Pay Stub Template

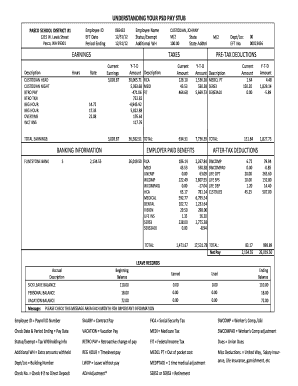

What is a Pay Stub Template?

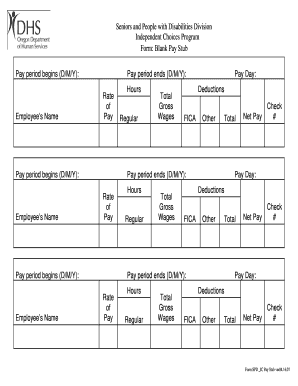

All employees, business people or just ordinary people who earn money need to know what a pay stub is. It is a kind of document that must be attached to a paycheck. It helps people keep their earnings and payments in order. When an individual receives a paycheck with their wage, they may separate a this stub from the paycheck and use it at the close of the tax year.

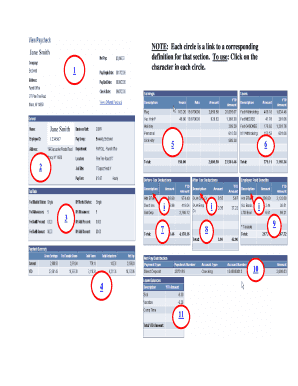

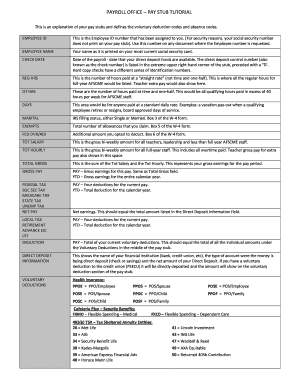

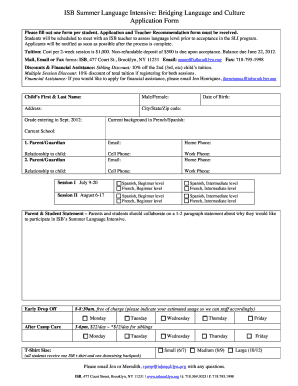

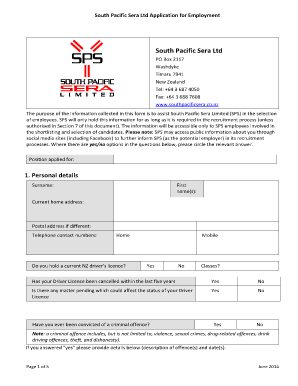

How to Fill out a Pay Stub Form

The document is divided into three sections. Below you can check each one:

Remember that you have two options: either to fill out the fillable form electronically or print the document out and do the same manually. Some will prefer the second option, but the first one offers many more advantages.

You must download several pay stub templates and choose the one you need. It may be in PDF or Word format. Keep up with new technologies and put aside all that paperwork. Save your time, filling out the document electronically. Thus, it is quite possible to edit the document, correct the mistakes, add more fillable fields and save it in the necessary format.