Get the free Mo food pantry tax credit: Fill out & sign online

Get, Create, Make and Sign mo food pantry tax

How to edit mo food pantry tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo food pantry tax

How to fill out form mo-fpt - food

Who needs form mo-fpt - food?

Comprehensive Guide to the Form mo-fpt - Food Form

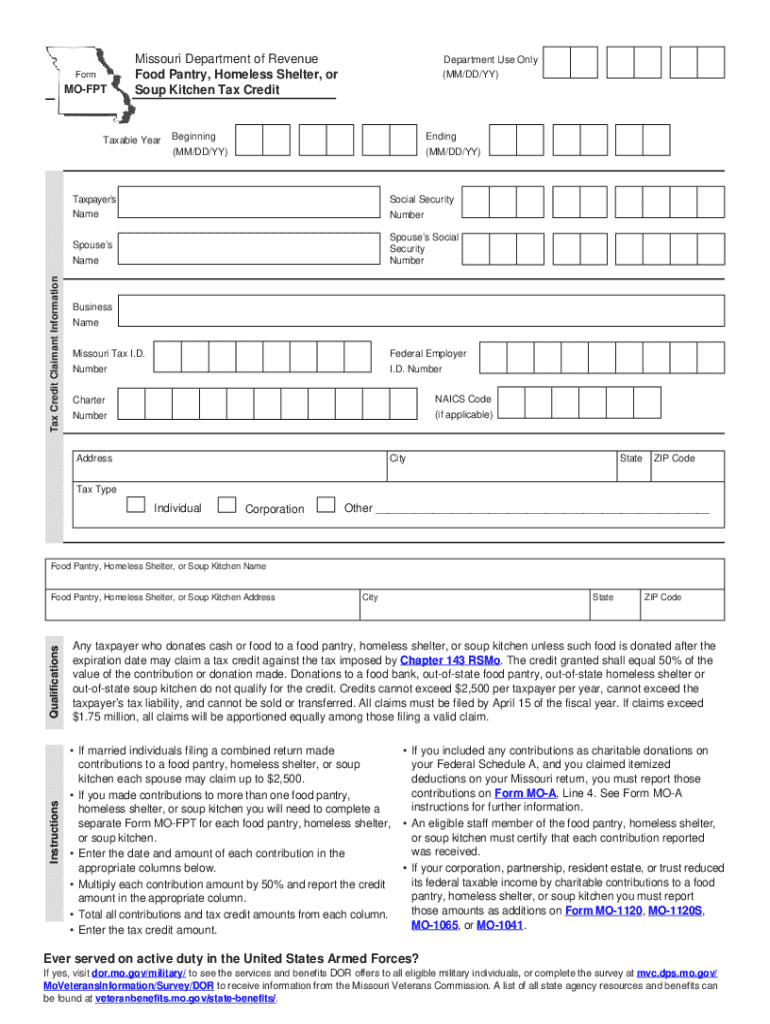

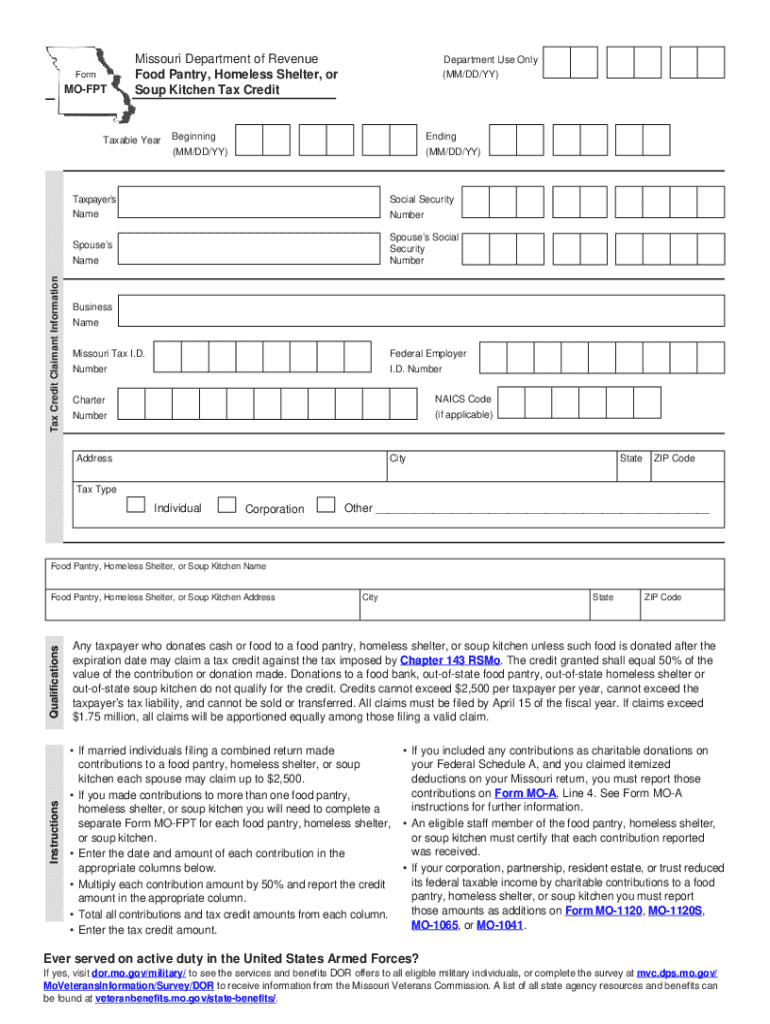

Understanding the food form (mo-fpt)

The form mo-fpt, also known as the food form, is a crucial document designed to facilitate tax credits for eligible food pantries and related organizations. This form plays a significant role in supporting food insecurity initiatives by enabling these organizations to operate effectively. From providing fresh produce to stocking pantry shelves with essential non-perishables, the food form is integral to maintaining the supply chain for those in need.

The importance of the food form extends beyond mere paperwork. It serves as a financial lifeline for food pantries, ensuring they have access to the necessary resources to combat hunger in their communities. With proper completion and submission of the mo-fpt, pantries can secure tax credits that can significantly enhance their operational capabilities, allowing them to reach more individuals and families facing food insecurity.

Purpose of the food form (mo-fpt)

The primary objective of the mo-fpt food form is twofold: it seeks to support eligible food pantries while ensuring compliance with regulations surrounding tax credits. By requiring detailed accountability, the form allows tax authorities to verify that the funds are used appropriately and reach their intended beneficiaries. This framework promotes transparency in the distribution of donations, food supplies, and cash grants to pantries and soup kitchens.

