VAT Invoicing on Supplier Form: A Comprehensive Guide

Understanding VAT invoicing

Value Added Tax (VAT) is a fundamental aspect of business transactions in many economies, acting as a consumption tax levied on the value added to goods and services. Understanding VAT invoicing is crucial for both suppliers and buyers to ensure compliance with tax regulations and maintain accurate financial records. The importance of VAT in business transactions cannot be overstated; failing to properly manage VAT can result in significant financial penalties and operational disruptions.

VAT is not only a government revenue system but also impacts pricing strategies and cash flow for businesses. Knowing how to navigate VAT invoicing on supplier forms is essential, as different types of VAT may apply depending on the jurisdiction, type of goods or services provided, and the buyer's status (B2B or B2C transactions).

Standard VAT: A fixed rate applied to most goods and services.

Reduced VAT: A lower rate applied to specific goods such as food and children's items.

Zero-rated VAT: No VAT applied, often used for exports or essential goods.

Exempt supplies: Goods and services that are not subject to VAT at all.

Identifying seller and buyer obligations

Both sellers and buyers play critical roles in ensuring VAT compliance. Sellers must issue VAT invoices that comply with local tax laws, including required details such as tax identification numbers and the applicable VAT rate. Buyers, on their part, are responsible for checking the accuracy of the invoices they receive, especially when claiming VAT refunds or deductions. This collaborative effort ensures a smooth, compliant invoicing process.

Challenges often arise in compliance, particularly when suppliers are unfamiliar with the specific VAT regulations applicable to their industry or locale. This can lead to incorrect invoicing, which can incur fines or hinder the buyer’s ability to reclaim VAT. Establishing clear communication with suppliers and ensuring that both parties understand their obligations is vital.

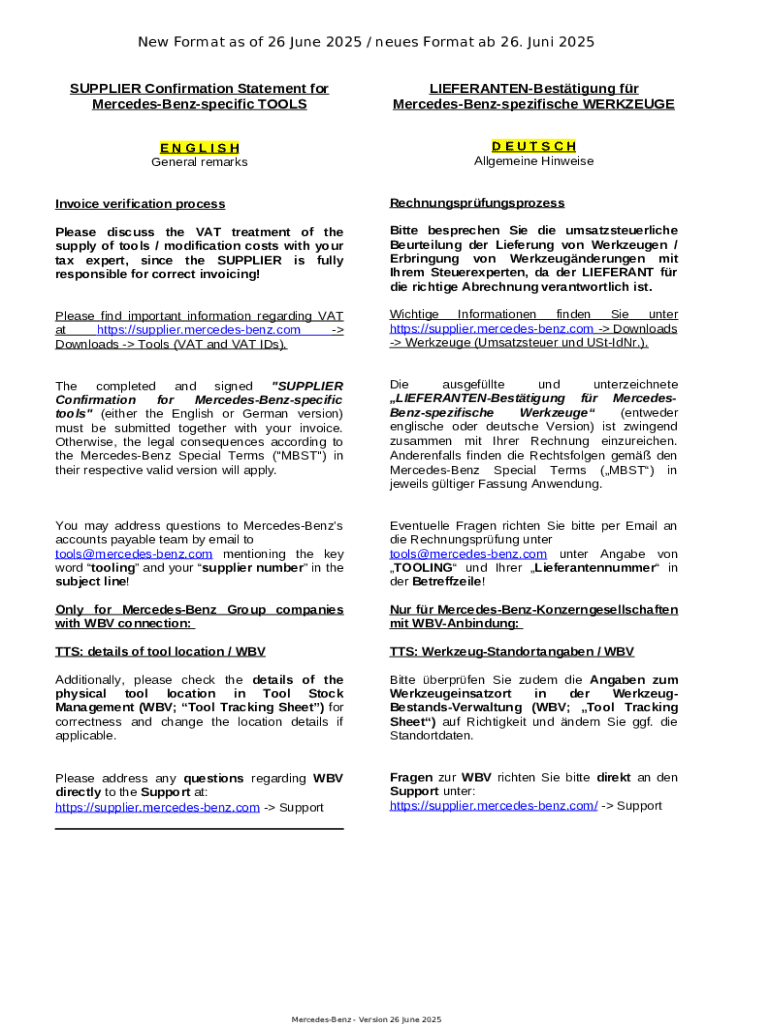

The VAT invoicing process on supplier forms

Creating a VAT invoice requires attention to detail and adherence to specific guidelines. This step-by-step guide will help streamline the process. First, gather all required information, which typically includes the seller's and buyer's names, addresses, tax identification numbers, a unique invoice number, the transaction date, item descriptions, quantity, price, VAT rate, and the total amount payable including VAT.

