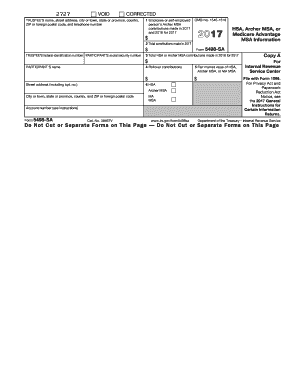

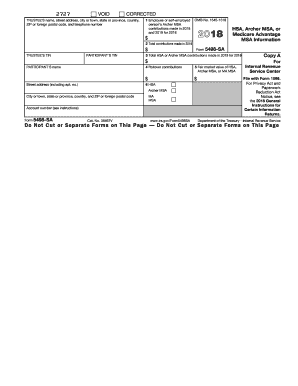

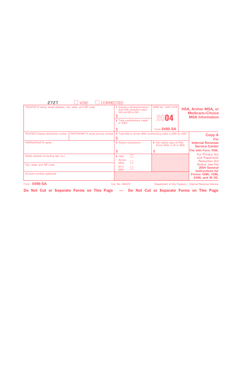

Form 5498-sa

What is form 5498-sa?

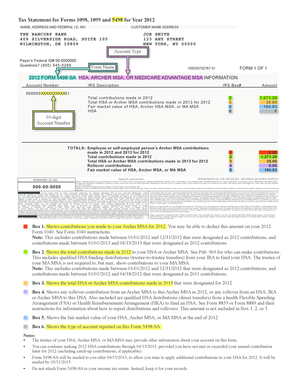

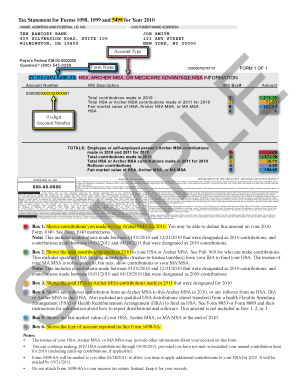

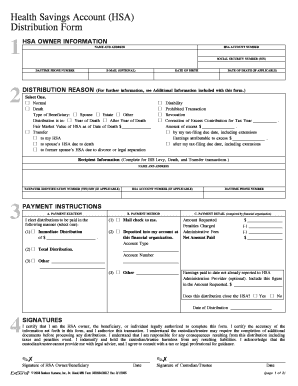

Form 5498-SA is a document that is used to report contributions made to a health savings account (HSA), Archer medical savings account (MSA), or Medicare Advantage medical savings account (MA MSA). It is important to fill out this form accurately to ensure proper reporting of your contributions and to avoid any potential tax issues. By completing this form, you provide the necessary information to the IRS regarding your contributions to these accounts.

What are the types of form 5498-sa?

There are primarily three types of form 5498-SA, depending on the type of savings account. These types include HSA, MSA, and MA MSA. Each form serves the purpose of reporting contributions specific to each account type.

How to complete form 5498-sa

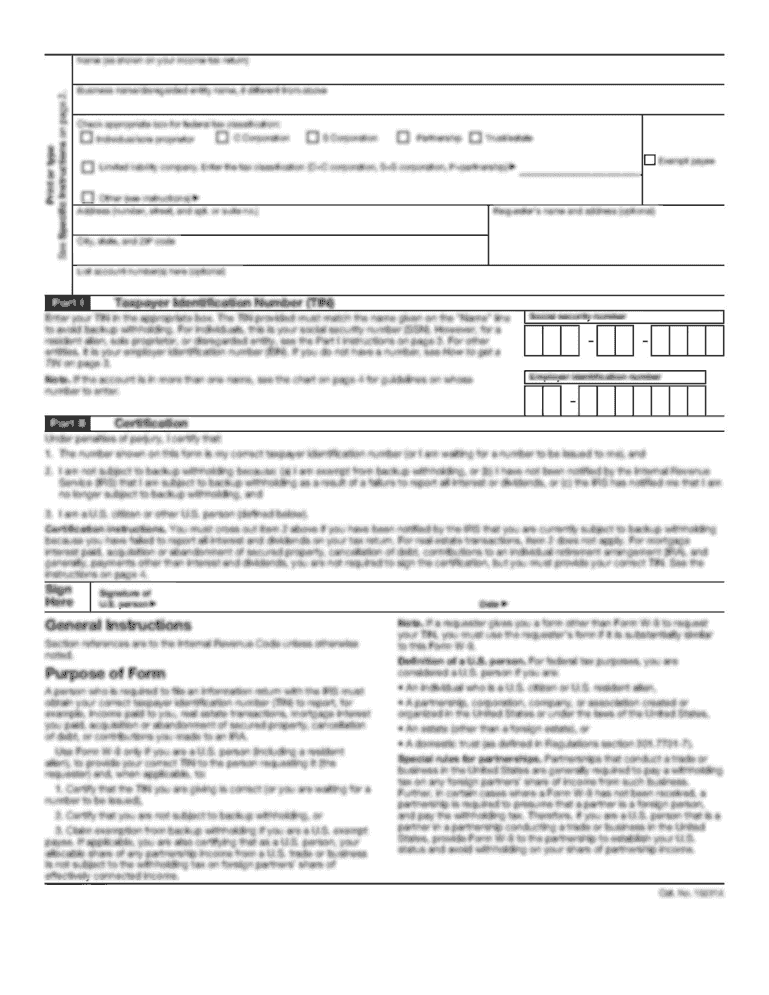

Completing form 5498-SA is a straightforward process, but it's essential to provide accurate information. Here is a step-by-step guide to help you complete the form:

pdfFiller can empower you to create, edit, and share your documents online, including form 5498-SA. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to efficiently complete and manage your important tax documents.