Moreover, the food form fits into a broader tax framework aimed at enhancing community welfare. Eligible organizations can demonstrate their need for financial assistance, which acts as a catalyst for ongoing support and funding from both government and private entities. The mo-fpt food form thus not only assists food pantries in sustaining their operations but also incentivizes continued investments in food security initiatives across Missouri.

Eligibility criteria

Eligibility for the mo-fpt food form is determined by specific criteria set forth by tax authorities in Missouri. Generally, both individuals and organizations can apply for this tax credit, but the primary focus remains on food pantries and similar non-profit entities. These organizations must meet defined requirements to demonstrate their operational legitimacy and commitment to alleviating food poverty.

To be deemed eligible, applicants are expected to undertake a needs assessment, providing detailed documentation to support their claims. This might include a demonstration of the number of individuals served, the types of food supplied, and evidence of existing funding or resources. Preparedness to present this information ensures a smoother application process and increases the chances of receiving valuable tax credits.

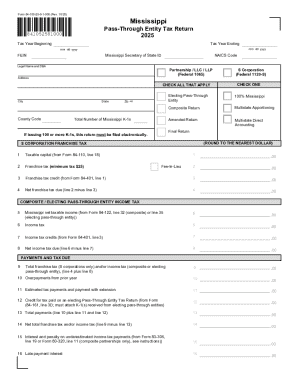

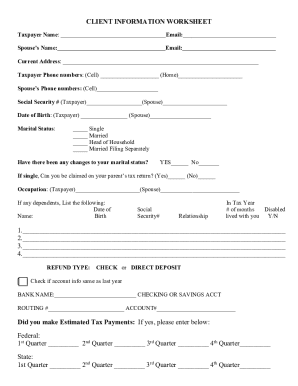

Step-by-step guide: How to fill out the food form

Filling out the mo-fpt food form requires careful attention to detail. Following a structured approach can help ensure your application is complete, which is vital for the approval of your tax credits. The first step involves gathering all necessary information before diving into the actual application. You'll need original documentation, including proof of eligible donations, financial records, and any other pertinent details about your food pantry’s operations.