Formatting guidelines for VAT invoices also play an important role in compliance. Including clear headings such as 'VAT Invoice' and breaking down total costs into net, VAT, and gross amounts improves clarity and reduces the chance of errors. Moreover, it’s crucial to avoid common mistakes like omitting VAT registration numbers or not clearly indicating the applied VAT rate.

Ensure all mandatory fields are filled.

Avoid using general terms; be specific for easy identification of products/services.

Double-check your VAT calculations to prevent errors.

Use a professional template that adheres to local standards.

Using interactive tools for VAT invoicing

Interactive forms are revolutionizing VAT management by simplifying the invoicing process. Using tools such as pdfFiller, businesses can create, edit, and store their VAT invoices in a secure, centralized location. This not only enhances efficiency but also minimizes human error through templated forms that guide users through the necessary steps.

pdfFiller offers features that enable users to fill and edit VAT invoice templates without hassle. Additionally, the ability to collaborate with team members means that multiple stakeholders can review and approve documents, ensuring accuracy and compliance before final submission. The interactive elements streamline the process, freeing up valuable time for businesses.

Editing and customizing your supplier form for VAT invoicing

Tailoring the supplier form to fit your business needs is essential for maintaining operational efficiency. pdfFiller allows users to personalize their VAT invoice templates by adding a logo, choosing color schemes, and including relevant fields pertinent to their specific transactions. Adding additional information such as terms of sale or payment instructions can significantly enhance the user experience.

Best practices for managing these documents involve keeping templates updated with any regulatory changes and ensuring easy access for all team members involved in the invoicing process. Proper document management can prevent miscommunication and delays, thus optimizing the VAT invoicing process overall.

eSigning VAT invoices and enhancing security

eSigning has become an indispensable part of VAT invoicing, significantly boosting both the speed and security of document approval processes. By using pdfFiller’s eSigning feature, users can sign invoices electronically, ensuring that transactions are authenticated and legally binding. The convenience of eSigning eliminates the need for physical signatures, which can slow down operations, particularly in businesses with remote teams.

Securing documents is another critical aspect of VAT invoicing. pdfFiller employs advanced encryption and security measures to protect sensitive information within invoices. These safeguards not only enhance compliance but also build trust among clients and suppliers.

Managing VAT documentation using cloud-based solutions

Utilizing a cloud-based document creation solution for VAT management brings numerous advantages, such as easy access from anywhere, enhanced collaboration, and streamlined organization. pdfFiller provides a unified platform for users to create, store, and manage VAT invoices, making it easier to keep track of important documents without the worry of physical storage limitations or lost paperwork.

Document management features in pdfFiller, such as version control, audit trails, and access permissions, enrich the VAT invoicing experience. These capabilities allow teams to communicate more effectively about invoices, reducing the potential for misunderstandings or compliance errors. Moreover, the integration with financial software can help automate VAT calculations and reporting, further improving operational efficiency.

Frequently asked questions (FAQs)

When navigating the VAT invoicing landscape, questions often arise regarding errors and recordkeeping. If you make a mistake on a VAT invoice, it's crucial to issue a corrected invoice as soon as possible, indicating the error clearly and noting the cancellation of the original invoice. Regarding recordkeeping, businesses should retain VAT invoices for a minimum of five years, depending on local regulations.

If a supplier does not provide proper VAT invoicing, it’s recommended to communicate directly with them to rectify the issue. If necessary, consulting a tax professional for assistance in handling discrepancies or ensuring compliance may safeguard against future complications.

Case studies: Successful VAT compliance through efficient supplier forms

Examining real-life case studies can illustrate the benefits of efficient VAT compliance. For instance, a retail business that implemented a standardized VAT invoicing system through pdfFiller saw a significant reduction in errors and improved cash flow as a result of prompt invoicing. This streamlined invoicing process also enhanced their relationship with suppliers, who appreciated the clarity and professionalism of their documentation.

Similarly, a service industry provider faced challenges with VAT compliance due to inconsistent invoicing practices among its team members. By transitioning to an interactive, cloud-based invoicing solution, the company not only improved compliance rates but also empowered its teams to collaborate in real-time, resulting in a more unified approach to managing client accounts.

Final thoughts on VAT invoicing best practices

Efficient VAT invoicing practices can significantly impact a business’s overall performance. By ensuring that invoices are accurate, timely, and compliant, businesses can optimize their cash flow and maintain good relationships with both customers and suppliers. Staying updated with VAT regulations is vital to avoid potential pitfalls related to invoicing and compliance.

Moving forward, embracing technology, such as pdfFiller, to manage VAT invoicing can help businesses stay ahead of the curve, maximizing efficiency while minimizing the risk of error or legal complications.