Itr 1 Form 2016-17

What is itr 1 form 2016-17?

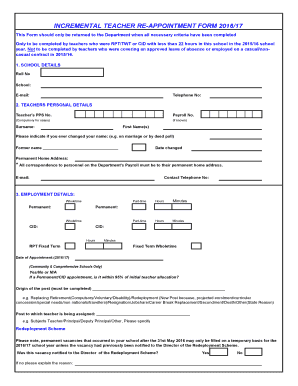

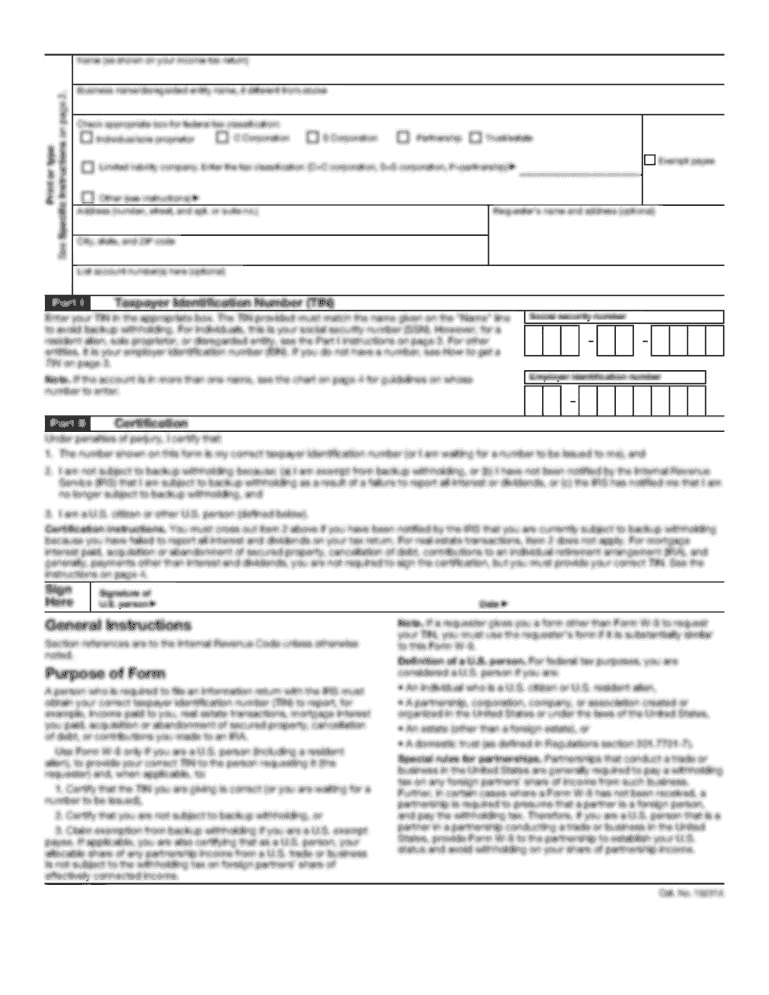

The itr 1 form 2016-17 is a document that taxpayers in India need to fill out and submit to the Income Tax Department. This form is specifically designed for individuals who have earned income through salary, pension, or income from a single house property. It is important to accurately fill out this form as it helps the government assess the tax liability of the individual.

What are the types of itr 1 form 2016-17?

The itr 1 form 2016-17 comes in different types depending on the source of income. The main types of itr 1 forms for the year 2016-17 are as follows:

How to complete itr 1 form 2016-17

Completing the itr 1 form 2016-17 is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.