Reimbursement Forms

What are Reimbursement Forms?

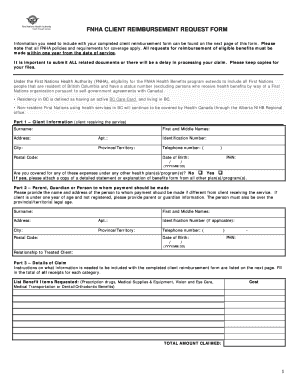

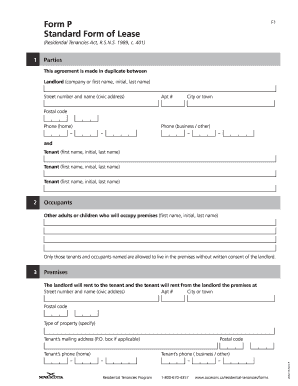

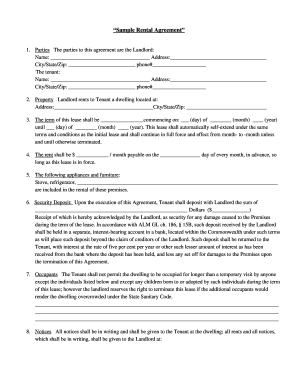

Reimbursement forms are documents used to request the repayment of expenses incurred by an individual in the course of their work or other activities. These forms help organizations track expenses and ensure that individuals are reimbursed in a timely and accurate manner.

What are the types of Reimbursement Forms?

There are several types of reimbursement forms that cater to different types of expenses. Some common types include: travel expense reimbursement forms, medical expense reimbursement forms, and business expense reimbursement forms.

How to complete Reimbursement Forms

Completing reimbursement forms is a straightforward process that requires attention to detail and accuracy. Here are some steps to help you complete reimbursement forms effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.