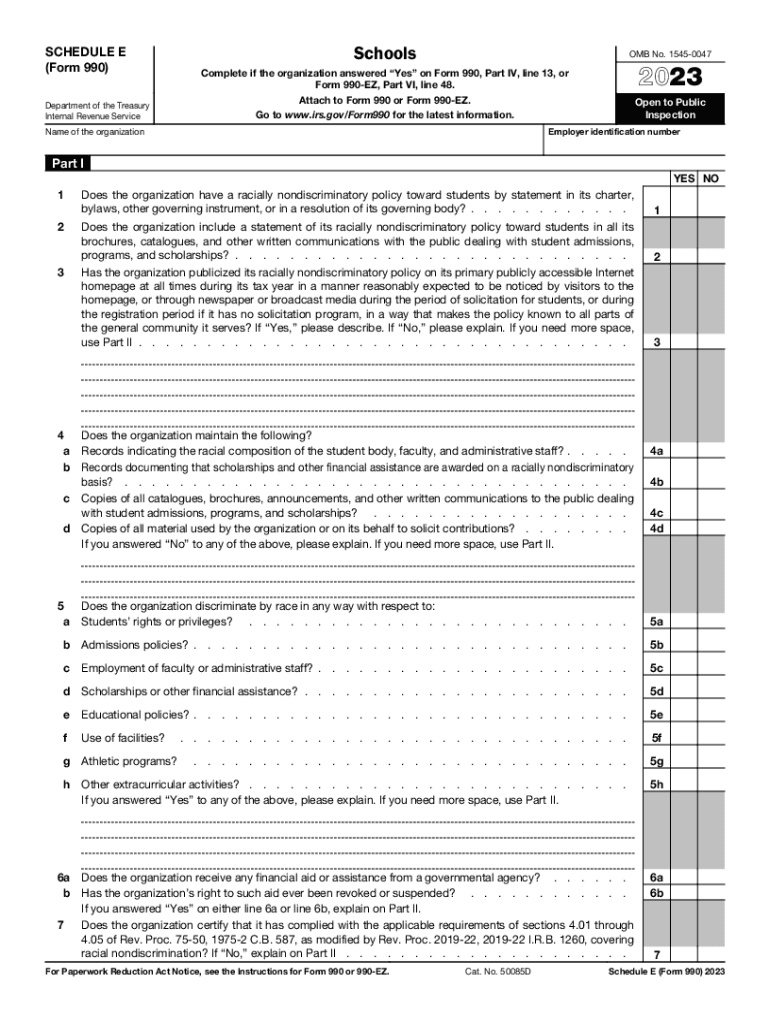

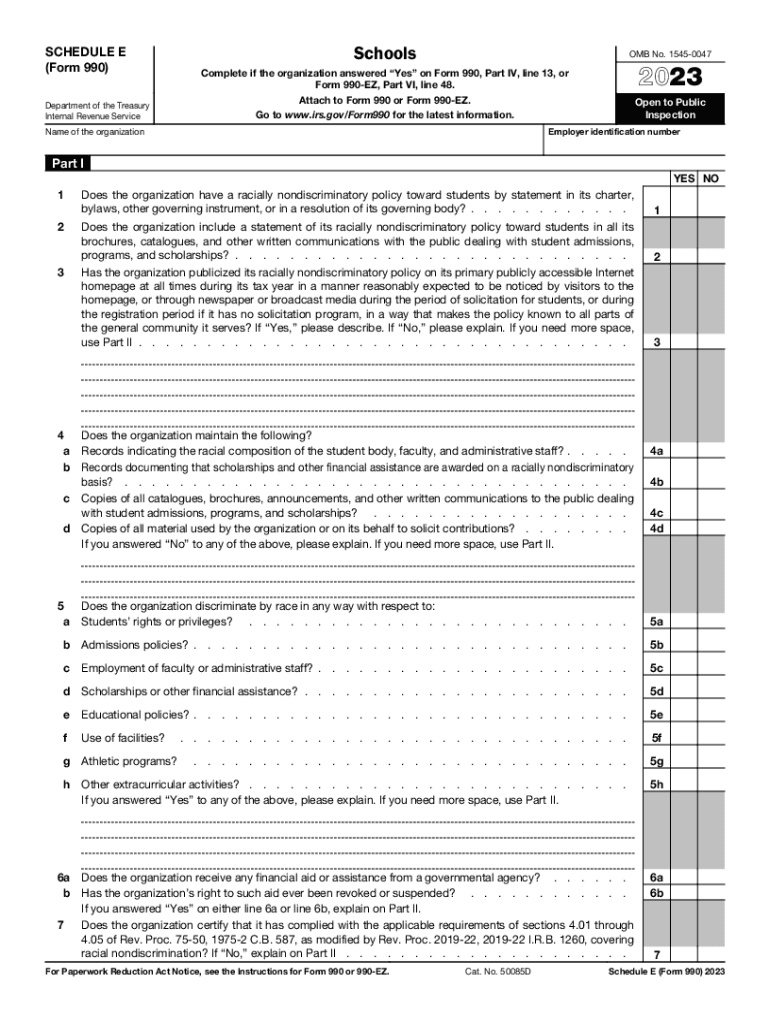

IRS 990 or 990-EZ - Schedule E 2023-2024 free printable template

Get, Create, Make and Sign

How to edit 2023 schedule e form online

IRS 990 or 990-EZ - Schedule E Form Versions

About 2023 schedule e form

How to fill out 2023 schedule e form

How to fill out 2023 schedule e form

Who needs 2023 schedule e form?

Instructions and Help about 2023 schedule e form

Welcome back to our channel Claire Valley Tech's my name is Brian Kim I'm a certified public accountant and in today's video we will be discussing the Schedule E for rental properties so the rental properties they'll have their income they'll have their expenses all this is reported on the Schedule E on your 1040 your individual income tax return, and we're gonna break down in this video line by line everything you need to know and that's applicable to you so let's take a look, so this is the Schedule E for rental properties this is where your rental income you're into expenses and ultimately your rental profit or your rental loss is reported on your individual income tax return keep in mind this is the format for 2018 we're not expecting any changes for 2019 if there are changes in the format for 2019 we will be updating this video however the more important thing is just knowing where to classify and categorize your expenses which is ultimately the point of this video so let's begin so here of course the name is fake John Doe in this example the social security numbers listed here this should automatically...

Fill form : Try Risk Free

People Also Ask about 2023 schedule e form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2023 schedule e form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Quick facts to know before filling out the form