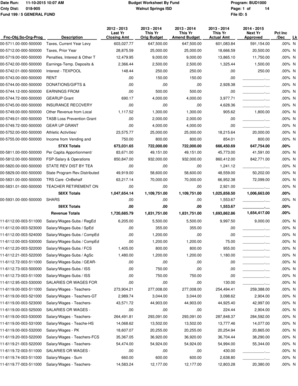

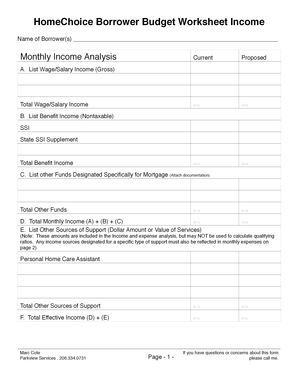

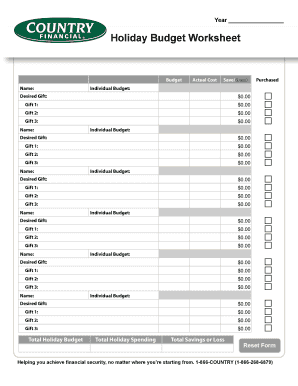

What is Holiday Budget Worksheet?

A Holiday Budget Worksheet is a tool used to plan and track your expenses during the holiday season. It helps you keep track of all your holiday-related expenses such as gifts, travel, decorations, and food. By using a Holiday Budget Worksheet, you can create a clear financial plan and avoid overspending, allowing you to enjoy the holiday season without any financial stress.

What are the types of Holiday Budget Worksheet?

There are various types of Holiday Budget Worksheets available depending on your specific needs and preferences. Some popular types include:

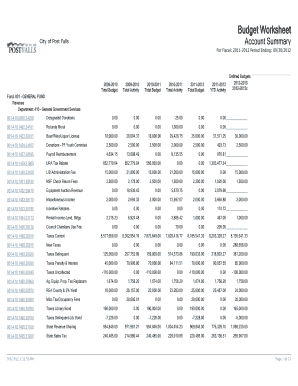

Basic Holiday Budget Worksheet: This type of worksheet provides a simple and straightforward layout where you can list your expected expenses and track your actual expenses.

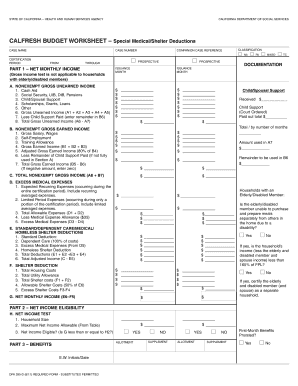

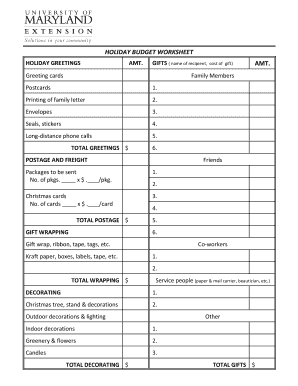

Detailed Holiday Budget Worksheet: This type of worksheet includes more detailed categories for expenses, allowing you to have a more comprehensive view of your holiday spending.

Travel-Specific Holiday Budget Worksheet: If you are traveling during the holidays, this type of worksheet focuses on tracking expenses related to your travel arrangements, accommodation, and other travel-specific costs.

How to complete Holiday Budget Worksheet

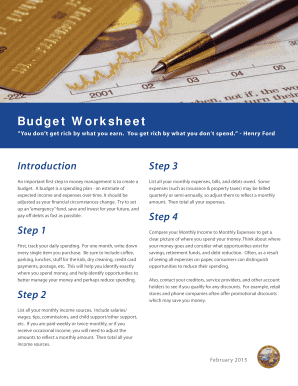

Completing a Holiday Budget Worksheet is easy and can be done in a few simple steps:

01

Determine your budget: Start by setting a budget for your holiday expenses. Take into account your income, savings, and any other financial obligations you may have.

02

List your expenses: Make a list of all the holiday expenses you anticipate, including gifts, decorations, travel expenses, food, and any other costs you expect to incur.

03

Assign estimated costs: Estimate the costs for each expense category based on your research or previous experience. Be realistic and try to allocate your budget accordingly.

04

Track your actual expenses: As you make purchases and incur expenses, keep track of the actual amounts spent in each category. This will help you stay on top of your budget and make adjustments if needed.

05

Review and adjust: Regularly review your Holiday Budget Worksheet to see if you're staying on track. If necessary, adjust your spending in certain categories to ensure you are not exceeding your budget.

Using a Holiday Budget Worksheet is an effective way to stay organized and financially responsible during the holiday season. Start planning early and make use of tools like pdfFiller, which empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that will help you get your holiday budget in order.