Get the free Post-Summary Corrections to Entry Summaries Filed in ACE - gpo

Show details

37136 Federal Register / Vol. 76, No. 122 / Friday, June 24, 2011 / Notices DEPARTMENT OF HOMELAND SECURITY U.S. Customs and Border Protection Potently Amendment (PEA) Processing Test: Modification,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

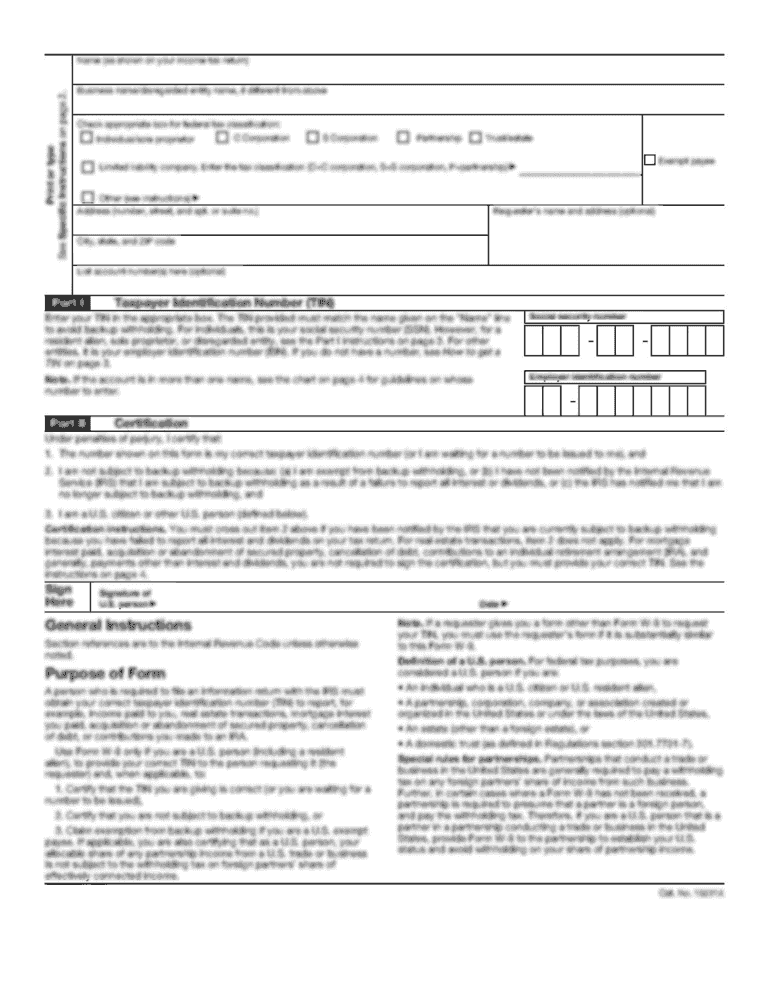

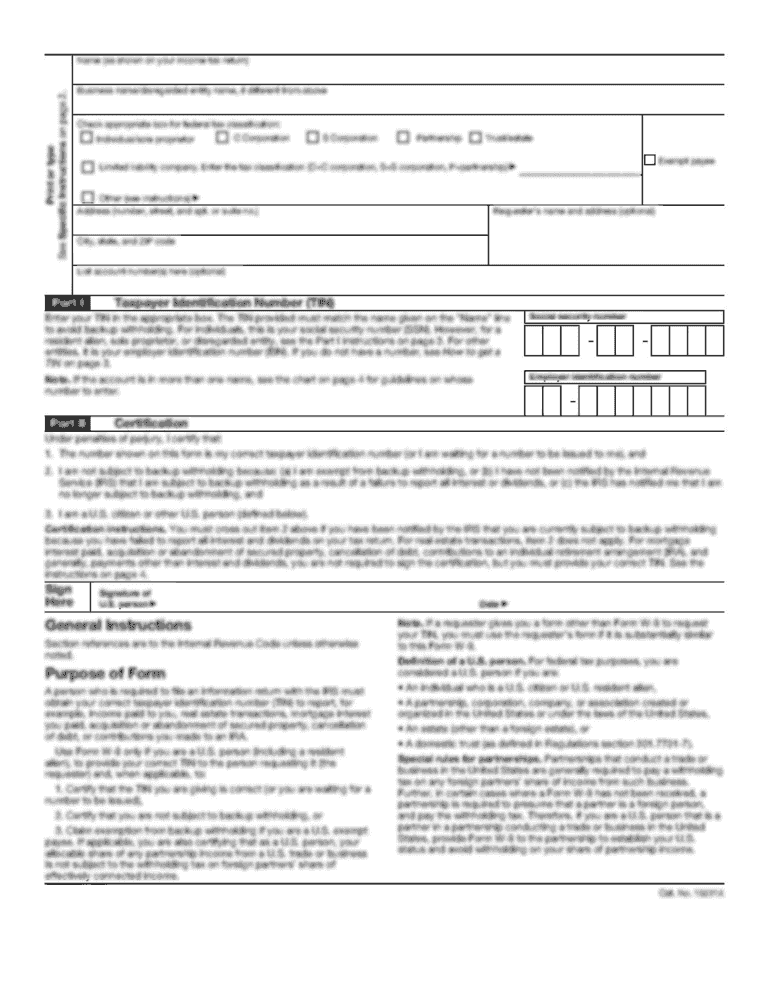

Edit your post-summary corrections to entry form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post-summary corrections to entry form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing post-summary corrections to entry online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit post-summary corrections to entry. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out post-summary corrections to entry

To fill out post-summary corrections to entry, follow these steps:

01

Obtain the necessary form: The first step is to obtain the post-summary corrections to entry form. This form can typically be found online or through your customs broker.

02

Enter the correct information: On the form, enter the correct information for the entry that needs to be corrected. This may include the entry number, importer of record, commodity description, value, or any other relevant details.

03

Identify the errors: Clearly identify the errors that need to be corrected. This could include incorrect classification, inaccurate value declaration, or any other mistakes in the original entry.

04

Provide supporting documentation: Depending on the nature of the correction, you may need to provide supporting documentation. For example, if you are correcting the classification of a product, you may need to include product literature or technical specifications to support the correction.

05

Justify the correction: Along with the supporting documentation, provide a clear justification for why the correction is necessary. This could be due to new information, a mistake in the original entry, or any other valid reason.

06

Submit the form: Once you have filled out the form, attach any required supporting documentation and submit it to the appropriate customs authority. This may be done electronically or in person, depending on the specific procedures in your country.

Who needs post-summary corrections to entry?

