What is 1098-t form online?

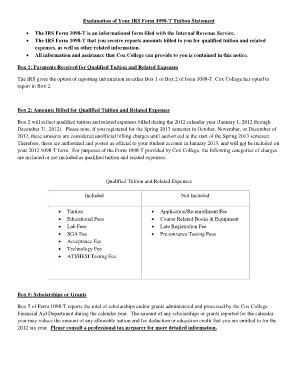

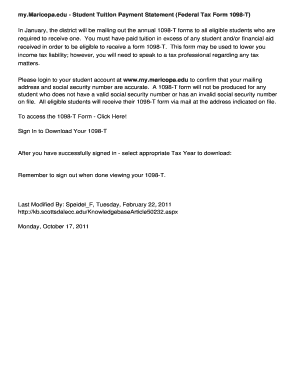

The 1098-T form online is an electronic version of the paper 1098-T form used by educational institutions to report a student's eligible educational expenses and scholarship or grant amounts for tax purposes. It is a tax form that provides information regarding educational expenses and can help students or their parents claim education-related tax credits or deductions.

What are the types of 1098-t form online?

There are two main types of 1098-T forms available online:

Standard 1098-T form: This is the most common type of 1098-T form that is provided by educational institutions to eligible students. It includes information about qualified tuition and related expenses, as well as scholarships or grants received.

Corrected 1098-T form: In some cases, an educational institution may need to correct the information provided on the original 1098-T form. The corrected form is used to rectify any errors or updates in the previously reported data.

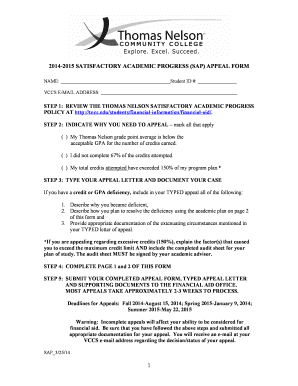

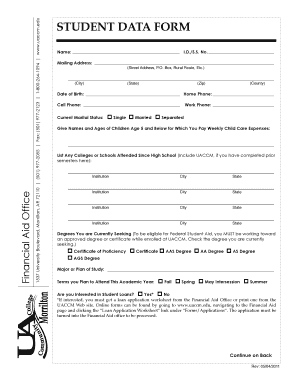

How to complete 1098-T form online

Completing the 1098-T form online is a straightforward process. Here are the steps to follow:

01

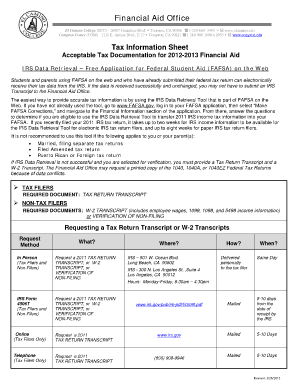

Access a reliable online platform or software that offers the option to fill out the 1098-T form electronically.

02

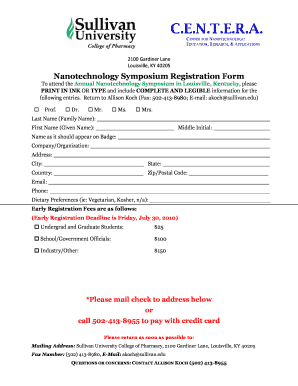

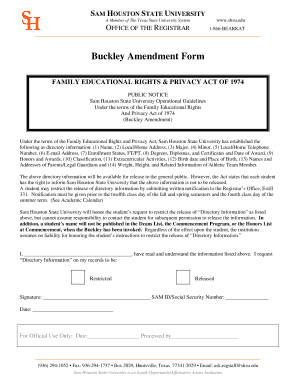

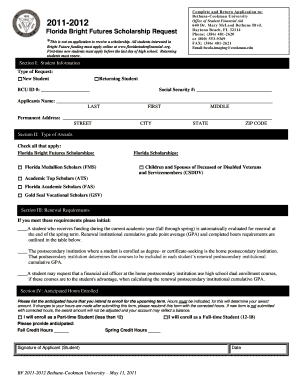

Enter the required information accurately. This may include personal details, educational institution information, and financial details such as tuition expenses and scholarship amounts.

03

Review the filled-out form for any errors or missing information. Make sure all the entered data is correct and complete.

04

Save the completed form electronically.

05

Share the form with the necessary parties, such as the student or their parents, as well as the educational institution.

06

Keep a copy of the completed form for your records.

pdfFiller is a leading online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process of completing the 1098-T form online. Its user-friendly interface and comprehensive features make it the only PDF editor you need to efficiently handle your document needs.