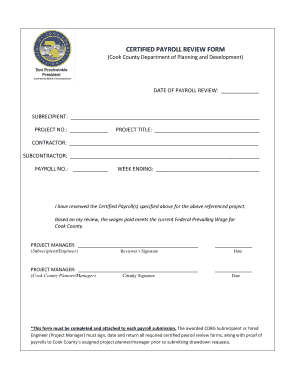

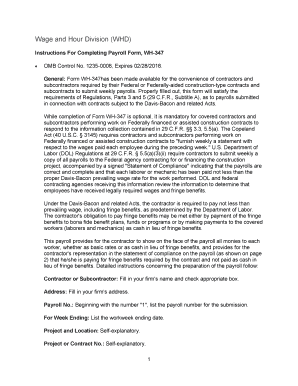

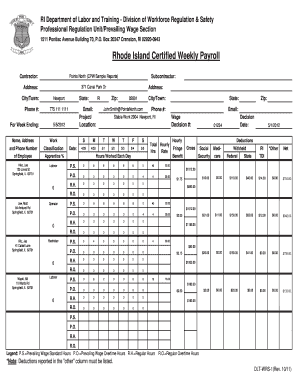

Certified Payroll Form

What is Certified Payroll Form?

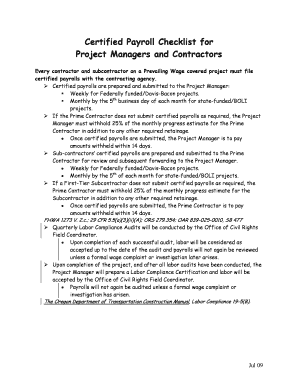

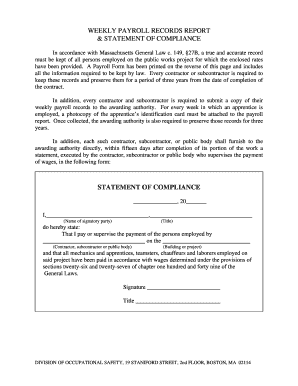

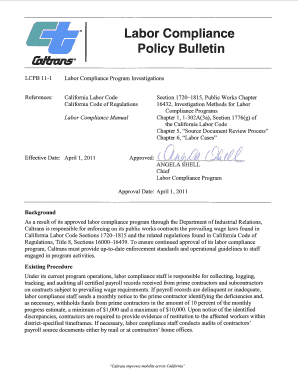

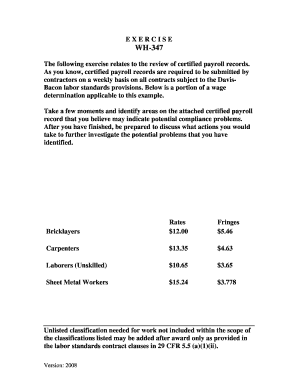

A Certified Payroll Form is a document used by employers to provide detailed information about the wages and benefits paid to employees working on government-funded construction projects. This form ensures that workers are being paid the prevailing wages specified by the Davis-Bacon Act and Related Acts. It helps to promote fair wages and prevent any potential exploitation of workers.

What are the types of Certified Payroll Form?

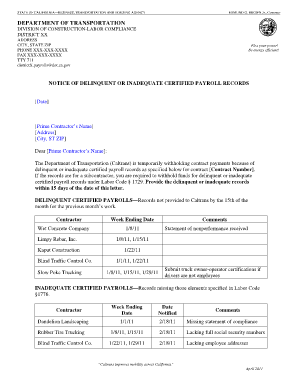

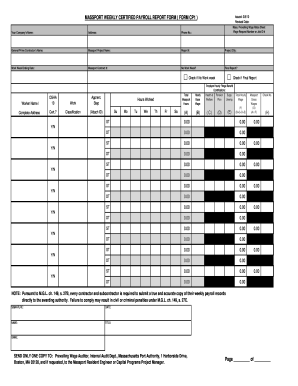

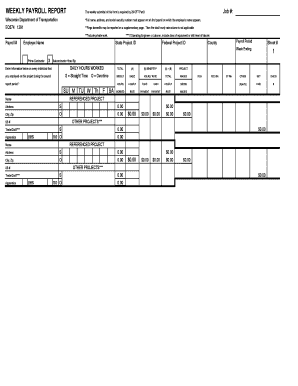

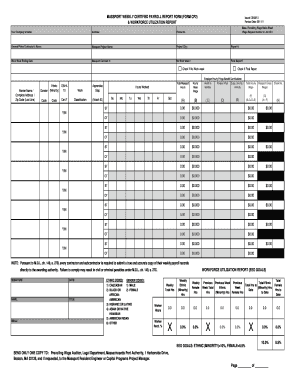

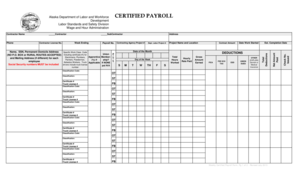

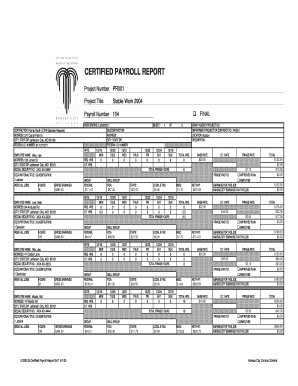

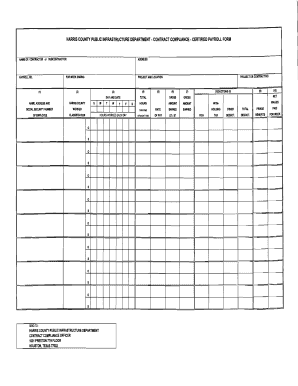

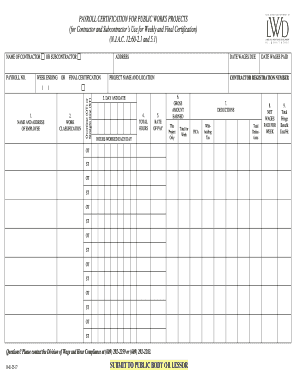

There are several types of Certified Payroll Forms that may vary depending on the specific project and the prevailing wage requirements. Some common types of Certified Payroll Forms include: - WH-347: This form is used for federal construction projects under the Davis-Bacon Act. - CEM-2501: This form is used for construction projects funded by the California Department of Transportation. - PW-4: This form is used for public works projects in New York. These forms may have slight differences in format or layout, but they all serve the same purpose of documenting employee wages and ensuring compliance with prevailing wage laws.

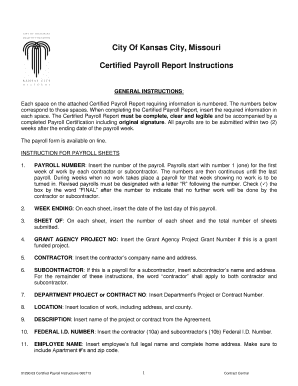

How to complete Certified Payroll Form

Completing a Certified Payroll Form can be a straightforward process if you follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.