Once you’ve collected the necessary information, proceed to complete the application. Each section of the form is designed to capture essential data ranging from contact details to specifics about the food items you distribute. Reviewing your submission is critical – a thorough check can help catch common mistakes such as missing signatures or incorrect figures, which may delay your application process. Finally, submit the food form via the designated methods, opting for online submission for faster processing.

Managing your food form submission

Once you have submitted the mo-fpt food form, it's essential to manage your application effectively. There are various tools and methods that can help you track the status of your application, such as dedicated online tracking systems provided by tax authorities or third-party platforms. These resources can give you real-time updates about whether your application is under review, approved, or if additional information is needed.

If you discover that changes are required after submission – whether due to incorrect information or a change in circumstances – it's crucial to act promptly. The process for submitting corrections typically requires filing an amendment or a new application form, depending on the extent of the adjustments needed. Keeping all relevant documentation organized can streamline any updates you may need to make.

How to claim the food pantry credit

Claiming the food pantry tax credit is a multifaceted process that requires careful adherence to specific conditions. To qualify, organizations must ensure they have successfully submitted the mo-fpt food form and received approval. Moreover, claiming these credits entails adhering to essential deadlines and keeping thorough documentation organized for any potential audits or reviews by tax authorities.

Key deadlines often correlate with the tax year, and understanding these timeframes ensures you maximize your available benefits. Late submissions or incomplete documentation may hinder your ability to claim the credits effectively. Therefore, it’s beneficial to prepare a checklist of key dates and required documentation, helping streamline the claiming process for your food pantry.

Eligible uses of tax credit

Understanding the eligible uses of the food pantry tax credit is fundamental for maximizing its benefits. Funds obtained through these credits can be utilized for a variety of expenses, primarily focused on supporting pantry operations and improving food accessibility. Notably, organizations can use the credit for the procurement of food supplies, operational costs, and even community outreach programs aimed at increasing awareness and accessibility to food resources.

Conversely, it's crucial to recognize which expenses do not qualify for tax credit usage. For instance, personal expenditures not related to the pantry's operations or activities beyond food distribution will not be supported. Thus, being well-informed about both eligible and ineligible purchases can significantly affect how effectively a food pantry can utilize its resources.

Authorization and compliance

Understanding the authorization process for the mo-fpt food form is fundamental for a successful application submission. Typically, certain individuals within an organization are designated with signing authority, and having these permissions well-documented is critical for compliance purposes. The necessity for accurate representation can’t be overstated, as it establishes the legitimacy of the application and reassures tax authorities of the responsible handling of funds.

In addition, compliance and reporting requirements follow the submission of the food form. Organizations must adhere to ongoing obligations that may include periodic reporting on the use of funds, how many individuals they’ve served, and other operational metrics. This transparency reinforces the credibility of the organization and its mission, fostering trust among community stakeholders and donors.

Interactive tools and resources

Leveraging interactive tools can significantly enhance the efficiency of managing the mo-fpt food form. Platforms like pdfFiller provide a suite of document management tools, allowing users to edit, sign, and collaborate seamlessly. Utilizing these capabilities facilitates not only form completion but also real-time updates and adjustments to submitted applications as necessary.

In addition to editing functionalities, users can access customer support channels for assistance with any queries related to their submissions. Community forums also serve as an invaluable resource for sharing experiences and best practices among food pantry operators. Engaging in these networks will enhance your understanding of the form's intricacies and bolster your ability to navigate potential challenges effectively.

Frequently asked questions (FAQs)

Many applicants have common concerns regarding the mo-fpt food form. The most frequently asked questions often revolve around eligibility criteria, submission deadlines, and the specific documentation needed for approval. Familiarizing yourself with these queries can preemptively address potential issues, ensuring a smoother application process.

Additionally, troubleshooting tips for applicants, such as keeping meticulous records, clarifying submission guidelines, and understanding what to expect post-submission, are paramount. Implementing best practices to maximize benefits from the food pantry tax credit allows organizations to focus on their core mission of providing food support to their communities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mo food pantry tax from Google Drive?

How can I send mo food pantry tax for eSignature?

How do I fill out mo food pantry tax on an Android device?

What is form mo-fpt - food?

Who is required to file form mo-fpt - food?

How to fill out form mo-fpt - food?

What is the purpose of form mo-fpt - food?

What information must be reported on form mo-fpt - food?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.