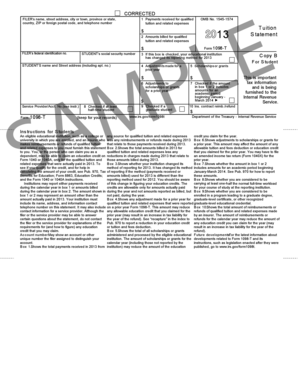

1098-t Form 2013

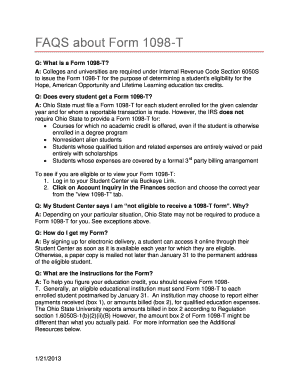

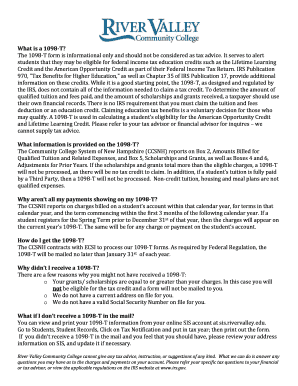

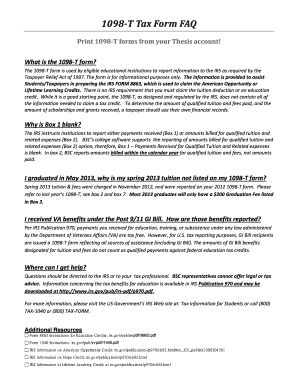

What is 1098-t Form 2013?

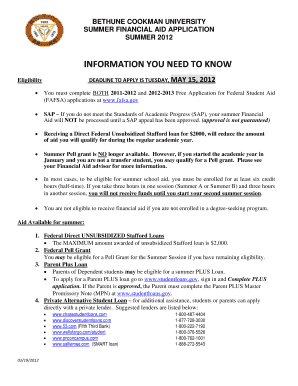

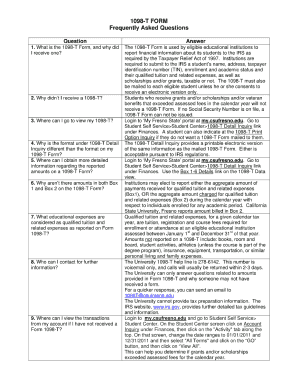

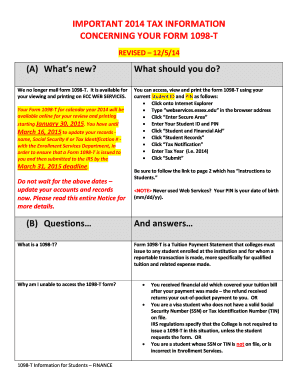

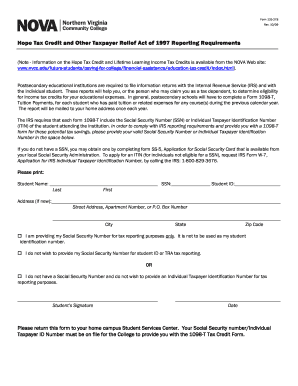

The 1098-t Form 2013 is a document used by educational institutions to report information about a student's qualified education expenses. It is an essential tax form that helps students or their guardians claim education-related tax benefits on their federal income tax returns. The form provides details such as the amounts paid for tuition, scholarships, grants, and other educational expenses during the tax year.

What are the types of 1098-t Form 2013?

The 1098-t Form 2013 has two major types: 1. Blank 1098-t Form: This is the standard version of the form, which individuals need to fill out themselves with the required information. 2. Pre-filled 1098-t Form: This type of form is generated by educational institutions and sent directly to the students or their guardians, containing the already filled information regarding the qualified education expenses. It saves time and makes the process more convenient for the recipients.

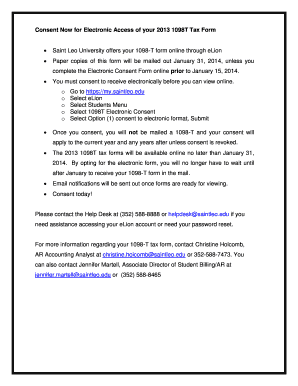

How to complete 1098-t Form 2013

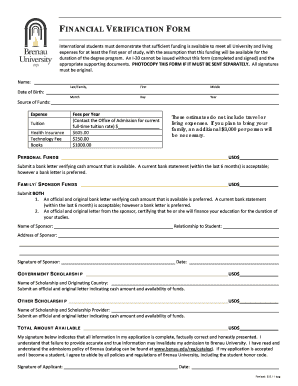

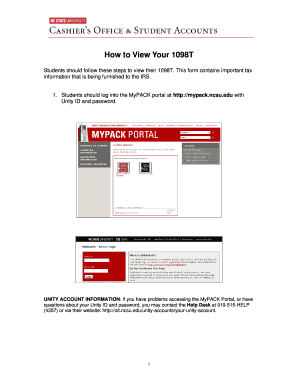

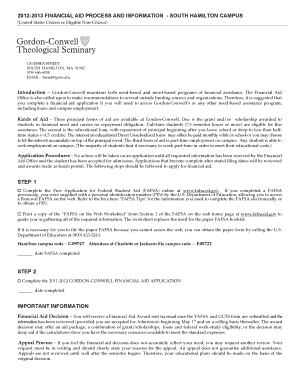

To complete the 1098-t Form 2013, follow these simple steps: 1. Provide personal information: Start by entering your name, address, and taxpayer identification number. 2. Fill in educational institution details: Enter the name, address, and taxpayer identification number of the educational institution from which you received the form. 3. Report qualified education expenses: Fill out the appropriate sections with the amounts paid for tuition, scholarships, grants, and other educational expenses. 4. Review and submit: Double-check all the information filled in the form for accuracy and completeness. Once done, sign and date the form before submission.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.