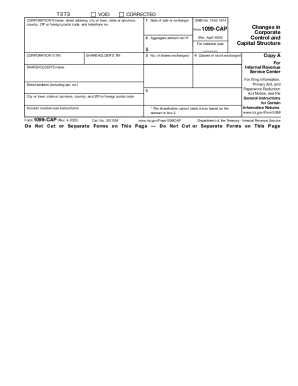

IRS 1099-CAP 2017 free printable template

Show details

Shows the class or classes of stock that were exchanged. Future developments. For the latest information about developments related to Form 1099-CAP and its instructions such as legislation enacted after they were published go to www.irs.gov/form1099cap. Copy C For Corporation To complete Form 1099-CAP use Returns and the 2017 Instructions for Form 1099-CAP. File with Form 1096. For Paperwork Reduction Act Notice see the 2017 General Instructions for Certain Information Returns. 1099-CAP...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1099-CAP

Edit your IRS 1099-CAP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1099-CAP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1099-CAP online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1099-CAP. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1099-CAP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1099-CAP

How to fill out IRS 1099-CAP

01

Obtain a blank IRS Form 1099-CAP.

02

Fill in the recipient’s name, address, and Taxpayer Identification Number (TIN) in the designated fields.

03

Enter your company’s name, address, and TIN in the appropriate sections.

04

Report the amount received by the recipient in the 'Amount' box.

05

Indicate the date of the transaction in the 'Date' box.

06

Complete any other required information as per the instructions provided by the IRS.

07

Review the form for accuracy and sign it if required.

08

Send the form to the recipient and file it with the IRS by the deadline.

Who needs IRS 1099-CAP?

01

Any corporation that receives an amount of $10,000 or more in connection with the cancellation of debt must file Form 1099-CAP.

02

Shareholders of corporations that are in the process of liquidation or the acquisition of control must also receive a 1099-CAP if applicable.

Fill

form

: Try Risk Free

People Also Ask about

What does a 1099 form tell you?

A 1099 form shows non-employment income, such as income earned by freelancers and independent contractors. On the other hand, a W-2 shows the annual wages or employment income that a taxpayer earned from a particular employer during the tax year.

What qualifies me for a 1099 form?

Examples of when you might get a 1099 Form If you earned $600 or more in nonemployee compensation from a person or business who isn't typically your employer, you should receive a Form 1099-NEC. If you earned $600 or more in rent or royalty payments, you should receive Form 1099-MISC.

What is a 1099-cap form?

This form is furnished to shareholders who receive cash, stock, or other property from an acquisition of control or a substantial change in capital structure.

How do I report a 1099-cap?

Shareholders who receive a 1099-CAP may be required to recognize gains from the receipt of cash, stock, or other property that was exchanged for the company's stock. If you do have a gain from the exchange, report it on IRS Form 8949 when you file your income tax return.

How much can you make on a 1099 before you have to claim it?

Normally income you received totaling over $600 for non-employee compensation (and/or at least $10 in royalties or broker payments) is reported on Form 1099-MISC. If you are self-employed, you are required to report your self-employment income if the amount you receive from all sources equals $400 or more.

What is 1099 income limit?

Usually, anyone who was paid $600 or more in non-employment income should receive a 1099. However, there are many types of 1099s for different situations. Also, there are many exceptions to the $600 rule, meaning you may receive a 1099 even if you were paid less than $600 in non-employment income during the tax year.

What happens if I don't file my 1099 K?

Once the IRS thinks that you owe additional tax on your unreported 1099 income, it will usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

How do I report 1099 income to IRS?

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. You may need to make estimated tax payments.

Fill out your IRS 1099-CAP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1099-CAP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.