Post-summary corrections to entry may be needed by importers or customs brokers who have identified errors or discrepancies in the original entry. Any party involved in the importation process, such as the importer of record, may require post-summary corrections to ensure accurate and compliant documentation. It is important to address these errors promptly to avoid penalties or delays in customs clearance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is post-summary corrections to entry?

Post-summary corrections to entry are corrections made to import entries after they have been filed with customs.

Who is required to file post-summary corrections to entry?

Importers or their authorized agents are required to file post-summary corrections to entry.

How to fill out post-summary corrections to entry?

Post-summary corrections to entry can be filled out electronically through the Automated Commercial Environment (ACE) portal.

What is the purpose of post-summary corrections to entry?

The purpose of post-summary corrections to entry is to correct any errors or discrepancies in the original import entry.

What information must be reported on post-summary corrections to entry?

Post-summary corrections to entry must include details of the corrections needed, such as tariff classifications, valuation adjustments, or country of origin changes.

When is the deadline to file post-summary corrections to entry in 2023?

The deadline to file post-summary corrections to entry in 2023 is typically within 10 business days of discovering the error.

What is the penalty for the late filing of post-summary corrections to entry?

The penalty for the late filing of post-summary corrections to entry can vary, but may include additional duties, fines, or delays in processing the correction.

How can I edit post-summary corrections to entry from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like post-summary corrections to entry, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I sign the post-summary corrections to entry electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your post-summary corrections to entry.

Can I create an eSignature for the post-summary corrections to entry in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your post-summary corrections to entry and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your post-summary corrections to entry online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.