Get the free arms of hope donation receipt - armsofhope

Show details

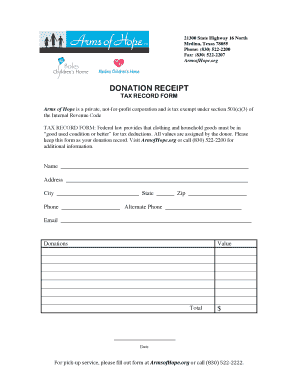

21300 State Highway 16 North Medina, Texas 78055 Phone: (830) 5222200 ArmsofHope.org DONATION RECEIPT TAX RECORD FORM Arms of Hope is a private, notforprofit corporation and is tax-exempt under section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arms of hope donation

Edit your arms of hope donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arms of hope donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arms of hope donation online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit arms of hope donation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arms of hope donation

How to fill out Arms of Hope donation:

01

Visit the Arms of Hope website or donation page.

02

Provide your personal information, including name, address, and contact details.

03

Choose the donation amount or select a specific program to support.

04

Select the frequency of your donation, whether it's a one-time contribution or recurring monthly donations.

05

Follow the prompts to enter your payment information securely.

06

Review the donation details and confirm your contribution.

07

You may receive a confirmation email or receipt for your donation.

Who needs Arms of Hope donation:

01

Individuals and families facing various hardships and challenges.

02

Orphaned or abandoned children in need of shelter, education, and support.

03

Women and children escaping domestic violence or abusive situations.

04

Individuals struggling with addiction and seeking recovery services.

05

Those affected by natural disasters, poverty, or other difficult circumstances.

06

Low-income families or individuals needing assistance with basic needs like food, clothing, and healthcare.

By donating to Arms of Hope, you can contribute to their mission of providing hope, healing, and support to those in need.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit arms of hope donation straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing arms of hope donation, you can start right away.

How do I edit arms of hope donation on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign arms of hope donation. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit arms of hope donation on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share arms of hope donation on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is arms of hope donation?

The Arms of Hope donation refers to a charitable contribution aimed at supporting organizations or initiatives that assist underprivileged groups, particularly children and families in need.

Who is required to file arms of hope donation?

Typically, individuals or organizations making charitable contributions may need to file an Arms of Hope donation report for tax purposes if the donations exceed a certain amount or are part of a tax-reducing strategy.

How to fill out arms of hope donation?

To fill out an Arms of Hope donation form, provide accurate donor information, specify the amount donated, enter details about the recipient organization, and include a declaration of the nature of the donation along with any relevant tax identification numbers.

What is the purpose of arms of hope donation?

The purpose of Arms of Hope donation is to provide financial assistance and resources to non-profit organizations and community programs that support vulnerable populations and facilitate positive social impact.

What information must be reported on arms of hope donation?

Information that must be reported includes the donor's name and contact details, the amount donated, the date of the donation, details of the recipient organization including its tax identification number, and a description of how the funds will be used.

Fill out your arms of hope donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arms Of Hope Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.