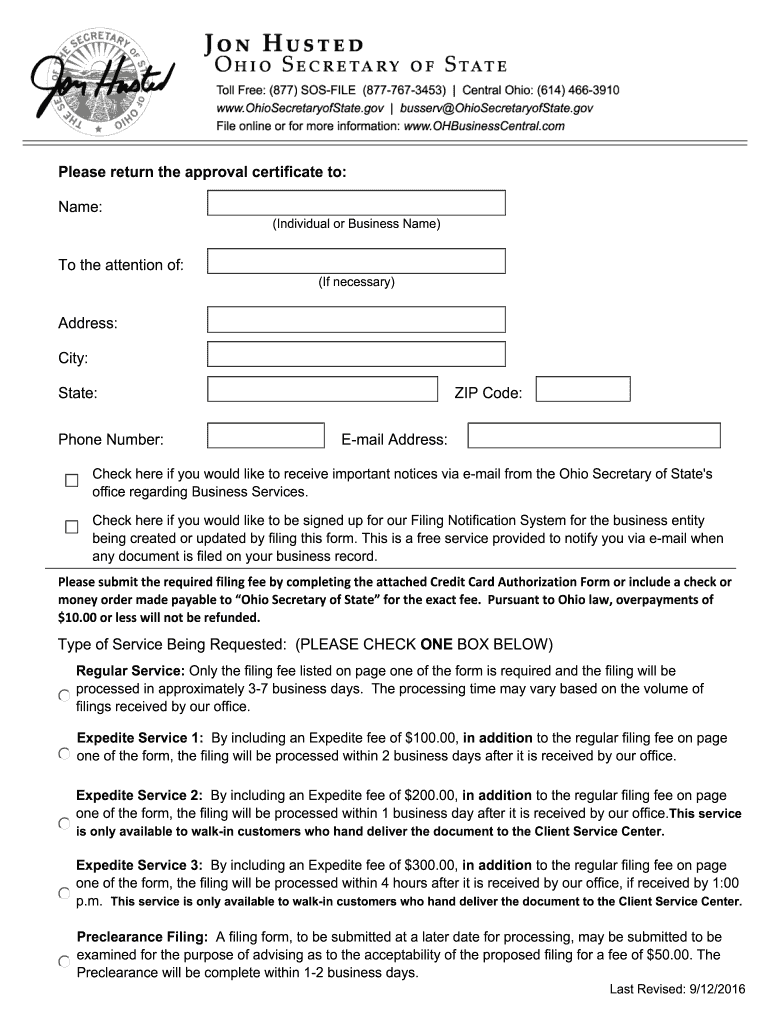

OH SOS 561 2014 free printable template

Get, Create, Make and Sign ohio 561 - sos

Editing ohio 561 - sos online

Uncompromising security for your PDF editing and eSignature needs

OH SOS 561 Form Versions

How to fill out ohio 561 - sos

How to fill out OH SOS 561

Who needs OH SOS 561?

Instructions and Help about ohio 561 - sos

Hi if you're looking to look for Ohio corporations all you to do is click on the link right below this video, and you'll get it brought to this funky-looking webpage by the state of Ohio so all you have to do is search by business name is click right in the first field right here and type in the corporation that you're looking for, so we're just going to type in McDonald's and look for our favorite fast food joint, but this tool is also great if you're going to be creating a new corporation, and you want to make sure that the name that you're going to be selecting is in fact available so as we scroll down here you can see we have many pages here more than one McDonald's but let's just click actually on any one of these it doesn't really matter we're just trying to give you a feel for what these look like and if you just click on the link right there this is McDonald's mercy corporation for profit their status is dead, so they're no longer running but here's the information on the owner it who is this person and there are last filings, so that's it that's how you can do a simple search of corporations in Ohio

People Also Ask about

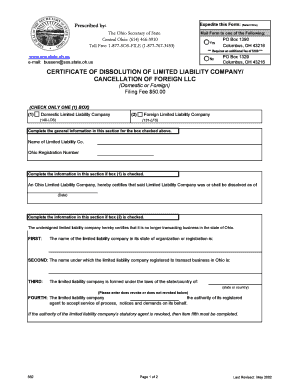

How do I file a business Dissolution in Ohio?

How do I obtain a tax clearance certificate?

How do I dissolve a business in Ohio?

What is the fee to dissolve an LLC in Ohio?

How do you dissolve a partnership in Ohio?

How do I dissolve an entity in Ohio?

How do I dissolve a corporation in the US?

How to get a certificate of Tax clearance in Ohio?

Can I get my company tax clearance certificate online?

How to close Ohio Withholding account?

How much is tax clearance certificate?

How do I cancel a business license in Ohio?

How do I file articles of Dissolution in Ohio?

How do I unregister a corporation?

How do I dissolve a foreign corporation in Ohio?

What documents are needed for tax clearance certificate?

How do you close an LLC in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ohio 561 - sos online?

How do I edit ohio 561 - sos straight from my smartphone?

How do I edit ohio 561 - sos on an Android device?

What is OH SOS 561?

Who is required to file OH SOS 561?

How to fill out OH SOS 561?

What is the purpose of OH SOS 561?

What information must be reported on OH SOS 561?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.