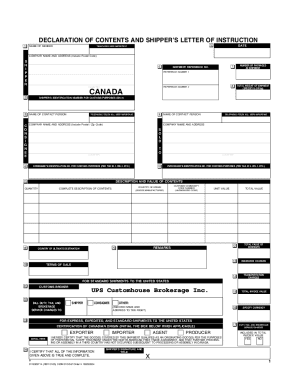

Canada Customs Invoice Instructions

What is canada customs invoice instructions?

Canada customs invoice instructions refer to the guidelines and requirements set by the Canadian government for completing a customs invoice. A customs invoice is a document that details the contents, value, and origin of goods being imported into Canada. It is an important document that helps customs authorities determine the appropriate duties and taxes for the imported goods.

What are the types of canada customs invoice instructions?

There are several types of Canada customs invoice instructions, including:

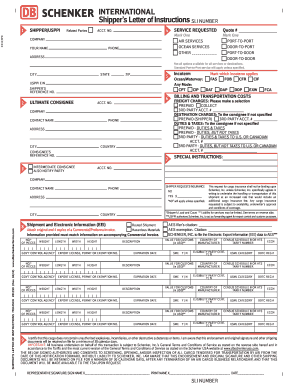

Commercial invoice instructions: These instructions provide guidance on how to complete a commercial invoice, which is one of the documents required for customs clearance.

Value for duty instructions: These instructions explain how to determine the value of imported goods for the purpose of assessing duties and taxes.

Origin instructions: These instructions outline the requirements for indicating the country of origin of the imported goods.

Tariff classification instructions: These instructions explain how to determine the appropriate tariff classification code for the imported goods.

How to complete canada customs invoice instructions

To complete Canada customs invoice instructions, follow these steps:

01

Provide accurate and detailed information about the goods being imported, including their description, quantity, and value.

02

Include the country of origin and the harmonized system (HS) code for the goods.

03

Ensure that the invoice includes all the necessary details required by customs authorities, such as the name and address of the importer and exporter.

04

Calculate and include the appropriate duties and taxes based on the value of the goods and the applicable tariff rates.

05

Verify the accuracy of the completed invoice before submitting it to customs authorities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the difference between a commercial invoice and a Canada customs invoice?

According to the Canada Border Services Agency, the Canada Customs Invoice (CCI) is a special invoice that incorporates more data elements than a standard commercial invoice.

How do I complete a Canadian customs invoice?

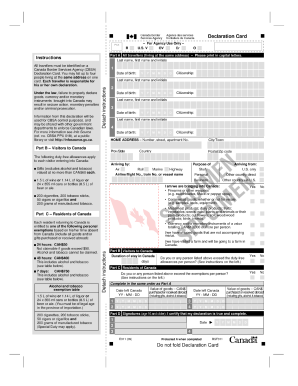

CI1 – Canada Customs Invoice Vendor (name and address) Date of direct shipment to Canada (yyyy/mm/dd) Other references (include purchaser's order No.) Consignee (name and address) Purchaser's name and address (if other than consignee) Country of transhipment.

What are 5 things that should be included in an invoice?

What should be included in an invoice? 1. ' Invoice' A unique invoice number. Your company name and address. The company name and address of the customer. A description of the goods/services. The date of supply. The date of the invoice. The amount of the individual goods or services to be paid.

What is required on the commercial invoice for Canada?

You can use a Commercial Invoice in place of a CCI as long as you include the following information: The exporter's full name, address and country. The importer's full name and address. A detailed description of the goods in the shipment.

What is a US customs invoice?

A commercial invoice is a crucial document that details all the relevant information about the shipment's price, value, and quantity of goods. This will in turn determine the taxes and duties that you'll need to pay for your shipment to clear customs.

Who can complete a CCI Canada customs invoice )?

The exporter, importer or owner, or their agent may prepare form CCI, and the exporter, importer or owner, or their agent can add the information required in field 6, and in fields 23 to 25 of the commercial invoice.