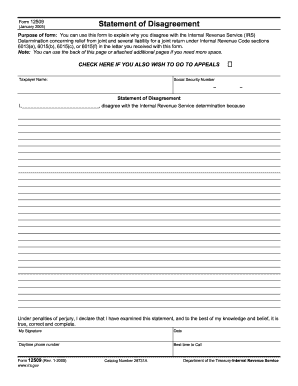

12509 Form

What is 12509 Form?

The 12509 Form, also known as the Employee Benefits Security Administration (EBSA) Short Form, is a document used to request information from an employer about their employee benefit plans. This form helps gather data to ensure compliance with the Employee Retirement Income Security Act (ERISA). It is an essential tool for the Employee Benefits Security Administration to monitor and regulate employee benefit plans effectively.

What are the types of 12509 Form?

The 12509 Form comes in various types based on the specific information required. The common types of 12509 Form include: 1. Financial Statements: This type requests financial information about the employer's employee benefit plans. 2. Plan Administration: This type focuses on gathering data regarding the administration of the employee benefit plans, such as plan documents and amendments. 3. Reporting and Filing: This type requires information related to the reporting and filing of annual returns for the employee benefit plans. Each type of 12509 Form serves a distinct purpose and is designed to collect specific data for regulatory and compliance purposes.

How to complete 12509 Form

Completing the 12509 Form is relatively straightforward. Here are the steps you need to follow: 1. Obtain the form: Download the 12509 Form from the official Employee Benefits Security Administration website or any reputable source. 2. Provide accurate information: Fill in the required fields with accurate details about your employee benefit plans. 3. Attach supporting documents: If applicable, attach any supporting documents requested by the specific type of 12509 Form. 4. Review and submit: Double-check all the information provided, ensuring its accuracy and completeness. Once reviewed, submit the form as per the submission instructions provided. By following these steps, you can effectively complete the 12509 Form and fulfill your obligations regarding the disclosure of information about your employee benefit plans.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.