Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is minnesota form direct deposit?

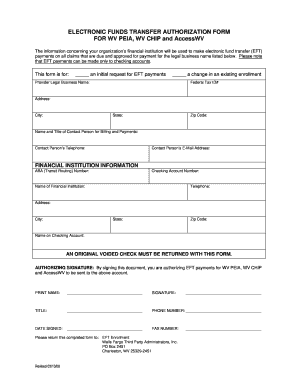

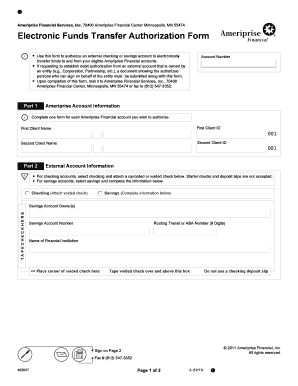

Minnesota does not have a specific form for direct deposit. However, employers in Minnesota are required to provide employees with a direct deposit authorization form that complies with federal law. This form generally requires employees to provide their bank account information, such as the routing number and account number, to authorize the direct deposit of their wages. The specific format and content of the form may vary depending on the employer.

Who is required to file minnesota form direct deposit?

Minnesota requires all employers who have an employee residing in the state to file the Direct Deposit Authorization Form. This form must be filed regardless of whether the employer offers direct deposit as a payment option to its employees or not.

How to fill out minnesota form direct deposit?

To fill out the Minnesota form for direct deposit, follow these steps:

1. Obtain the Minnesota form for direct deposit. You can usually find this form on the website of the organization or employer requiring it.

2. Provide your personal information: Start by entering your name, address, city, state, and ZIP code in the appropriate fields. This information should match the details on your bank account.

3. Enter your Social Security Number in the designated field.

4. Provide your bank account information: Enter your bank's routing number in the first field. This is a nine-digit code that identifies your specific financial institution. The routing number can be found on your bank's website, on the bottom left-hand side of your checks, or by contacting your bank directly.

5. Enter your bank account number in the second field. This is the unique number assigned to your individual account. Make sure to double-check this number for accuracy.

6. Indicate the type of account you have, whether it is a checking or savings account, by checking the relevant box.

7. Sign and date the form at the bottom to authorize the direct deposit.

8. If required, provide any additional information or documentation requested by the organization or employer.

9. Submit the completed form to the appropriate entity. This could be your employer, the organization, or the government agency requesting the form. Keep a copy of the filled-out form for your records.

It's important to note that these instructions are general and can vary slightly depending on the specific form you are filling out. Always carefully read the instructions provided with the form to ensure accuracy.

What is the purpose of minnesota form direct deposit?

The purpose of Minnesota Form Direct Deposit is to authorize the State of Minnesota to electronically deposit payments directly into the recipient's bank account instead of issuing a physical paper check. This form is typically used by individuals who receive payments from the state, such as employees, vendors, or contractors, to provide their bank account information and authorize the electronic transfer of funds. By opting for direct deposit, recipients can receive their payments faster, have greater convenience, and minimize the risk of lost or stolen checks.

What information must be reported on minnesota form direct deposit?

The Minnesota Direct Deposit Form requires the following information to be reported:

1. Employee Information: Name, address, Social Security Number, and employee contact information.

2. Employer Information: Company name, address, and a unique Employer Identification Number (EIN).

3. Financial Institution Details: Name of the financial institution, address, and routing number.

4. Account Information: Employee's account number and account type (checking or savings).

5. Allocation Instructions: Employee's choice on how the funds should be allocated (e.g., full deposit to checking or partial to checking and savings).

6. Signature: Employee's signature and date of completion.

It is important to note that this information may vary slightly depending on the specific form used or any additional requirements specified by the employer or financial institution.

What is the penalty for the late filing of minnesota form direct deposit?

There does not appear to be a specific penalty for the late filing of a Minnesota form for direct deposit. However, if you fail to comply with Minnesota state tax requirements or fail to report and pay the required taxes on time, you may face penalties and interest charges. It is always advisable to file forms and fulfill tax obligations in a timely manner to avoid potential penalties.

How do I modify my mn form direct deposit authorization in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign minnesota form direct deposit and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find mn dhs form direct deposit?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mn form deposit and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the minnesota form deposit in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your mn dhs direct deposit form in minutes.